Untitled

Untitled

Untitled

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2012

CONTENTContentIntegrated Report 2012 1

CONTENTMessage from the Chairman of the Board of Directors of JSC “Samruk-Energy”Dear Colleagues!Head of State, Government ofthe Republic of Kazakhstan andJSC “Sovereign Wealth Fund“Samruk-Kazyna” (hereinafterreferred to as the Fund) place aspecial emphasis on boosting thepower energy of the country.The task was set to the powerindustry to satisfy the growingneeds of the economy in thesphere of electric energy.Modernization and reconstruction of existing 7 GWgenerating capacities and introduction of new 14 GWcapacities is required to be completed by 2030.JSC “Samruk-Energy” (hereinafter referred to as theCompany), the largest electric power holding companyin Kazakhstan, plays an important role in reaching of theabove goals.The Board of Directors and management team of JSC“Samruk-Energy” employs cutting edge methods andtechniques to achieve sustainable growth of the Companyand power industry as a whole.In 2012, due to joint efforts of JSC “Samruk-Energy” and itspartners the operation of Moinakskaya HPP and 8 th powerunit of Ekibastuzskaya GRES-1, as well as constructionof Balkhash TPP were started, and modernization ofelectrical networks of Almaty is being performed.Effective work of JSC “Samruk-Energy” team allowsachieving an annual growth of financial and economicactivity, increased assets, and most importantly – formacohesive team of professionals.Last year JSC “Samruk-Energy” celebrated its fifthanniversary. However, in such a short period of time theCompany made a significant contribution to the industry,and launched a series of large projects. All strategicprojects of the Company are included in the State Programof Forced Industrial-Innovative Development of the countryand the Industrialization Map.In August 2012, 50% stake in the share capital of LLP“Ekibastuzskaya GRES-1 named after Bulat Nurzhanov”was transferred to the share capital of the Company. Inaddition, in 2012, 100% of shares of JSC “East KazakhstanElectricity Distribution Company” were transferred to thetrust management of the Company and later in 2013 thesaid shares will be transferred to the share capital of theCompany.Thus, the Company acquired and combined power stationswith a total installed capacity of about 9.7 GW, or 47.3% ofinstalled capacity of the Unified Electric Power Systemof Kazakhstan, as well as the two largest electricitydistribution companies.In 2012, with the adoption of new strategic assets, ahuge work was performed by JSC “Samruk-Energy”to update the long-term development strategy of theCompany reflecting the vision of its development, aswell as the Company’s position and value in the industry.The approval of the strategy by the Board of Directors isscheduled for the beginning of 2013 and further submittedto the Management Board of JSC “Sovereign Wealth Fund“Samruk-Kazyna” and the Prime Minister of the Republicof Kazakhstan.In order to protect the interests of the Shareholder,increase performance efficiency, and to enhance the valueof the company, JSC "Samruk-Energy” is working on theimprovement of corporate governance and implementationof risk management and internal control systems inaccordance with the leading international practices.Along with the main production activity, improvement ofsocial policy is an important direction of the developmentof the Company. In 2012, funding of social paymentsand guarantees as provided in collective bargainingagreements of subsidiary and affiliated organizations ofthe Company significantly increased. Following the 2012evaluation results, the level of staff satisfaction within theSamruk-Energy Group of Companies was 83%.In the reporting period JSC “Samruk-Energy” hassuccessfully passed the first supervisory audit of CorporateManagement System on compliance with internationalstandard ISO 9001:2008.According to the diagnostics results on compliance withthe best international practices, the level of corporategovernance of the Company in 2012 was 65%, andJSC “Samruk-Energy” was ranked 3 rd among the Fund’sorganizations. The task is set to the Company to furtherimprove corporate governance and achieve the level ofcompliance of 75% in the year 2015.In 2012, following independent evaluation results, theperformance of the Company’s Board of Directors wasconsidered efficient, and recommendations for its furtherdevelopment were provided.The Shareholder defined the importance and responsibilityof the Board of Directors for strategic management, andannounced its expectations for the coming 2013 year onmajor activities of the Company. In particular, in respectof long-term strategy, definition of strategic objectives ofinnovative technological development and mechanisms ofimplementation of innovative strategies of the Company,approval and monitoring of the program to reduce costs,construction of an appropriate strategy for sustainabledevelopment and social responsibility, and implementationof corporate policies and standards.I am confident that the above plans, despite of theirimmensity, will be achieved by the highly professional anddedicated team of the Group of Companies of Samruk-Energy.Bektemirov Kuanysh AbdugaliyevichChairman of the Board of Directors of JSC "Samruk-Energy”Integrated Report 2012 2

