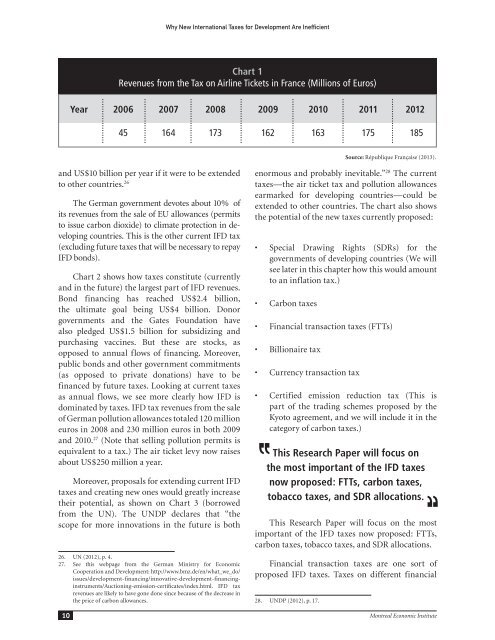

Why New International Taxes for Development Are InefficientChart 1Revenues from the Tax on Airline Tickets in France (Millions of Euros)Year 2006 2007 2008 2009 2010 2011 201245 164 173 162 163 175 185Source: République Française (2013).and US$10 billion per year if it were to be exten<strong>de</strong>dto other countries. 26The German government <strong>de</strong>votes about 10% ofits revenues from the sale of EU allowances (permitsto issue carbon dioxi<strong>de</strong>) to climate protection in <strong>de</strong>velopingcountries. This is the other current IFD tax(excluding future taxes that will be necessary to repayIFD bonds).Chart 2 shows how taxes constitute (currentlyand in the future) the largest part of IFD revenues.Bond financing has reached US$2.4 billion,the ultimate goal being US$4 billion. Donorgovernments and the Gates Foundation havealso pledged US$1.5 billion for subsidizing andpurchasing vaccines. But these are stocks, asopposed to annual flows of financing. Moreover,public bonds and other government commitments(as opposed to private donations) have to befinanced by future taxes. Looking at current taxesas annual flows, we see more clearly how IFD isdominated by taxes. IFD tax revenues from the saleof German pollution allowances totaled 120 millioneuros in 2008 and 230 million euros in both 2009and 2010. 27 (Note that selling pollution permits isequivalent to a tax.) The air ticket levy now raisesabout US$250 million a year.Moreover, proposals for extending current IFDtaxes and creating new ones would greatly increasetheir potential, as shown on Chart 3 (borrowedfrom the UN). The UNDP <strong>de</strong>clares that “thescope for more innovations in the future is both26. UN (2012), p. 4.27. See this webpage from the German Ministry for EconomicCooperation and Development: http://www.bmz.<strong>de</strong>/en/what_we_do/issues/<strong>de</strong>velopment-financing/innovative-<strong>de</strong>velopment-financinginstruments/Auctioning-emission-certificates/in<strong>de</strong>x.html.IFD taxrevenues are likely to have gone done since because of the <strong>de</strong>crease inthe price of carbon allowances.10enormous and probably inevitable.” 28 The currenttaxes—the air ticket tax and pollution allowancesearmarked for <strong>de</strong>veloping countries—could beexten<strong>de</strong>d to other countries. The chart also showsthe potential of the new taxes currently proposed:Special Drawing Rights (SDRs) for thegovernments of <strong>de</strong>veloping countries (We willsee later in this chapter how this would amountto an inflation tax.) part of the trading schemes proposed by theKyoto agreement, and we will inclu<strong>de</strong> it in thecategory of carbon taxes.),,This Research Paper will focus onthe most important of the IFD taxesnow proposed: FTTs, carbon taxes,tobacco taxes, and SDR allocations. ,,This Research Paper will focus on the mostimportant of the IFD taxes now proposed: FTTs,carbon taxes, tobacco taxes, and SDR allocations.Financial transaction taxes are one sort ofproposed IFD taxes. Taxes on different financial28. UNDP (2012), p. 17.Montreal Economic <strong>Institut</strong>e

