Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

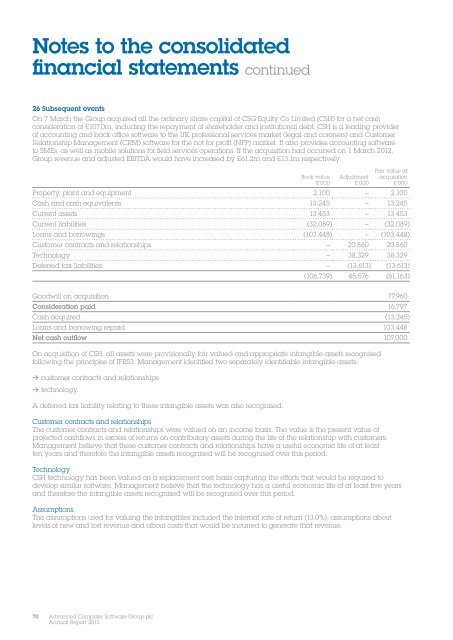

Notes to the consolidatedfinancial statements continued26 Subsequent eventsOn 7 March the <strong>Group</strong> acquired all the ordinary share capital of CSG Equity Co Limited (CSH) for a net cashconsideration of £107.0m, including the repayment of shareholder and institutional debt. CSH is a leading providerof accounting and back office software to the UK professional services market (legal and coroners) and CustomerRelationship Management (CRM) software for the not for profit (NFP) market. It also provides accounting softwareto SMEs, as well as mobile solutions for field services operations. If the acquisition had occurred on 1 March 2012,<strong>Group</strong> revenue and adjusted EBITDA would have increased by £61.2m and £13.1m respectively.Book value£’000Adjustment£’000Fair value atacquisition£’000Property, plant and equipment 2,100 – 2,100Cash and cash equivalents 13,245 – 13,245Current assets 13,453 – 13,453Current liabilities (32,089) – (32,089)Loans and borrowings (103,448) – (103,448)Customer contracts and relationships – 20,860 20,860Technology – 38,329 38,329Deferred tax liabilities – (13,613) (13,613)(106,739) 45,576 (61,163)Goodwill on acquisition 77,960Consideration paid 16,797Cash acquired (13,245)Loans and borrowing repaid 103,448Net cash outflow 107,000On acquisition of CSH, all assets were provisionally fair valued and appropriate intangible assets recognisedfollowing the principles of IFRS3. Management identified two separately identifiable intangible assets:> > customer contracts and relationships> > technology.A deferred tax liability relating to these intangible assets was also recognised.Customer contracts and relationshipsThe customer contracts and relationships were valued on an income basis. The value is the present value ofprojected cashflows in excess of returns on contributory assets during the life of the relationship with customers.Management believe that these customer contracts and relationships have a useful economic life of at leastten years and therefore the intangible assets recognised will be recognised over this period.TechnologyCSH technology has been valued on a replacement cost basis capturing the efforts that would be required todevelop similar software. Management believe that the technology has a useful economic life of at least five yearsand therefore the intangible assets recognised will be recognised over this period.AssumptionsThe assumptions used for valuing the intangibles included the internal rate of return (13.0%), assumptions aboutlevels of new and lost revenue and about costs that would be incurred to generate that revenue.70<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>