CONTENTMessage from the Chairman of the Management Board of the CompanyDear Colleagues!The year 2012 was a successful yearfor the Company. All tasks set to theteam of Samruk-Energy Group ofcompanies were completed.Close attention of the Governmentof the Republic of Kazakhstanand JSC “Sovereign Wealth Fund“Samruk-Kazyna” to the issues ofconsistent development of domesticpower industry contributed to thissuccess.Electricity production amounted to 17,418 million kW/h,exceeding the planned target.Electricity sale was also ahead of schedule and reached5,626 million kW/h.Projected target for services on transmission anddistribution of electricity was beaten as well; and the planfor coal production was over-fulfilled by 9%.During the reporting period, JSC “Alatau ZharykCompaniyasy” and LLP “AlmatyEnergoSbyt” were withdrawn from loss.As a result, the total profit for the year 2012 accordingto the audited financial statements is 18,632 mln tenge,exceeding the target by 19%. The profit will be reinvested inthe modernization and maintenance of technical conditionof power plants, and in financing a number of investmentprojects.The year 2012 was marked by a number of significant eventsfor the Company, including commissioning a unique highpressureMoinakskaya HPP with a 300 MW capacity, andthe recovery of 500 MW power unit No.8 of EkibastuzskayaGRES-1.On September 13, 2012 in the framework of official visit ofthe President of Korea Lee Myung Bak to the Republic ofKazakhstan, the official ceremony for construction of thefirst module of Balkhashskaya TES with 1,320 MW capacitywas conducted. The ceremony was held in the format ofvideo conference Astana – Ulken with the participation ofthe heads of the two states.In November last year, the international rating companyStandard & Poor’s has assigned the Company a long-termcredit rating at “BB+” level and a “kzAA-” national scalerating. The outlook is “Stable”.In addition, the international rating company Fitch Ratingshas assigned the Company a long-term issuer defaultrating (IDR) in foreign and local currency at “BBB”and “BBB+” levels respectively, and a short-term foreign currencyIDR at “F3” level, while national long-term rating was “AAA(kaz)”.The outlook for long-term rating is “Stable” as well.As a result, the Company has successfully placed five-yearEurobonds worth 500 million US Dollars with the yield setat 3.75% per annum on the Irish Stock Exchange (ISE) andthe Kazakhstan Stock Exchange (KASE).This has been the best placement of Kazakh issuers inthe history of the financial market of Kazakhstan, and thefigure became a benchmark for many companies, includingthe development institutes of the country.JSC “Samruk-Energy” recognizes its social responsibilityfor providing reliable and stable operation of enterprisesand compliance with the existing legislationin respect ofenvironmental protection and labor safety, in matters ofliability to consumers for the quality of services provided.In order to minimize environmental pollution the Companyconducts systematic work to reduce harmful emissionsinto the atmosphere and water facilities, as well asmodernization of technological processes and explores thepossibility of application of clean coal technologies.Measures were taken to prevent accidents. As a result, in2012 the number of accidents in the Group of companiesof Samruk-Energy, as compared to 2011, significantlydecreased. In 2013, this work will be continued.The Company will promote its business activities associatedwith providing reliable power supply and creation of properconditions for sustainable development of the real sectorof the economy of Kazakhstan, and meeting the needs ofpeople in power and heat.Satkaliyev Almasadam MaidanovichChairman of the Management Board of JSC “Samruk-Energy”Integrated Report 2012 3

CONTENTAbout the ReportIntegrated Report 2012 4

CONTENTReporting period to which the presented information is applicable andthe date of publishing of the previous ReportThe Integrated Reportof JSC “Samruk-Energy” (hereinafter referred to as the Report) represents theoverview of performance results and achievements of Samruk-Energy Group of Companies for theperiod from January 1, 2012 to December 31, 2012.The present Report provides information in the spheres of economy, environment, industrial safety,labor protection, corporate social responsibility and financial activity. All information and quantitativedata are presented for the year 2012; however, the figures for 2010 and 2011 were used for comparisonand analysis purposes where applicable.The previous Annual Report was published in August, 2012.Reporting cycleThe present Report is the first Integrated Report in the history of the Company and includessustainable development and financial indicators of Samruk-Energy Group of companies for the year2012.The history of preparation of non-financial reports of the Company dates back to 2010, when the firstAnnual Report of the Company was published covering the activity results of the year 2009.In 2011, along with the Annual Report, the Company published the Sustainable Development Reportof Samruk-Energy Group of companies for the period from January 1, 2010 to December 31, 2010.JSC “Samruk-Energy” (hereinafter – the Company) intends to publish the Integrated Report on anannual basisContact information for questionsin respect of the Report or its contentAddress of the Central Administrative Office of Samruk-Energy Group of companies:010000, Astana, 17 Kabanbay batyr Ave.,Lukoil Business Center, Block ETelephones: + 7 (7172) 55-30-00,+ 7 (7172) 55-30-21Fax: +7 (7172) 55-30-30Е-mail: info@samruk-energy.kzFor any questions regarding the Report or its content please contact:Mukusheva Madina Sheriyazdanovna, DirectorCorporate Governance DepartmentTelephone: +7 (7172) 55-30-05Process for defining the Report contentThe present Report is prepared in accordance with the “Global Reporting Initiative” (GRI3.1) principlesof the International Integrated Reporting Committee and the International Financial ReportingStandards. The Report is developed on the basis of the version 3.1. of the Sustainable DevelopmentReporting Guidelines (Global Reporting Initiative, G3.1) and Industry Protocol in the field of ElectricUtility, EU. The table indicating standard elements of the Report is provided in Annex 1: Table ofCorrespondence of the Report to the GRI Guidelines.When determining the materiality of the Report the Company was considering the actual spheres ofinterest of the involved parties.Scope of the ReportThe Company is amanaging company and does not perform operational activity, thus exerting littleimpact on the environment. As at December 31, 2012 the structure of JSC “Samruk-Energy” consistedof 37 organizations. For the purposes of full disclosure of sustainable development indicators, theReport contains consolidated information on the Group of companies of Samruk-Energy, comprising 25subsidiary and affiliated organizations, excluding the following:• Forum Muider B.V.-Managing company;• JSC “Bukhtarminskaya HPP”, JSC “Shulbinskaya HPP” and JSC “Ust-Kamenogorskaya HPP” – onlease and concession;• LLP “Kaaragandagiproshakht and K” and JSC “East-Kazakhstan “Regional Electric Company” –under trust management;• 12 other companies;• JSC “KazKuat” and JSC “KMG-Energo” – in the process of liquidation.Methods of data calculation including suggestions and methodologiesused for preparation of indicators and other information includedin the ReportCalculation, collection and consolidation of performance, social and ecological indicators providedin the Report of the Company were performed in accordance with the reporting principles andrequirements of the Global Reporting Initiative, G3.1 and corporate governance procedures of JSC"Samruk-Energy”. A margin of quantitative data errors for each sustainable development indicatoris minimized. Ratios and specific values are supplemented with absolute values. Quantitative datais presented using a common system of measurement and calculated using standard coefficients.Policy and current practice with regardto seeking external assurance for the ReportThe Report has been prepared in accordance with the “B” level of GRI 3.1 reporting system:SelfdeclarationThird partycheckС С+ B B+ A A+ExternalassurancepassedExternalassurancepassedExternalassurancepassedAbout the ReportIntegrated Report 2012 5