Why New International Taxes for Development Are InefficientChart 2 Important IFD Mechanisms and Agencies, Implemented or Proposed as of 2010*INITIATIVEPURPOSEHOW DOES IT WORK?REVENUESIS IT OFFICIALDEVELOPMENTASSISTANCE?NEW AGENCIESGAVI Alliance (2000)Public-private partnership forimmunisations.Pooled funds distributed, basedon proposals from poorer<strong>de</strong>veloping countries.About USD 300m. a year. USD3.7b. approved for 2000-15, asof 2009.Yes, but only for officialcontributions.The Global Fund (2002)NEW MECHANISMSPublic-private partnership tofight AIDS, TB and malaria.Pooled funds distributed, basedon proposals from poorer<strong>de</strong>veloping coountries.About USD 3.2b. a year. Total ofUSD 14b. raised by 2009.Yes, but only for officialcontributions.(a) New revenue raisingAir-ticket levy (2006)Fund a purchase facility(UNTAID) for AIDS, TB andmalaria treatments.13 countries apply a domestictax (2009). UNITAID funds arechanneled through existinginstitutions, esp. ClintonFoundation.USD 251m. a year.Yes, when funds collectedare paid to UNITAID or otherinternational agencies.Auctioning/sales of emissionpermits (2009)Currency Transaction Levy(b(b) Bonds (front-loading)International Finance Facility forImmunization (IFFIm, 2006)(c ) Voluntary contributionsGlobal Digital Solidarity fund(2003)(PRODUCT) RED (2006)Airline ticket voluntary solidaritycontribution(d) Guarantees (incentives)Advance Market Commitment(AMC, 2007)In<strong>de</strong>x-based weather insuranceProvi<strong>de</strong> funds for climatemitigation and adaptation.Increase the funds allocated tofinance <strong>de</strong>velopment.Fund GAVI campaigns.Promote an inclusivein<strong>format</strong>ion society.Provi<strong>de</strong> additional funding toGlobal Fund’s activities in sub-Saharan Africa.Provi<strong>de</strong> additional resources tofund UNITAID activities.Provi<strong>de</strong> incentive to <strong>de</strong>velopnew vaccines.Un<strong>de</strong>r EU regulations, EUAllowances (EUA) for carbondioxi<strong>de</strong> emissions are sold toemitters.Governments apply a tax onforeign exchange transactions.Bonds are sold in theinternational capital marketsagainst legally binding longtermODA commitments from 8donor countries.Public or private bodiesvoluntarily contribute 1% ofdigital procurement contracts.Product RED tra<strong>de</strong>mark licensedto global companies that pledgea share of profits from sales ofRED Products to Global Fundprograms.Individuals or corporations electto contribute to <strong>de</strong>velopementwhen booking flights.Donors commit to buy asuccesful vaccine from vaccinemakers at a negotiated pricewhich covers <strong>de</strong>velopment costs.Reduce the vulnerability of rural IFAD-WFP partnership provi<strong>de</strong>spoor to extreme weather events. farmers with weather-in<strong>de</strong>xedinsurance.Germany’s 2009 budgetallocates EUR 225m. in EUAsales to <strong>de</strong>velopment.Levying 0,005% on majorcurrencies would yield USD 33b.a year.USD 2.4b. raised by 2009; aim isto raise a total of USD 4b.Since 2003, more thanEUR 30m. allocated to300 grantees.USD 134.5m. tranfered to GlobalFund to date.USD 2 per ticket contributionmight raise up to USD 960m.a year.USD 1.5b. pledged by 5donors and Bill & MelindaGates Foundation for AMC forpneumococcal disease.Weather insurance schemesalready piloted in Ethiopia,Malawi, Nicaragua, Hondurasand India.Yes, when proceeds are spenton <strong>de</strong>velopment.Yes, when funds collectedare spent on <strong>de</strong>velopmentassistance.Yes, for governement paymentsto meet bond interest andprincipal.Yes, but only for officialcontributions.No, only when private fundsare involved.No, only when private funds areinvolved.Yes, but only when donorgovernments pay for vaccines.Yes, but only for officialcontributions to insurancepremiums.* Italics represent proposed schemes as of 2010. As suggested in the text, many projects have changed since. Source: Sandor et al. (2009), p. 4.Montreal Economic <strong>Institut</strong>e 11