Why New International Taxes for Development Are InefficientBecause of these problems, the governmentsof many countries have repealed or reduced theirtransaction taxes on shares trading over the pastfew <strong>de</strong>ca<strong>de</strong>s. 59 The Swedish government repealedits own FTT in 1991, after 60% of trading inthe most actively tra<strong>de</strong>d shares had moved toLondon. 60 After an extensive review of the literature,an IMF analyst, Thorton Matheson, conclu<strong>de</strong>s thatFTTs are not a <strong>de</strong>sirable form of taxation. 61 It isstrange that the i<strong>de</strong>a is now being recycled for IFD.In Chart 4, we say that the efficiency of FTTsis probably poor in or<strong>de</strong>r to be fair to Stiglitz, whohimself favours such a tax. 62 But he has arguedfor it because, in his opinion, it would curbunnecessary short-term speculation, not becauseit does not carry an excess bur<strong>de</strong>n. The IMFanalysis by Matheson, reported in the precedingparagraph, seems more convincing than Stiglitz’s.The revenues of the planned European FTT arenot likely to be earmarked for IFD anyway, as theUNDP has admitted. 63Carbon taxesAssuming that the benefits of carbon reductionoutweigh the <strong>de</strong>adweight loss caused by efficientcarbon taxes, the relative efficiency of carbon taxes<strong>de</strong>pends on their type. As mentioned before, carbontaxes come in two varieties: specific taxes per tonof CO 2 emitted; and emission trading systems,also called “cap-and-tra<strong>de</strong>.” Both methods can belikened to Pigovian taxes, for they have the sameeffect: They add an extra cost to the production ofeach unit of the “bad” being taxed, and thus reduceoutput. Pigovian taxes are specifically <strong>de</strong>signedto change behaviour so as to avoid an existing<strong>de</strong>adweight loss, such as the one created by pollutionwhen people do not take into consi<strong>de</strong>ration the realcosts of their actions. IFD taxes, on the contrary,are <strong>de</strong>signed to raise revenue. Some proponents ofcarbon taxes wish for a tax that would be both arevenue-raiser and a Pigovian tax, thus eliminatingthe excess bur<strong>de</strong>n of raising revenues. If revenuescan be raised by reducing a “bad,” no inefficiencyis involved.This might work if the proposal was to earmarkfor IFD some revenues from a cap-and-tra<strong>de</strong>system, like the German government actually doeswithin the European Emissions Trading System.Economists generally admit that a cap-and-tra<strong>de</strong>system is more efficient than specific Pigoviantaxes, for it lets the market compute the optimalamount of the tax: the state only has to fix thecap, and the market calculates carbon prices. 64However, the government of Germany remains anexception in using the Emissions Trading System asan IFD mechanism, and few other governments arelikely to follow suit. The international cooperationrequired to create an international cap-and-tra<strong>de</strong>system would be even more difficult to achieve.More likely to be adopted is the World Bank’sand IMF’s proposal for a specific tax on the carbonproduced by international aviation and maritimefuel. Not being broad-based, such a tax wouldbe discriminatory: It would hit internationalpassengers (again) and internationally-shippedgoods. The IMF estimates that a US$25 tax pertonne of CO 2 would lead to a 2%-4% price increaseon air tickets, and a 0.2%-0.3% price increase onseaborne imports. 