CONTENTSignificant events and state awards for 2012State awards24 JanuaryBy the decision of the Management Board of JSC “SovereignWealth Fund “Samruk-Kazyna” Satkaliyev AlmasadamMaidanovich was appointed to the position of Chairman ofthe Management Board of the Company.27 January“Kurmet”medal“Eren enbegiushin”medalCertificateof Honor ofKazakhstanPresident of the Republic of Kazakhstan in his Message“Social-economic modernization – the main vector ofdevelopment of Kazakhstan” set task to start constructionof the first module of 1,320 MW “Balkhashskaya TES” in2012.13 FebruaryNew composition of the Company’s Management Boardwas appointed at the meeting of the Board of Directors ofthe Company (Minutes #55).22 MarchBaimukhambetov Kalaubek,acting General DirectorJSC “Moinakskaya HPP”Guzovskaya Nadezhda, driverof steam turbinesJSC “AlES”Zhurgarayev Mukhtar,chief senior station shiftsupervisorJSC “Zhambylskaya GRES”Kuzhaliyev Zhaksylyk,Deputy Head of the ElectricEquipment Repair departmentJSC “Alatau ZharykCompaniyasy”Release of the audited financial statements for the year2011.27 MarchDuring the official visit of the Head of State to the Republicof Korea held in the framework of the Kazakhstan- KoreanBusiness Council the signing ceremony of the contractofsale of shares of JSC “Balkhashskaya TES” was held inSeoul.A Memorandum of Understanding was signed between theCompany and Hyundai Corporation17 AprilThe Company completed the deal on sale of shares ofJSC “Balkhashskaya TES” to Samsung Corporation in theamount of 755,691 shares, constituting 75% -1 share ofcharter capital.26 MayThe President of the Republic of Kazakhstan NursultanNazarbayev visited Moinakskaya HPP (Raiymbek districtof Almaty oblast). The Head of state flew over Bestyubinskreservoir, got acquainted with hydroelectric productionfacilities and operation of the first 150 MW hydraulic unit,after which had officially started the ceremony for launchof the second hydroelectric generating set of MoinakskayaHPP.About the ReportIntegrated Report 2012 6

CONTENT29 MayA Memorandum on Cooperation was signed in the city ofTaldykorgan between the Company and Akimat of Almatyoblast as part of the “Construction of Wind Power Plants(WPP) with 60 to 300 MW capacity in Shelek Corridor ofYenbekshi kazakh District of Almaty Oblast” project.25 JuneA turnkey contract between JSC “Balkhashskaya TES”and Samsung Engineering Company Limited for theconstruction of the first module of Balkhashskaya TES wassigned in Astana.3 JulyDuring the online nation wide teleconference “StrongKa zakhs tan will build together!” President NursultanNazarbayev approved the start of operation of the eighthpower unit of LLP “Ekibastuzskaya GRES-1 named afterBulat Nurzhanov”.17 AugustApproval of the 2011 Annual Report of the Company.24 AugustJSC “Shardarinskaya HPP” and the European BankforReconstruction and Development (hereinafter – EBRD)signed a loan agreement amounting to 9,150 billion tenge.The funds will be used to finance the investment project“Modernization of Shardarinskaya HPP”.29 AugustIn accordance with the Resolution of the Government of theRepublic of Kazakhstan #1103 the Company’s shares with a5.6% participation of JSC “KazTransGas” were transferred toJSC “Sovereign Wealth Fund “Samruk-Kazyna”.JSC “Sovereign Wealth Fund “Samruk-Kazyna” became a100% shareholder of the Company.August-SeptemberFollowing the diagnostics results on compliance withthe best international practices the level of corporategovernance of the Company in 2012 was 65%.12 SeptemberA Memorandum of Understanding was signed between theCompany and Korea Electric Power Corp. (KEPCO, Republicof Korea) on cooperation in the field of nuclear energy.13 SeptemberAn official ceremony for the construction of the first moduleof 1320 MW Balkhashskaya TES was held during the officialvisit to the Republic of Kazakhstan of the President of theRepublic of Korea Lee Myung Bak.The ceremony, which was held in the format of videoconference“Astana- Ulken village”, was attended by thePresident of Kazakhstan Nursultan Nazarbayev and thePresident of Korea Lee Myung Bak.31 OctoberIn accordance with the act of acceptance, 50% shares ofparticipation of JSC “Sovereign Wealth Fund “Samruk-Kazyna” in the charter capital of LLP “Ekibastuzskaya GRES-1 named after Bulat Nurzhanov” was transferred to the sharecapital of JSC “Samruk-Energy”.20 NovemberInternational rating agency Standard & Poor’s has assignedthe Company a long-term credit rating at “BB+” level and a“kzAA-” national scale rating. The outlook is “Stable”.26 NovemberInternational rating company Fitch Ratings has assignedJSC “Samruk-Energy” a long-term issuer default rating(IDR) in foreign and local currency at “BBB” and “BBB +”levels respectively, and a short-term foreign currency IDRat “F3” level, while national long-term rating was at “AAA(kaz)” level. The outlook for long-term ratings is “Stable”.4–5 DecemberThe Company successfully completed the first supervisoryaudit of Corporate Management System on compliancewith international standard ISO 9001:2008.14 DecemberChanges in the composition of the Management Board ofthe Company.21 DecemberFive-year Eurobonds for 500 million US Dollars with theyield of 3.75% per annum were placed on the Irish StockExchange (ISE) and the Kazakhstan Stock Exchange (KASE).About the ReportIntegrated Report 2012 7

