Download Annual Report - Renata

Download Annual Report - Renata

Download Annual Report - Renata

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

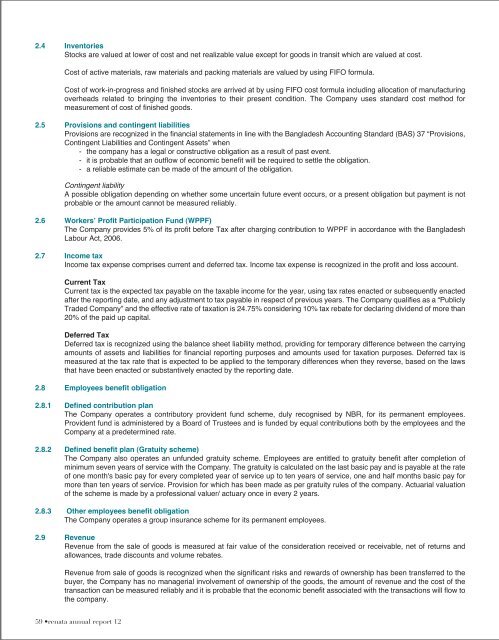

2.4 InventoriesStocks are valued at lower of cost and net realizable value except for goods in transit which are valued at cost.Cost of active materials, raw materials and packing materials are valued by using FIFO formula.Cost of work-in-progress and finished stocks are arrived at by using FIFO cost formula including allocation of manufacturingoverheads related to bringing the inventories to their present condition. The Company uses standard cost method formeasurement of cost of finished goods.2.5 Provisions and contingent liabilitiesProvisions are recognized in the financial statements in line with the Bangladesh Accounting Standard (BAS) 37 “Provisions,Contingent Liabilities and Contingent Assets” when- the company has a legal or constructive obligation as a result of past event.- it is probable that an outflow of economic benefit will be required to settle the obligation.- a reliable estimate can be made of the amount of the obligation.Contingent liabilityA possible obligation depending on whether some uncertain future event occurs, or a present obligation but payment is notprobable or the amount cannot be measured reliably.2.6 Workers’ Profit Participation Fund (WPPF)The Company provides 5% of its profit before Tax after charging contribution to WPPF in accordance with the BangladeshLabour Act, 2006.2.7 Income taxIncome tax expense comprises current and deferred tax. Income tax expense is recognized in the profit and loss account.Current TaxCurrent tax is the expected tax payable on the taxable income for the year, using tax rates enacted or subsequently enactedafter the reporting date, and any adjustment to tax payable in respect of previous years. The Company qualifies as a “PubliclyTraded Company” and the effective rate of taxation is 24.75% considering 10% tax rebate for declaring dividend of more than20% of the paid up capital.Deferred TaxDeferred tax is recognized using the balance sheet liability method, providing for temporary difference between the carryingamounts of assets and liabilities for financial reporting purposes and amounts used for taxation purposes. Deferred tax ismeasured at the tax rate that is expected to be applied to the temporary differences when they reverse, based on the lawsthat have been enacted or substantively enacted by the reporting date.2.8 Employees benefit obligation2.8.1 Defined contribution planThe Company operates a contributory provident fund scheme, duly recognised by NBR, for its permanent employees.Provident fund is administered by a Board of Trustees and is funded by equal contributions both by the employees and theCompany at a predetermined rate.2.8.2 Defined benefit plan (Gratuity scheme)The Company also operates an unfunded gratuity scheme. Employees are entitled to gratuity benefit after completion ofminimum seven years of service with the Company. The gratuity is calculated on the last basic pay and is payable at the rateof one month's basic pay for every completed year of service up to ten years of service, one and half months basic pay formore than ten years of service. Provision for which has been made as per gratuity rules of the company. Actuarial valuationof the scheme is made by a professional valuer/ actuary once in every 2 years.2.8.3 Other employees benefit obligationThe Company operates a group insurance scheme for its permanent employees.2.9 RevenueRevenue from the sale of goods is measured at fair value of the consideration received or receivable, net of returns andallowances, trade discounts and volume rebates.Revenue from sale of goods is recognized when the significant risks and rewards of ownership has been transferred to thebuyer, the Company has no managerial involvement of ownership of the goods, the amount of revenue and the cost of thetransaction can be measured reliably and it is probable that the economic benefit associated with the transactions will flow tothe company.59 •renata annual report 12