Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

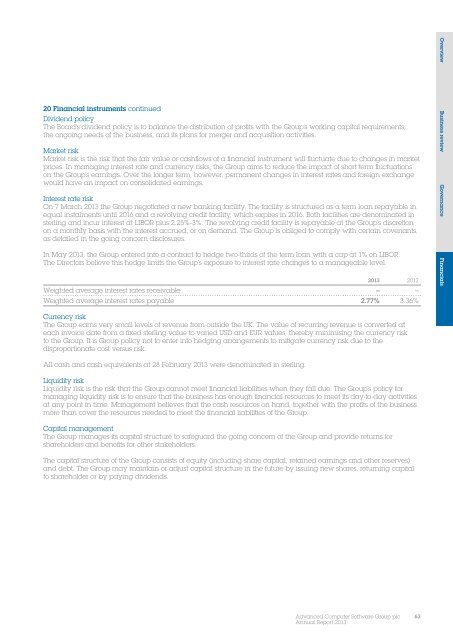

20 Financial instruments continuedDividend policyThe Board’s dividend policy is to balance the distribution of profits with the <strong>Group</strong>’s working capital requirements,the ongoing needs of the business, and its plans for merger and acquisition activities.Market riskMarket risk is the risk that the fair value or cashflows of a financial instrument will fluctuate due to changes in marketprices. In managing interest rate and currency risks, the <strong>Group</strong> aims to reduce the impact of short term fluctuationson the <strong>Group</strong>’s earnings. Over the longer term, however, permanent changes in interest rates and foreign exchangewould have an impact on consolidated earnings.Interest rate riskOn 7 March <strong>2013</strong> the <strong>Group</strong> negotiated a new banking facility. The facility is structured as a term loan repayable inequal instalments until 2016 and a revolving credit facility, which expires in 2016. Both facilities are denominated insterling and incur interest at LIBOR plus 2.25%-3%. The revolving credit facility is repayable at the <strong>Group</strong>’s discretionon a monthly basis with the interest accrued, or on demand. The <strong>Group</strong> is obliged to comply with certain covenants,as detailed in the going concern disclosures.In May <strong>2013</strong>, the <strong>Group</strong> entered into a contract to hedge two-thirds of the term loan with a cap at 1% on LIBOR.The Directors believe this hedge limits the <strong>Group</strong>’s exposure to interest rate changes to a manageable level.<strong>2013</strong> 2012Weighted average interest rates receivable – –Weighted average interest rates payable 2.77% 3.36%Overview Business review Governance FinancialsCurrency riskThe <strong>Group</strong> earns very small levels of revenue from outside the UK. The value of recurring revenue is converted ateach invoice date from a fixed sterling value to varied USD and EUR values, thereby minimising the currency riskto the <strong>Group</strong>. It is <strong>Group</strong> policy not to enter into hedging arrangements to mitigate currency risk due to thedisproportionate cost versus risk.All cash and cash equivalents at 28 February <strong>2013</strong> were denominated in sterling.Liquidity riskLiquidity risk is the risk that the <strong>Group</strong> cannot meet financial liabilities when they fall due. The <strong>Group</strong>’s policy formanaging liquidity risk is to ensure that the business has enough financial resources to meet its day-to-day activitiesat any point in time. Management believes that the cash resources on hand, together with the profits of the businessmore than cover the resources needed to meet the financial liabilities of the <strong>Group</strong>.Capital managementThe <strong>Group</strong> manages its capital structure to safeguard the going concern of the <strong>Group</strong> and provide returns forshareholders and benefits for other stakeholders.The capital structure of the <strong>Group</strong> consists of equity (including share capital, retained earnings and other reserves)and debt. The <strong>Group</strong> may maintain or adjust capital structure in the future by issuing new shares, returning capitalto shareholder or by paying dividends.<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>63