CONTENTMain indicators of the Society for 2012thous. Gcal7 471Production of thermalenergymln kW/h17 418Production of electricitymln tons44Coal outputmln kW/h5 626Electricity salesmln kW/h8 395Electricity transmission43,2%Share of investmentsfor development andimplementation of newproducts and technologies (in% to the Company’s expenses)bln tenge18,76Net income65%Corporate governanceratingmln tenge1206.2%6.4%20%Sponsorship andcharitable expensesROACEROEEBITDA MarginAbout the ReportIntegrated Report 2012 8

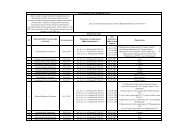

CONTENTKey performance indicators of the CompanyProduction indicators*IndicatorUnit ofmeasurement2010 20112012(actual)2013(planned)2015(planned)Production of electricity mln kW/h 12 686 13 397 17 418 31 004 33 708Electricity sales mln kW/h 4 993 5 330 5 626 5 833 6 459Electricity transmission mln kW/h 7 548 7 961 8 395 8 697 9 394Production of thermal energy thous. Gcal 7 460 7 756 7 471 7 568 7 574Coal output mln tons 38,9 40,64 44 49,47 51,67Labor productivity in coal mining tons/person 5 677 5 796 5 939 5 762 6 113Labor productivity in coal miningthous. tenge/person11 902 12 609 17 377 17 728 20 282Labor productivity in electricity productionthousand kW/h/person2 062 2 195 2 383 4 261 4 580Labor productivity in electricity productionmln tenge/person- - 13 834 30 691 38 322Labor productivity in electricity transmissionthousand kW/h/person1 908 1 897 1 919 1 616 1 674Number of process failures unit 1 613 1 748 1 712 4 877** 4 389**IndicatorUnit ofmeasurement2010 20112012(actual)Financial indicators*2013(planned)2015(planned)ROACE % 8,9 7,8 6,2 15,5 11,93EBITDA Margin % 21 20 20 22,4 41,9Net income bln tenge 10,86 14,79 18,76 55,3 108,1ROE % 9,67 9,0 6,4 15,0 16,6About the ReportIntegrated Report 2012 9

CONTENTIndustrial and innovation indicatorsIndicatorShare of investments for developmentand implementation of new products andtechnologies (in % to the Company’s expenses)Unit ofmeasurement2010 20112012(actual)2013(planned)2015(planned)% 3 4 43,21 13 11Corporate Governance indicators*IndicatorUnit ofmeasurement2010 20112012(actual)2013(planned)2015(planned)Corporate governance rating % 39,7 61,9 65 66 75IndicatorUnit ofmeasurement2010 20112012(actual)Social indicators*2013(planned)2015(planned)Staff involvement degree % - - - 60 68Staff annual turnover % 8 8 8,6 11 10Number of accidents at work per thous andpeopleShare of local content in procurement ofgoodsShare of local content in procurement ofworks and servicesnumber/1000people1,18 1,49 0,85 - -% 62 70 64 65 65% 57 87 73 76 76* Projected figures (plan for 2013–2015) are presented in accordance with the Development Strategy of JSC “Samruk-Energy” for 2012–2022** increase in the number of process failures was due to LLP “Ekibastuzskaya GRES-1” and “East-Kazakhstan “Regional Electric Company” joining the Group ofCompanies of JSC “Samruk-Energy”About the ReportIntegrated Report 2012 10

CONTENTABOUT THE COMPANYGeneral InformationMarket Overview and the Company's Position in the MarketAssets Structure of the Company as of December 31, 2012Priority Activity Directions and Main Products:Production CapacityProduction Goals and ObjectivesSubsidiary and Affiliated Organizations of the CompanyInnovation ActivityIntegrated Report 2012 11

