Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

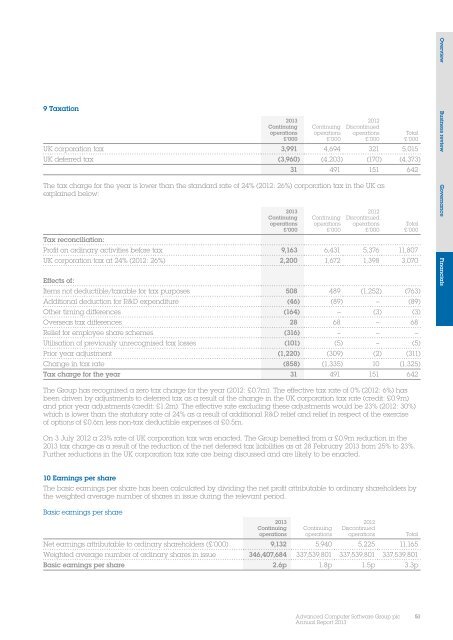

9 Taxation<strong>2013</strong>Continuingoperations£’000Continuingoperations£’0002012Discontinuedoperations£’000UK corporation tax 3,991 4,694 321 5,015UK deferred tax (3,960) (4,203) (170) (4,373)31 491 151 642The tax charge for the year is lower than the standard rate of 24% (2012: 26%) corporation tax in the UK asexplained below:<strong>2013</strong>Continuingoperations£’000Continuingoperations£’0002012Discontinuedoperations£’000Tax reconciliation:Profit on ordinary activities before tax 9,163 6,431 5,376 11,807UK corporation tax at 24% (2012: 26%) 2,200 1,672 1,398 3,070Effects of:Items not deductible/taxable for tax purposes 508 489 (1,252) (763)Additional deduction for R&D expenditure (46) (89) – (89)Other timing differences (164) – (3) (3)Overseas tax differences 28 68 – 68Relief for employee share schemes (316) – – –Utilisation of previously unrecognised tax losses (101) (5) – (5)Prior year adjustment (1,220) (309) (2) (311)Change in tax rate (858) (1,335) 10 (1,325)Tax charge for the year 31 491 151 642Total£’000Total£’000Overview Business review Governance FinancialsThe <strong>Group</strong> has recognised a zero tax charge for the year (2012: £0.7m). The effective tax rate of 0% (2012: 6%) hasbeen driven by adjustments to deferred tax as a result of the change in the UK corporation tax rate (credit: £0.9m)and prior year adjustments (credit: £1.2m). The effective rate excluding these adjustments would be 23% (2012: 30%)which is lower than the statutory rate of 24% as a result of additional R&D relief and relief in respect of the exerciseof options of £0.6m less non-tax deductible expenses of £0.5m.On 3 July 2012 a 23% rate of UK corporation tax was enacted. The <strong>Group</strong> benefited from a £0.9m reduction in the<strong>2013</strong> tax charge as a result of the reduction of the net deferred tax liabilities as at 28 February <strong>2013</strong> from 25% to 23%.Further reductions in the UK corporation tax rate are being discussed and are likely to be enacted.10 Earnings per shareThe basic earnings per share has been calculated by dividing the net profit attributable to ordinary shareholders bythe weighted average number of shares in issue during the relevant period.Basic earnings per share<strong>2013</strong>ContinuingoperationsContinuingoperations2012DiscontinuedoperationsTotalNet earnings attributable to ordinary shareholders (£’000) 9,132 5,940 5,225 11,165Weighted average number of ordinary shares in issue 346,407,684 337,539,801 337,539,801 337,539,801Basic earnings per share 2.6p 1.8p 1.5p 3.3p<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>51