65 Since the elasticity of <strong>de</strong>mandfor maritime transport (which carries mainlygoods) is lower than for air passenger transport, 66we should therefore expect a smaller excess bur<strong>de</strong>nin maritime shipping.This result must be qualified by three factors.First, the excess bur<strong>de</strong>n in airline passenger transportwould be relatively high (given the high elasticity of<strong>de</strong>mand in many sub-markets). Second, the excessbur<strong>de</strong>n in maritime shipping would still be nonnegligible,as 90% of world tra<strong>de</strong> (measured by tonnekilometer)is carried by ship. 67 Third, if the carbontax is really set at US$25/ton, which is much higherthan the implicit tax imposed by the EU Emissions59. Matheson (2011), p. 9.60. The Economist (2013c).61. Matheson (2011).62. Stiglitz (1989).63. UNDP (2012), p. 18.64. It should be noted however that <strong>de</strong>termining the optimal cap is notnecessarily less arbitrary than finding the optimal tax.65. IMF (2011), p. 7.66. Coto-Millán et al. (2005), p. 369, and passim.67. IMF (2011), p. 16.20Montreal Economic <strong>Institut</strong>e

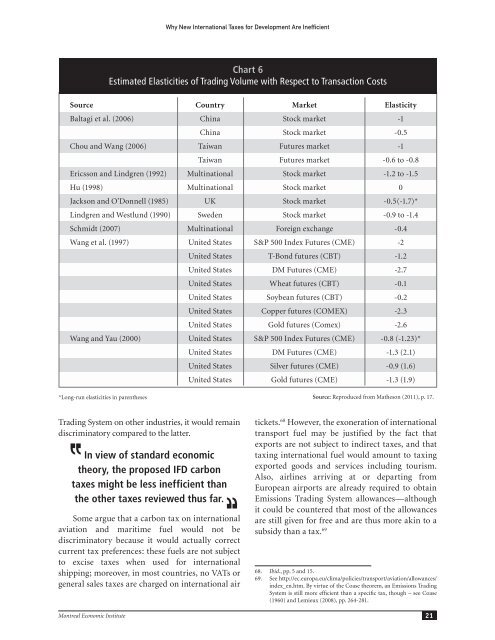

Why New International Taxes for Development Are InefficientChart 6Estimated Elasticities of Trading Volume with Respect to Transaction CostsSourceCountryMarketElasticityBaltagi et al. (2006)ChinaStock market-1ChinaStock market-0.5Chou and Wang (2006)TaiwanFutures market-1TaiwanFutures market-0.6 to -0.8Ericsson and Lindgren (1992)MultinationalStock market-1.2 to -1.5Hu (1998)MultinationalStock market0Jackson and O’Donnell (1985)UKStock market-0.5(-1.7)*Lindgren and Westlund (1990)Swe<strong>de</strong>nStock market-0.9 to -1.4Schmidt (2007)MultinationalForeign exchange-0.4Wang et al. (1997)United StatesS&P 500 In<strong>de</strong>x Futures (CME)-2United StatesT-Bond futures (CBT)-1.2United StatesDM Futures (CME)-2.7United StatesWheat futures (CBT)-0.1United StatesSoybean futures (CBT)-0.2United StatesCopper futures (COMEX)-2.3United StatesGold futures (Comex)-2.6Wang and Yau (2000)United StatesS&P 500 In<strong>de</strong>x Futures (CME)-0.8 (-1.23)*United StatesDM Futures (CME)-1.3 (2.1)United StatesSilver futures (CME)-0.9 (1.6)United StatesGold futures (CME)-1.3 (1.9)*Long-run elasticities in parenthesesSource: Reproduced from Matheson (2011), p. 17.,,Trading System on other industries, it would remaindiscriminatory compared to the latter.In view of standard economictheory, the proposed IFD carbontaxes might be less inefficient thanthe other taxes reviewed thus far. ,,Some argue that a carbon tax on internationalaviation and maritime fuel would not bediscriminatory because it would actually correctcurrent tax preferences: these fuels are not subjectto excise taxes when used for internationalshipping; moreover, in most countries, no VATs orgeneral sales taxes are charged on international airtickets. 68 However, the exoneration of internationaltransport fuel may be justified by the fact thatexports are not subject to indirect taxes, and thattaxing international fuel would amount to taxingexported goods and services including tourism.Also, airlines arriving at or <strong>de</strong>parting fromEuropean airports are already required to obtainEmissions Trading System allowances—althoughit could be countered that most of the allowancesare still given for free and are thus more akin to asubsidy than a tax. 6968. Ibid., pp. 5 and 15.69. See http://ec.europa.eu/clima/policies/transport/aviation/allowances/in<strong>de</strong>x_en.htm. By virtue of the Coase theorem, an Emissions TradingSystem is still more efficient than a specific tax, though – see Coase(1960) and Lemieux (2008), pp. 264-281.Montreal Economic <strong>Institut</strong>e 21