CONTENTGeneral informationJSC “Samruk-Energy” was established on April 18, 2007 in the framework of developmentand implementation of a long-term state policy on modernization of existing andintroduction of new generating facilities, and pursuant to the decision of the GeneralMeeting of Founders. The Company’s founders at that moment were JSC “KazakhstanState Assets Management Holding “Samruk” and JSC “KazTransGas”.The Company was registered on May 10, 2007 with its Central office located in Almaty.On November 3, 2008, due to the merge of JSC “Kazakhstan State Assets ManagementHolding “Samruk” and JSC “Sovereign Wealth Fund “Samruk-Kazyna”, the Company’sShareholder became JSC “Sovereign Wealth Fund “Samruk-Kazyna”, the successor of JSC“Kazakhstan State Assets Management Holding “Samruk”.In May 2010, the Company moved from Almaty to Astana.The Company is a holding that manages energy and coal enterprises in the RepublicofKazakhstan. As of December 31, 2012, asset structure of JSC “Samruk-Energy” included37 organizations. JSC “KazKuat” and JSC “KMG-Energo” are in the process of voluntaryliquidation.Market overview and the Company’sposition in the marketKey sales markets (electric power wholesale and retail markets, thermal power local markets)and the services of subsidiary and related organizations of JSC “Samruk-Energy” by zones ofthe Unified Electric Power System of the Republic of Kazakhstan:• Northern Zone – Akmola, Aktobe, West Kazakhstan, Karagandy, Kostanay, Pavlodar,North Kazakhstan oblasts, and Astana.80% of electricity of the total value of production in Kazakhstanis generated in the Northernzone.This is mainly due to the fact that the main coal deposits of Kazakhstan and hydro powerresources are located in the Northern zone, which significantly reduces the cost ofelectricity generation.Excess of electricity is transmitted to the power-hungry Southern zone and exported toRussia.• Southern Zone – Almaty, Zhambyl, Kyzylorda and South Kazakhstan oblasts, and the cityof Almaty. This zone is characterized by power shortages and high prices for it.The deficit is covered by electricity transmission from the Northern Zone and theConsolidated Power System of Central Asia.• Western Zone–Mangistau, Atyrau, West Kazakhstan oblasts. Most of the projects in theoil and gas sector belong to Western oblasts.Despite the significant hydrocarbon resources, part of the needs in the electric energy iscovered by imports from Russia. In the future, to fully cover its own needs and for powerexport abroad new power generating capacities are planned to be established in the region.ABOUT THE COMPANYIntegrated Report 2012 12

CONTENTPetropavlovskKostanaiKokshetauUralskPavlodarAstanaAktobeSemeyUst-KamenogorskKaragandaAtyrauTaldykorganAktauKyzylordaCaspian SeaShymkentTarazAlmatyABOUT THE COMPANYIntegrated Report 2012 13

CONTENTJSC “Samruk-Energy”Asset structure of the Companyas of December 31, 2012LLP “AlmatyEnergoSbyt” – 100%LLP “Samruk-Green Energy”JSC “Alatau Zharyk Kompaniyasy”– 100%JSC“Aktobe CHP”JSC“AlES”LLP “Energy of theSemirechye”LLP “The First WindPower Station”JSC “MREC”1 shareLLP “Teguise Munai”JSC “ZGRES”JSC “Ekibastuzskaya GRES-2 Station”LLP “Ekibastuzskaya GRES-1”JSC “Balkhashskaya TES”LLP “AlmatyEnergoSbyt” – 100%1 shareLLP “Mangyshlak-Munai”JSC “Shulbinskaya HPP”JSC “Ust-Kamenogorskaya HPP”JSC “Bukhtarminskaya HPP”JSC “Moinakskaya HPP”LLP “Bogatyr Komir”LLP “Samruk-Energy Stroy-Service”LLP “TPEP”JSC “KMG-Energy”JSC “Shardarinskaya HPP”JSC “KazKuat”at the stage of liquidationIn the process of acquisition for direct controlABOUT THE COMPANYIntegrated Report 2012 14

CONTENTToday the Company represents the largest diversified energy holding successfullyintegrated into the international power balance, forming a highly efficient system of energysupply, and ensuring the sustainable development of all sectors of Kazakhstan.Priority Activity Directions and Main Products:• production of electric energy• production of thermal energy• transmission and distribution of electric energy• extraction of power-generating coal• reconstruction, expansion and construction of energy facilitiesProduction capacitiesThe available capacity of electric power station was 9,665.2 MW, or 47.3% of the grossinstalled capacity of the UES of the republic.Electric power generation was 34,749.3 mln kW/h, or 38.5% of the gross installed capacityof the UES of the republic in 2012.Length of 0.4-220 kV, km power transmission lines (hereinafter the PTL):• Overhead transmission lines – 63,535;• Cable transmission lines – 5,749;• total length of transmission lines – 69,285 (including JSC “EK REC”).220 kV and below substations:• substations of 35kV and above; Number – 575; full capacity – 11200 МVA• substations of 6-10/04 kV; Number – 13861; full capacity – 3792.2 МVAInstalled (production) capacity brokendown by energy sourceand by regulatory regimeName 2010 2011 2012 Unit of measurementHPP and RES 2.2 2.2 2.5 GWGRES* 2.230 2.230 6.230 GWCHP* 0.930 0,930 0.916 GWCoal mines** 42 42 42 mln tons/year*unit of measurement capacity in GW, including LLP “Ekibastuzskaya GRES-1”** Bogatyr (32 mln tons a year) and Severnyi (10 mln tons a year) coal minesABOUT THE COMPANYIntegrated Report 2012 15

