Bosch Ltd (MICO) - ICICI Direct

Bosch Ltd (MICO) - ICICI Direct

Bosch Ltd (MICO) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

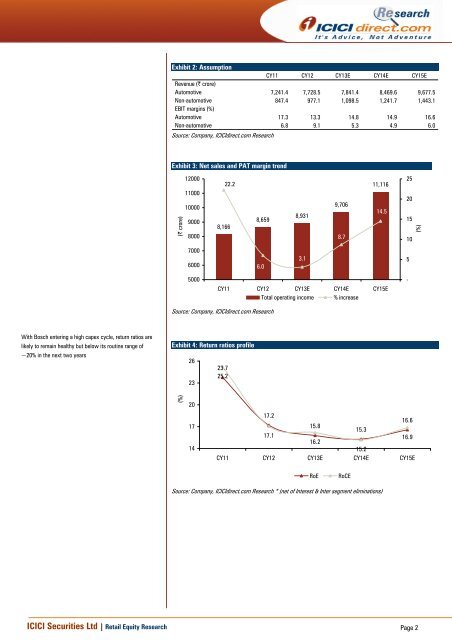

Exhibit 2: AssumptionCY11 CY12 CY13E CY14E CY15ERevenue (| crore)Automotive 7,241.4 7,728.5 7,841.4 8,469.6 9,677.5Non-automotive 847.4 977.1 1,098.5 1,241.7 1,443.1EBIT margins (%)Automotive 17.3 13.3 14.8 14.9 16.6Non-automotive 6.8 9.1 5.3 4.9 6.0Source: Company, <strong>ICICI</strong>direct.com ResearchExhibit 3: Net sales and PAT margin trend(| crore)1200011000100009000800022.28,1668,6598,9319,7068.711,11614.525201510(%)700060006.03.155000CY11 CY12 CY13E CY14E CY15ETotal operating income % increase-Source: Company, <strong>ICICI</strong>direct.com ResearchWith <strong>Bosch</strong> entering a high capex cycle, return ratios arelikely to remain healthy but below its routine range of~20% in the next two yearsExhibit 4: Return ratios profile262323.725.2(%)20171417.216.615.815.317.116.916.215.2CY11 CY12 CY13E CY14E CY15ERoERoCESource: Company, <strong>ICICI</strong>direct.com Research * (net of Interest & Inter segment eliminations)<strong>ICICI</strong> Securities <strong>Ltd</strong> | Retail Equity Research Page 2