Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

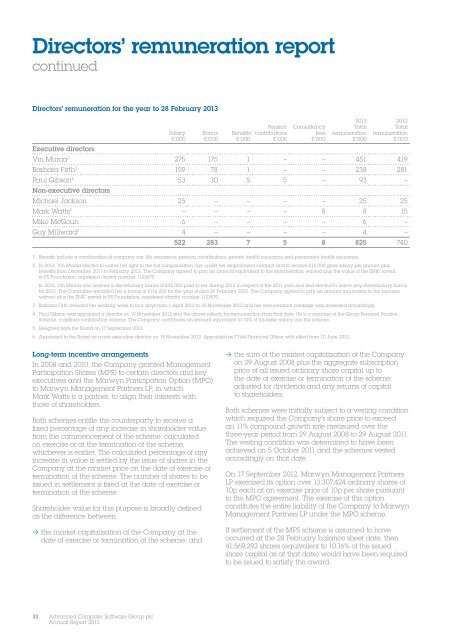

Directors’ remuneration <strong>report</strong>continuedDirectors’ remuneration for the year to 28 February <strong>2013</strong>Salary£’000Bonus£’000Benefits 1£’000Pensioncontributions£’000Consultancyfees£’000<strong>2013</strong>Totalremuneration£’0002012Totalremuneration£’000Executive directorsVin Murria 2 275 175 1 – – 451 419Barbara Firth 3 159 78 1 – – 238 281Paul Gibson 4 53 30 5 5 – 93 –Non-executive directorsMichael Jackson 25 – – – – 25 25Mark Watts 5 – – – – 8 8 15Mike McGoun 6 – – – – 6 –Guy Millward 6 4 – – – – 4 –522 283 7 5 8 825 7401 Benefits include a combination of company car, life assurance, pension contributions, private health insurance and permanent health insurance.2 In 2012, Vin Murria elected to waive her right to the full compensation due under her employment contract and to receive £15,000 gross salary per annum plusbenefits from December 2011 to February 2012. The Company agreed to pay an amount equivalent to the remuneration waived plus the value of the ENIC savedto PS Foundation, registered charity number 1123570.In 2012, Vin Murria also waived a discretionary bonus of £25,000 paid to her during 2012 in respect of the 2011 year end and elected to waive any discretionary bonusfor 2012. The Committee awarded her a bonus of £116,250 for the year ended 29 February 2012. The Company agreed to pay an amount equivalent to the bonuseswaived plus the ENIC saved to PS Foundation, registered charity number 1123570.3 Barbara Firth reduced her working week to four days from 1 April 2012 to 30 November 2012 and her remuneration package was amended accordingly.4 Paul Gibson was appointed a director on 19 November 2012 and the above reflects his remuneration from that date. He is a member of the <strong>Group</strong> Personal PensionScheme, a defined contribution scheme. The Company contributes an amount equivalent to 10% of his basic salary into the scheme.5 Resigned from the Board on 17 September 2012.6 Appointed to the Board as a non-executive director on 19 November 2012. Appointed as Chief Financial Officer with effect from 10 June <strong>2013</strong>.Long-term incentive arrangementsIn 2008 and 2010, the Company granted ManagementParticipation Shares (MPS) to certain directors and keyexecutives and the Marwyn Participation Option (MPO)to Marwyn Management Partners LP, in whichMark Watts is a partner, to align their interests withthose of shareholders.Both schemes entitle the counterparty to receive afixed percentage of any increase in shareholder valuefrom the commencement of the scheme, calculatedon exercise or at the termination of the scheme,whichever is earlier. The calculated percentage of anyincrease in value is settled by the issue of shares in theCompany at the market price on the date of exercise ortermination of the scheme. The number of shares to beissued in settlement is fixed at the date of exercise ortermination of the scheme.Shareholder value for this purpose is broadly definedas the difference between:> > the market capitalisation of the Company at thedate of exercise or termination of the scheme; and> > the sum of the market capitalisation of the Companyon 29 August 2008 plus the aggregate subscriptionprice of all issued ordinary share capital up tothe date of exercise or termination of the scheme,adjusted for dividends and any returns of capitalto shareholders.Both schemes were initially subject to a vesting conditionwhich required the Company’s share price to exceedan 11% compound growth rate measured over thethree-year period from 29 August 2008 to 29 August 2011.The vesting condition was determined to have beenachieved on 5 October 2011 and the schemes vestedaccordingly on that date.On 17 September 2012, Marwyn Management PartnersLP exercised its option over 13,307,424 ordinary shares of10p each at an exercise price of 10p per share pursuantto the MPO agreement. The exercise of this optionconstitutes the entire liability of the Company to MarwynManagement Partners LP under the MPO scheme.If settlement of the MPS scheme is assumed to haveoccurred at the 28 February balance sheet date, then41,569,293 shares (equivalent to 10.16% of the issuedshare capital as at that date) would have been requiredto be issued to satisfy the award.32<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>