CONTENTGeneration (production) broken down by energy source and by regulatory regimeName 2010 2011 2012 Unit of measurementHPP and RES 7,834.8 7,685.3 7,607.5 GW/hGRES* 5,896 6,785.6 22.676 GW/hCHP 4,122.3 4,410.1 4,642.28 GW/hCoal mines 38.9 40.6 44 mln tons*including LLP “Ekibastuzskaya GRES-1”ABOUT THE COMPANYIntegrated Report 2012 16

CONTENTIn 2012, the increased production of electric power in relation to the planned figures wasobserved at the Company’s power plants by the amount of 701 million kW/h (2.5%), includingdue to the new equipmentand more intense boot of LLP “Ekibastuzskaya GRES-1” for 508million kW/h or 3.46%.Key performance indicators of LLP “Ekibastuzskaya GRES-1” show a decrease in fuelconsumption from 368.5g/kW/h to 368.2 g/kW/h, and an increase in installed capacityutilization index from 41.7% to 43.16%, which was achieved by increase in the averagestation load in 2012.As far as JSC “EGRES-2” is concerned, production increased from 5,968 mln kW/h to 6,134mln kW/h due to the reduced number of downtime of power generating units in the plannedand unplanned repairs. The increase in the specific consumption of fuel from 357.05 g/kW/h to 372.24 g/kW/h was connected with repair of high pressure heaters (hereinafter –HPH), and, as a consequence, reduced efficiency of turbine units of stations #1,2. However,the installed capacity utilization index significantly improved from the planned 67.955% tothe actual 69.83%.Electricity generation at Zhambyl GRES in the Southern Zone of Kazakhstan in 2012increased by 171 million kW/h (14.2%) and amounted to 1,377.9 million kW/h. From April toOctober Zhambyl GRES suspended its activities in connection with the end of the autumnwinterperiod. There were from one to four units operating at the station. Specific energyconsumption for own needs decreased from 7.1% to 6.75% as compared to the previous yearand set targets due to increase of the average station load in 2012 to 286 MW, comparingto 241 MW in 2011. Specific fuel consumption in 2012 corresponded to the planned figureand was 386.3 g/kW/h.Electricity generation at JSC “AlES” in comparison to the year 2011 decreased by 138 millionkW/h, or 2.53% to 5,311.2 million kW/h. Generation decreased due to lower generation athydropower plants. Operating mode of the HPP was determined by the water managementbalance and hydrological conditions.Due to the reduce of water resources consumption compared with 2011 production atKapshagay HPP in 2012 decreased by 27% and was 1090.2 billion kW/h.Following the results of the analysis of performance indicators of JSC “Aktobe CHP”, theplant has reduced the production of electric energy from 677,214.439 thousand kW/h in2011 to 631,356.263 thousand kW/h in 2012, which is by 1% less than the production planin 2012 (637,728 thousand kW/h). Decrease in electricity generation as compared to thetarget is connected with disposal of facilities in connection with the replacement of turbineunit at station #3.In percentage, consumption of electricity for own needs in 2012 was 17.7%, higher than 16%in 2011, which is due to lower average load for the year as a whole. Capacity utilization indexincreased by 73% in comparison with the target 71%.The main fuel of JSC “Aktobe CHP” is oil associated gas of Zhanazhol field. Supply of fuelwas carried in full and on time, total gas consumption in 2012 was 423,344 thousand cubicmeters. Consumption of fuel per unit of delivered products in 2012 was as follows:• for electric energy output – 375.8 g/kW/h, by 1.3 g/kW/h higher than in 2011;• for thermal energy output – 174.2 kg/Gcal, by 1.7 kg/Gcal higher than last year.Coal was the main type of fuel for Samruk-Energy Group of companies burned in thermalelectric stations, as in the previous year.Coal consumption by electric stations in 2012 amounted to 16,772,830 tons of naturalfuels,and increased in comparison with 2011 by 1,576 thousand tons, or 9.3%. The main typeof solid fuel burned in thermal electric stations of JSC “Samruk-Energy” was Ekibastuzcoal.Water storage in Kapshagay long-term storage reservoir in 2012 decreased by 1.12 billion m 3 ,compared to the previous year.ABOUT THE COMPANYIntegrated Report 2012 17

CONTENTNumber of accounts of households,industrial, institutional and businessconsumersName 2010 2011 2012Unit ofmeasurementHouseholds 644 937 676 909 689 956 accountIndustrial consumers 1 834 1 881 1 948 accountBudget consumers 1 313 1 318 1 218 accountOther (including commercial consumers) 20 741 21 733 21 745 accountTOTAL: 688 825 701 841 714 929 accountABOUT THE COMPANYIntegrated Report 2012 18

