Download Annual Report - Renata

Download Annual Report - Renata

Download Annual Report - Renata

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

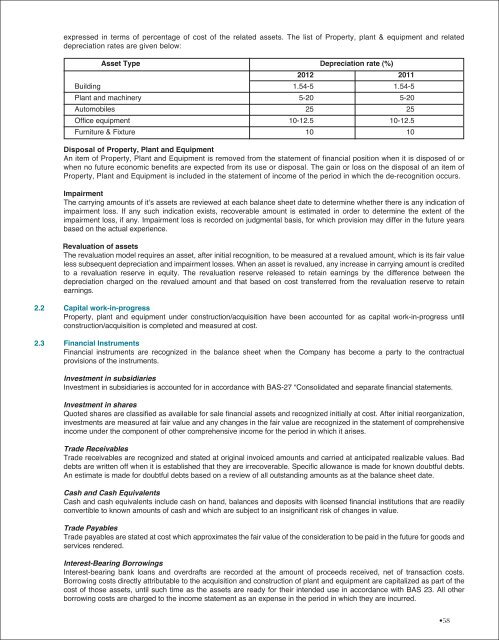

expressed in terms of percentage of cost of the related assets. The list of Property, plant & equipment and relateddepreciation rates are given below:Asset Type Depreciation rate (%)2012 2011Building 1.54-5 1.54-5Plant and machinery 5-20 5-20Automobiles 25 25Office equipment 10-12.5 10-12.5Furniture & Fixture 10 10Disposal of Property, Plant and EquipmentAn item of Property, Plant and Equipment is removed from the statement of financial position when it is disposed of orwhen no future economic benefits are expected from its use or disposal. The gain or loss on the disposal of an item ofProperty, Plant and Equipment is included in the statement of income of the period in which the de-recognition occurs.ImpairmentThe carrying amounts of it’s assets are reviewed at each balance sheet date to determine whether there is any indication ofimpairment loss. If any such indication exists, recoverable amount is estimated in order to determine the extent of theimpairment loss, if any. Impairment loss is recorded on judgmental basis, for which provision may differ in the future yearsbased on the actual experience.Revaluation of assetsThe revaluation model requires an asset, after initial recognition, to be measured at a revalued amount, which is its fair valueless subsequent depreciation and impairment losses. When an asset is revalued, any increase in carrying amount is creditedto a revaluation reserve in equity. The revaluation reserve released to retain earnings by the difference between thedepreciation charged on the revalued amount and that based on cost transferred from the revaluation reserve to retainearnings.2.2 Capital work-in-progressProperty, plant and equipment under construction/acquisition have been accounted for as capital work-in-progress untilconstruction/acquisition is completed and measured at cost.2.3 Financial InstrumentsFinancial instruments are recognized in the balance sheet when the Company has become a party to the contractualprovisions of the instruments.Investment in subsidiariesInvestment in subsidiaries is accounted for in accordance with BAS-27 “Consolidated and separate financial statements.Investment in sharesQuoted shares are classified as available for sale financial assets and recognized initially at cost. After initial reorganization,investments are measured at fair value and any changes in the fair value are recognized in the statement of comprehensiveincome under the component of other comprehensive income for the period in which it arises.Trade ReceivablesTrade receivables are recognized and stated at original invoiced amounts and carried at anticipated realizable values. Baddebts are written off when it is established that they are irrecoverable. Specific allowance is made for known doubtful debts.An estimate is made for doubtful debts based on a review of all outstanding amounts as at the balance sheet date.Cash and Cash EquivalentsCash and cash equivalents include cash on hand, balances and deposits with licensed financial institutions that are readilyconvertible to known amounts of cash and which are subject to an insignificant risk of changes in value.Trade PayablesTrade payables are stated at cost which approximates the fair value of the consideration to be paid in the future for goods andservices rendered.Interest-Bearing BorrowingsInterest-bearing bank loans and overdrafts are recorded at the amount of proceeds received, net of transaction costs.Borrowing costs directly attributable to the acquisition and construction of plant and equipment are capitalized as part of thecost of those assets, until such time as the assets are ready for their intended use in accordance with BAS 23. All otherborrowing costs are charged to the income statement as an expense in the period in which they are incurred.•58