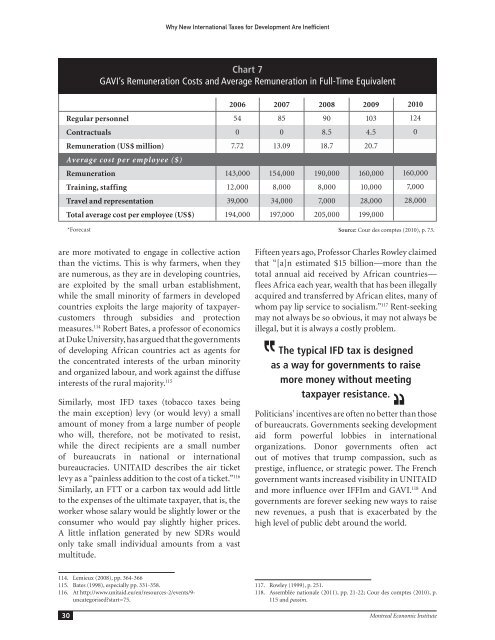

Why New International Taxes for Development Are InefficientChart 7GAVI’s Remuneration Costs and Average Remuneration in Full-Time Equivalent20062007200820092010Regular personnel548590103124Contractuals008.54.50Remuneration (US$ million)7.7213.0918.720.7Average cost per employee ($)Remuneration143,000154,000190,000160,000160,000Training, staffing12,0008,0008,00010,0007,000Travel and representation39,00034,0007,00028,00028,000Total average cost per employee (US$)194,000197,000205,000199,000*ForecastSource: Cour <strong>de</strong>s comptes (2010), p. 73.are more motivated to engage in collective actionthan the victims. This is why farmers, when theyare numerous, as they are in <strong>de</strong>veloping countries,are exploited by the small urban establishment,while the small minority of farmers in <strong>de</strong>velopedcountries exploits the large majority of taxpayercustomersthrough subsidies and protectionmeasures. 114 Robert Bates, a professor of economicsat Duke University, has argued that the governmentsof <strong>de</strong>veloping African countries act as agents forthe concentrated interests of the urban minorityand organized labour, and work against the diffuseinterests of the rural majority. 115Similarly, most IFD taxes (tobacco taxes beingthe main exception) levy (or would levy) a smallamount of money from a large number of peoplewho will, therefore, not be motivated to resist,while the direct recipients are a small numberof bureaucrats in national or internationalbureaucracies. UNITAID <strong>de</strong>scribes the air ticketlevy as a “painless addition to the cost of a ticket.” 116Similarly, an FTT or a carbon tax would add littleto the expenses of the ultimate taxpayer, that is, theworker whose salary would be slightly lower or theconsumer who would pay slightly higher prices.A little inflation generated by new SDRs wouldonly take small individual amounts from a vastmultitu<strong>de</strong>.Fifteen years ago, Professor Charles Rowley claimedthat “[a]n estimated $15 billion—more than thetotal annual aid received by African countries—flees Africa each year, wealth that has been illegallyacquired and transferred by African elites, many ofwhom pay lip service to socialism.” 117 Rent-seekingmay not always be so obvious, it may not always beillegal, but it is always a costly problem.,,The typical IFD tax is <strong>de</strong>signedas a way for governments to raisemore money without meetingtaxpayer resistance. ,,Politicians’ incentives are often no better than thoseof bureaucrats. Governments seeking <strong>de</strong>velopmentaid form powerful lobbies in internationalorganizations. Donor governments often actout of motives that trump compassion, such asprestige, influence, or strategic power. The Frenchgovernment wants increased visibility in UNITAIDand more influence over IFFIm and GAVI. 118 Andgovernments are forever seeking new ways to raisenew revenues, a push that is exacerbated by thehigh level of public <strong>de</strong>bt around the world.114. Lemieux (2008), pp. 364-366115. Bates (1998), especially pp. 331-358.116. At http://www.unitaid.eu/en/resources-2/events/9-uncategorised?start=75.30117. Rowley (1999), p. 251.118. Assemblée nationale (2011), pp. 21-22; Cour <strong>de</strong>s comptes (2010), p.115 and passim.Montreal Economic <strong>Institut</strong>e

Why New International Taxes for Development Are Inefficient3.3 Hid<strong>de</strong>n and Inefficient Taxes:Transparency AgainWe are now in a position to extend our previousdiscussion of transparency. In Chapter 2, we sawthat IFD taxes (the current ones and most of themajor ones un<strong>de</strong>r consi<strong>de</strong>ration) were hid<strong>de</strong>n andnon-transparent. The government failures reviewedin the present chapter explain why. The typical IFDtax is <strong>de</strong>signed as a way for governments to raisemore money without meeting taxpayer resistance.This lack of transparency is not a bug, but onceagain, an integral feature of IFD taxes.Consi<strong>de</strong>r the general picture. Politicians indonor countries extend their