CONTENTLength of the above-ground and undergroundpower lines and distribution lines broken downby regulatory regimeAbove-groundUndergroundTotal length30000500030000250004000250002000015000100005 98824 4666 13924 481300020003 9654 2112000015000100006 05728 4316 25028 69250001000691115000002011 2012 2011 2012 2011 20120Length oflines morethan 35 kVLength oflines lessthan 35kVProduction goals and objectives of the Company:• Producing target outputs of electric and thermal power;• Minimization of adverse environmental impact;• Reducing specific fuel consumption and optimization of the equipment operation;• Ensuring the operation of the power-generating equipment is in compliance with theapplicable regulatory requirements;• Restoration, modernization and reconstruction of the existing and construction of newpower facilities.ABOUT THE COMPANYIntegrated Report 2012 19

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesJSC “Almaty Electric Stations”JSC “Almaty Electric Stations” (hereinafter – JSC “AlES”) isa legal entity established in accordance with the legislationof the Republic of Kazakhstan. In the course of its activityJSC “AlES” is governed by the existing legislation of theRepublic of Kazakhstan and the Charter of JSC “AlES”.Location: Republic of Kazakhstan, Almaty.Shareholders of JSC “AlES” are:• JSC “Samruk-Energy” – 43.65% shares;• JSC “Alatau Zharyk Companiyasy” – 56.35% shares.• Almaty Coordinated Hydroelectric System• Energoremont• Fuel Filling and Unloading CenterThe installed/ rated capacity of JSC “AlES” is 1,238.9 MWand 3,922.2 Gcal/h.In 2012, the enterprises of JSC “AlES” generated 5,311.3million kW/h of electric power and 5,532 thousand Gcal ofthermal power.Electricity and thermal power sales market for JSC “AlES”is Almaty region.JSC “AlES” consists of the following facilities:• Almaty CHP-1• Almaty CHP-2• Almaty CHP-3• Kapshagaiskaya HPP• Western Thermal Power ComplexABOUT THE COMPANYIntegrated Report 2012 20

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesJSC “Aktobe CHP”JSC “Aktobe CHP” is a legal entity established in accordance withthe legislation of the Republic of Kazakhstan and is governedby the existing legislation of the Republic of Kazakhstan and itsCharter.Location: Republic of Kazakhstan, Aktobe.The sole shareholder of JSC “Aktobe CHP” is JSC “AlatauZharyk Companiyasy”.Aktobe CHP is a supplier of electric and thermal power toconsumers of Aktobe.Its rated capacity is as follows:• thermal power – 1,139 Gcal/h• electric power – 102 MW.In 2012, the station generated 631.4 million kW/h of electricpower and 1,835.2 thousand Gcal of thermal power.ABOUT THE COMPANYIntegrated Report 2012 21

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesJSC “Balkhash TPP”JSC “Balkhashskaya Thermal Electric Station” (herein after – JSC “Balkhashskaya TES”) is a legal entityestablished in accordance with the legislation of theRepublic of Kazakhstan and is governed by the existing legaland regulation acts, the Charter and internal documents ofJSC “Balkhashskaya TES”.Location: Republic of Kazakhstan, Almaty oblast, Zhambylregion, Ulken village.Shareholders of JSC “Balkhashskaya TES” are:• JSC “Samruk-Energy” – 25%+1 shares;• SAMSUNG (South Korea) – 75%-1 shares.Construction of two-block unit with 1320 MW capacityis being held to cover energy shortage in the Republic ofKazakhstan through the production of 9.2 billion kW/h peryear.Commissioning period: 2010-2018.In February 2012 in order to attract investments forconstruction of Balkhashskaya TES, 75%-1 shares of JSC“Balkhashskaya TES” was sold to SAMSUNG Corporation(South Korea).ABOUT THE COMPANYIntegrated Report 2012 22

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesLLP “Ekibastuzskaya GRES-1named after B. Nurzhanov”Limited Liability Partnership “Ekibastuzskaya GRES-1named after Bulat Nurzhanov” a legal entity establishedand operating in accordance with the legislation of theRepublic of Kazakhstan.Location: Republic of Kazakhstan, Pavlodar oblast,Ekibastuz.During 2012, total volume of production of EkibastuzskayaGRES-1 was 15.164 bln kW/h. Electric energy sales marketsin Kazakhstan: Northern, Central, Eastern, Southernregions, and Aktobe oblast.Along with electricity supply to Kazakh consumers,Ekibastuzskaya GRES-1 supplies the energy system ofRussia in the framework of the contract concluded betweenthe station and OJSC “Inter RAO UES” in the amount of up to300 MW hourly.Partners of Ekibastuzskaya GRES-1 are:• JSC “Samruk-Energy” – 50% shares in charter capital;• LLP “Ekibastuz Holdings B.V.” – 50% shares in chartercapital.Installed capacity of the station is 4000 MW (8 units 500MW each).ABOUT THE COMPANYIntegrated Report 2012 23

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesJSC “Station Ekibastuzskaya GRES-2”JSC “Station Ekibastuzskaya GRES-2” is a legal entityestablished in accordance with the legislation of theRepublic of Kazakhstan. In the course of its activity thecompany is governed by the existing legislation of theRepublic of Kazakhstan and the Charter of JSC “StationEkibastuzskaya GRES-2”.Location: Republic of Kazakhstan, Pavlodar oblast,Solnechnyi village.Shareholders of JSC “Station Ekibastuzskaya GRES-2”are:• OJSC “Inter RAO UES” (Russia) – 50% shares;• JSC “Samruk-Energy” – 50% shares.The installed/ rated capacity of the station is 1,000 MW.Electric power output in 2012 was 6134.2 million kW/h.Electric power sales markets: Northern, Central, Easternand South regions, and Aktobe oblast of Kazakhstan.ABOUT THE COMPANYIntegrated Report 2012 24

