Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

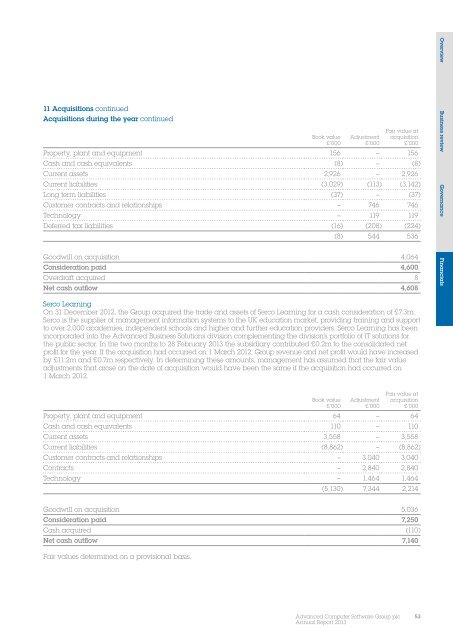

11 Acquisitions continuedAcquisitions during the year continuedBook value£’000Adjustment£’000Fair value atacquisition£’000Property, plant and equipment 156 – 156Cash and cash equivalents (8) – (8)Current assets 2,926 – 2,926Current liabilities (3,029) (113) (3,142)Long term liabilities (37) – (37)Customer contracts and relationships – 746 746Technology – 119 119Deferred tax liabilities (16) (208) (224)(8) 544 536Goodwill on acquisition 4,064Consideration paid 4,600Overdraft acquired 8Net cash outflow 4,608Overview Business review Governance FinancialsSerco LearningOn 31 December 2012, the <strong>Group</strong> acquired the trade and assets of Serco Learning for a cash consideration of £7.3m.Serco is the supplier of management information systems to the UK education market, providing training and supportto over 2,000 academies, independent schools and higher and further education providers. Serco Learning has beenincorporated into the <strong>Advanced</strong> Business Solutions division complementing the division’s portfolio of IT solutions forthe public sector. In the two months to 28 February <strong>2013</strong> the subsidiary contributed £0.2m to the consolidated netprofit for the year. If the acquisition had occurred on 1 March 2012, <strong>Group</strong> revenue and net profit would have increasedby £11.2m and £0.7m respectively. In determining these amounts, management has assumed that the fair valueadjustments that arose on the date of acquisition would have been the same if the acquisition had occurred on1 March 2012.Book value£’000Adjustment£’000Fair value atacquisition£’000Property, plant and equipment 64 – 64Cash and cash equivalents 110 – 110Current assets 3,558 – 3,558Current liabilities (8,862) – (8,862)Customer contracts and relationships – 3,040 3,040Contracts – 2,840 2,840Technology – 1,464 1,464(5,130) 7,344 2,214Goodwill on acquisition 5,036Consideration paid 7,250Cash acquired (110)Net cash outflow 7,140Fair values determined on a provisional basis.<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>53