international influence(and thus, often, their influence at home) by givingmoney to other governments and to internationalorganizations. Politicians in recipient countrieshave an interest in supplementing their budgetswith cheap international money. The bureaucratsmanning donor and recipient agencies have thesame interests. All the incentives seem to point inthe same direction. More generally, politicians arealways after more money with which to woo votersor satisfy special interests. The problem is to raisethe money without meeting taxpayer resistance.Hence the ten<strong>de</strong>ncy to impose taxes that will flyun<strong>de</strong>r the radar.Now consi<strong>de</strong>r the advantages of (current andproposed) IFD taxes. Not only are they often easyto hi<strong>de</strong>, but they are generally levied in smallamounts spread over a large number of taxpayers(or ultimate taxpayers). Given the logic of collectiveaction, no individual taxpayer is going to spendmuch time or other resources fighting a tax thatcosts him little; on the other hand, the bureaucratsand foreign governments who benefit will expendmuch effort lobbying for it.At least one IFD tax is even partly hid<strong>de</strong>n fromlegislators. Although the French air ticket tax ispaid into the account of the Agence française <strong>de</strong>développement, its proceeds are not accounted foras normal receipts but are hid<strong>de</strong>n in an annex ofthe government’s budget documents. 119 One IFDtax that we have not reviewed may provi<strong>de</strong> an119. Cour <strong>de</strong>s comptes (2010), p. 7.even better example of a well-hid<strong>de</strong>n tax: futuregovernment commitments, and thus future taxes,against which IFFIm issues bonds on capitalmarkets, are specifically <strong>de</strong>signed not to be recor<strong>de</strong>din national public <strong>de</strong>bt accounts. It was, says theCour <strong>de</strong>s comptes, a “political choice of France andthe other governments that <strong>de</strong>signed or adopted”this method. 120 The French auditor criticized suchcreative accounting.Not only are IFD taxes not transparent, but theinternational <strong>de</strong>velopment agencies that benefitfrom them are not paragons of transparency either.UNITAID is formally audited by the WHO, ofwhich it is a part; the WHO gives this mandateto India’s Auditor general who, as of mid-2010,still had to carry out a single formal audit. 121 Hefinally did produce audited statements in April2012, but only going back to 2008. 122 Internationalorganizations do not normally open their books toany other than their own auditors, which makesin<strong>de</strong>pen<strong>de</strong>nt inquiry difficult. Both the WHOand UNICEF, which benefit from a large part ofUNITAID’s money, refused the Cour <strong>de</strong>s comptesaccess to their internal audits. 123 The French auditor,who was thus unable to carry out a full audit, raisedquestions, and ma<strong>de</strong> recommendations, about thelack of transparency of international organizationsthat benefit directly or indirectly from the Frenchairline ticket tax. On the audit issue, the Cour<strong>de</strong>s comptes admits that no further bureaucraticlayers should be ad<strong>de</strong>d to what are already verybureaucratic organizations—which raises otherquestions about these organizations. A subsequentreport by a committee of the French NationalAssembly states that the auditing procedures atUNITAID, IFFIm and GAVI are not satisfactory. 124International agencies are not subject toaccess-to-in<strong>format</strong>ion laws like those of donorcountries. However, it should be noted that this isdue to international rules accepted by the donorgovernments themselves and transcribed intotheir own national laws. In Canada, for example,120. Ibid., pp. 91-92 and 124.121. Ibid., pp. 26 and 29.122. UNITAID (2012a).123. Cour <strong>de</strong>s comptes (2010), p. 29.124. “Les audits internes et externes <strong>de</strong>s structures Unitaid et du groupeIffim GAVI laissent à désirer.” Assemblée nationale (2011), p. 18.Montreal Economic <strong>Institut</strong>e 31