Download Annual Report - Renata

Download Annual Report - Renata

Download Annual Report - Renata

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

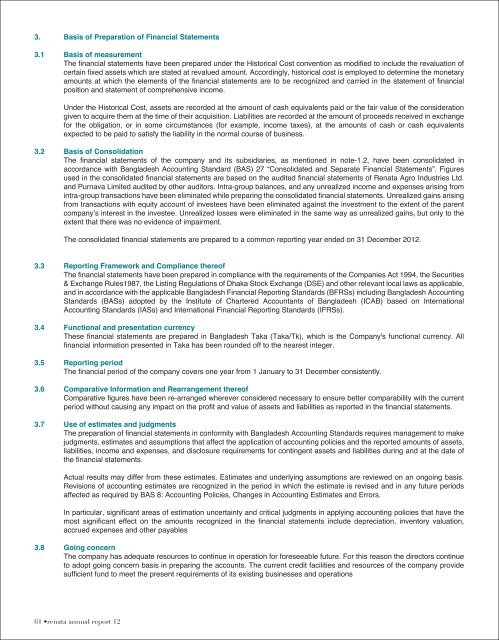

3. Basis of Preparation of Financial Statements3.1 Basis of measurementThe financial statements have been prepared under the Historical Cost convention as modified to include the revaluation ofcertain fixed assets which are stated at revalued amount. Accordingly, historical cost is employed to determine the monetaryamounts at which the elements of the financial statements are to be recognized and carried in the statement of financialposition and statement of comprehensive income.Under the Historical Cost, assets are recorded at the amount of cash equivalents paid or the fair value of the considerationgiven to acquire them at the time of their acquisition. Liabilities are recorded at the amount of proceeds received in exchangefor the obligation, or in some circumstances (for example, income taxes), at the amounts of cash or cash equivalentsexpected to be paid to satisfy the liability in the normal course of business.3.2 Basis of ConsolidationThe financial statements of the company and its subsidiaries, as mentioned in note-1.2, have been consolidated inaccordance with Bangladesh Accounting Standard (BAS) 27 “Consolidated and Separate Financial Statements”. Figuresused in the consolidated financial statements are based on the audited financial statements of <strong>Renata</strong> Agro Industries Ltd.and Purnava Limited audited by other auditors. Intra-group balances, and any unrealized income and expenses arising fromintra-group transactions have been eliminated while preparing the consolidated financial statements. Unrealized gains arisingfrom transactions with equity account of investees have been eliminated against the investment to the extent of the parentcompany’s interest in the investee. Unrealized losses were eliminated in the same way as unrealized gains, but only to theextent that there was no evidence of impairment.The consolidated financial statements are prepared to a common reporting year ended on 31 December 2012.3.3 <strong>Report</strong>ing Framework and Compliance thereofThe financial statements have been prepared in compliance with the requirements of the Companies Act 1994, the Securities& Exchange Rules1987, the Listing Regulations of Dhaka Stock Exchange (DSE) and other relevant local laws as applicable,and in accordance with the applicable Bangladesh Financial <strong>Report</strong>ing Standards (BFRSs) including Bangladesh AccountingStandards (BASs) adopted by the Institute of Chartered Accountants of Bangladesh (ICAB) based on InternationalAccounting Standards (IASs) and International Financial <strong>Report</strong>ing Standards (IFRSs).3.4 Functional and presentation currencyThese financial statements are prepared in Bangladesh Taka (Taka/Tk), which is the Company's functional currency. Allfinancial information presented in Taka has been rounded off to the nearest integer.3.5 <strong>Report</strong>ing periodThe financial period of the company covers one year from 1 January to 31 December consistently.3.6 Comparative Information and Rearrangement thereofComparative figures have been re-arranged wherever considered necessary to ensure better comparability with the currentperiod without causing any impact on the profit and value of assets and liabilities as reported in the financial statements.3.7 Use of estimates and judgmentsThe preparation of financial statements in conformity with Bangladesh Accounting Standards requires management to makejudgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets,liabilities, income and expenses, and disclosure requirements for contingent assets and liabilities during and at the date ofthe financial statements.Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis.Revisions of accounting estimates are recognized in the period in which the estimate is revised and in any future periodsaffected as required by BAS 8: Accounting Policies, Changes in Accounting Estimates and Errors.In particular, significant areas of estimation uncertainty and critical judgments in applying accounting policies that have themost significant effect on the amounts recognized in the financial statements include depreciation, inventory valuation,accrued expenses and other payables3.8 Going concernThe company has adequate resources to continue in operation for foreseeable future. For this reason the directors continueto adopt going concern basis in preparing the accounts. The current credit facilities and resources of the company providesufficient fund to meet the present requirements of its existing businesses and operations61 •renata annual report 12