Download Annual Report - Renata

Download Annual Report - Renata

Download Annual Report - Renata

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

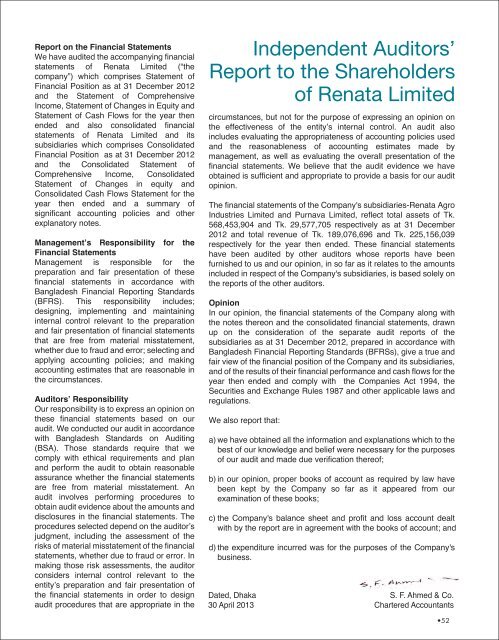

<strong>Report</strong> on the Financial StatementsWe have audited the accompanying financialstatements of <strong>Renata</strong> Limited (“thecompany”) which comprises Statement ofFinancial Position as at 31 December 2012and the Statement of ComprehensiveIncome, Statement of Changes in Equity andStatement of Cash Flows for the year thenended and also consolidated financialstatements of <strong>Renata</strong> Limited and itssubsidiaries which comprises ConsolidatedFinancial Position as at 31 December 2012and the Consolidated Statement ofComprehensive Income, ConsolidatedStatement of Changes in equity andConsolidated Cash Flows Statement for theyear then ended and a summary ofsignificant accounting policies and otherexplanatory notes.Management’s Responsibility for theFinancial StatementsManagement is responsible for thepreparation and fair presentation of thesefinancial statements in accordance withBangladesh Financial <strong>Report</strong>ing Standards(BFRS). This responsibility includes;designing, implementing and maintaininginternal control relevant to the preparationand fair presentation of financial statementsthat are free from material misstatement,whether due to fraud and error; selecting andapplying accounting policies; and makingaccounting estimates that are reasonable inthe circumstances.Auditors’ ResponsibilityOur responsibility is to express an opinion onthese financial statements based on ouraudit. We conducted our audit in accordancewith Bangladesh Standards on Auditing(BSA). Those standards require that wecomply with ethical requirements and planand perform the audit to obtain reasonableassurance whether the financial statementsare free from material misstatement. Anaudit involves performing procedures toobtain audit evidence about the amounts anddisclosures in the financial statements. Theprocedures selected depend on the auditor’sjudgment, including the assessment of therisks of material misstatement of the financialstatements, whether due to fraud or error. Inmaking those risk assessments, the auditorconsiders internal control relevant to theentity’s preparation and fair presentation ofthe financial statements in order to designaudit procedures that are appropriate in theIndependent Auditors’<strong>Report</strong> to the Shareholdersof <strong>Renata</strong> Limitedcircumstances, but not for the purpose of expressing an opinion onthe effectiveness of the entity’s internal control. An audit alsoincludes evaluating the appropriateness of accounting policies usedand the reasonableness of accounting estimates made bymanagement, as well as evaluating the overall presentation of thefinancial statements. We believe that the audit evidence we haveobtained is sufficient and appropriate to provide a basis for our auditopinion.The financial statements of the Company's subsidiaries-<strong>Renata</strong> AgroIndustries Limited and Purnava Limited, reflect total assets of Tk.568,453,904 and Tk. 29,577,705 respectively as at 31 December2012 and total revenue of Tk. 189,076,696 and Tk. 225,156,039respectively for the year then ended. These financial statementshave been audited by other auditors whose reports have beenfurnished to us and our opinion, in so far as it relates to the amountsincluded in respect of the Company's subsidiaries, is based solely onthe reports of the other auditors.OpinionIn our opinion, the financial statements of the Company along withthe notes thereon and the consolidated financial statements, drawnup on the consideration of the separate audit reports of thesubsidiaries as at 31 December 2012, prepared in accordance withBangladesh Financial <strong>Report</strong>ing Standards (BFRSs), give a true andfair view of the financial position of the Company and its subsidiaries,and of the results of their financial performance and cash flows for theyear then ended and comply with the Companies Act 1994, theSecurities and Exchange Rules 1987 and other applicable laws andregulations.We also report that:a) we have obtained all the information and explanations which to thebest of our knowledge and belief were necessary for the purposesof our audit and made due verification thereof;b) in our opinion, proper books of account as required by law havebeen kept by the Company so far as it appeared from ourexamination of these books;c) the Company's balance sheet and profit and loss account dealtwith by the report are in agreement with the books of account; andd) the expenditure incurred was for the purposes of the Company'sbusiness.Dated, DhakaS. F. Ahmed & Co.30 April 2013 Chartered Accountants•52