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsGenerating companiesJSC “Zhambylskaya GRES namedafter T.I. Baturov”JSC “Zhambylskaya GRES named after T.I. Baturov” (hereinafter– JSC “ZGRES”) is a legal entity established and operating inaccordance with the legislation of the Republic of Kazakhstan.Location: Republic of Kazakhstan, Zhambyl oblast, Taraz.Shareholders of JSC “Station Ekibastuzskaya GRES-2”are:• JSC “Samruk-Energy” – 50% shares;• LLP “TarazEnergo-2005” – 50% shares.Core activities: electric power generation.Rated capacity: 1230 MW (3х200 MW + 3х210 MW).Electric power sales market: Southern region of Kazakhstan.Electric power output in 2012 was 1,377.8 million kW/h.JSC “KMG-Energo”The company is under liquidation and is not operating.ABOUT THE COMPANYIntegrated Report 2012 25

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Moinakskaya HPP”JSC “Moinakskaya HPP”on the Charyn River in the Almaty oblasthas a capacity of 300 MW and is the fifth largest hydroelectricpower plant in Kazakhstan and the first power generatingfacility of the country which entered into servicein the years ofindependence of the Republic of Kazakhstan.JSC “Moinakskaya HPP” started operation in December 2012.The largest shareholder of JSC “Moinakskaya HPP” is JSC“Samruk-Energy” – 51% of shares.JSC “Moinakskaya HPP” is one of the three power plants in theCIS the elevation difference of which is about 500 m and tunneldiameter – up to 5.5 m.Electricity production in 2012 was 501.4 million kW/h.ABOUT THE COMPANYIntegrated Report 2012 26

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Bukhtarminskaya HPP”JSC “Bukhtarminskaya HPP” was established in accordancewith the decision #1053 dated December 19, 1996 “OnEstablishment of Joint Stock Company “BukhtarminskayaHPP” Released from the Reorganized Joint Stock Company“Altayenergo” of East Kazakhstan Territorial Committee onManagement of the State Property.According to the Resolution of the Government of theRepublic of Kazakhstan #1020 dated October 24, 2006 “Onthe Transfer of State Shares of Some Joint Stock Companiesto the Authorized Capital of JSC “Kazakhstan Holding forManagementof State Assets “Samruk”, on December 28,2006 the state-owned shares of JSC “BukhtarminskayaHPP” were transferred to the authorized capital of JSC“Holding “Samruk”. On January 4, 2008 JSC “Samruk-Energy” became the owner of the state-owned shares ofJSC “Bukhtarminskaya HPP”.“Bukhtarminskaya HPP” is located 15 km downstream fromthe mouth of the river Buhtarmy, 350 km from the head ofthe Irtysh River. Back pressure created by the BHPP damoverrides the natural levels of Zaysan Lake for 5-6 meters,forming a reservoir with 49.6 billion cubic meters capacity.Surface area is 5490 square kilometers.The largest shareholder of JSC “Bukhtarminskaya HPP” isJSC “Samruk-Energy” – 90% of shares.Electricity production in 2012 was 2,315.5 million kW/h.ABOUT THE COMPANYIntegrated Report 2012 27

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Ust-Kamenogorskaya” HPPThe station is located in the north-eastern suburb of Ust-Kamenogorsk and has now four turbines (82.8 MW) with aninstalled capacity of 331.2 MW.The composition of HPP:• concrete spillway dam with crest length of 92 m whichhas four spillway holes;• deaf concrete dams of 300 m;• appurtenant HPP building length 129 m;• single-lift shipping lock.The installed capacity of the plant is 331.2 MW, but due tothe fact that the bridge was not completely removed andchanged the calculated level of the downstream by 1.5meters approximately, available capacity is 315 MW.Long-term average annual generation of the plant is 1,580million kW/h, and in low-water year – 1200 million kW/h.Electricity production in 2012 was 1396.4 million kW/h.The largest shareholder of JSC “Ust-KamenogorskayaHPP” is JSC “Samruk-Energy” – 89.9% of shares.ABOUT THE COMPANYIntegrated Report 2012 28

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Shulbinskaya HPP”JSC “Shulbinskaya HPP” is located in the middle reachof the Irtysh River, 70 km above the city of Semey.Construction of hydropower plant started in 1976 and thefirst hydroelectric set was launched into operation onDecember 23, 1987, while the last of six hydroelectric setswas put into operation on December 19, 1994.The capacity of hydro system objects is designed toaccept 240 m maximum flood under normal waterlevel with 1% probability of exceedance – 7770 m 3 /sec,andunder maximum water level of 243 m of 0.01%probability – 8770 m 3 /sec.The structure of Shulbinskaya HPP includes:• power house;• earth dam;• navigation lock;• water reservoir;• grade-control structure;• 220 kV outdoor switchgear.The major shareholder of JSC “Shulbinskaya HPP” is JSC“Samruk-Energy” – 92.14% of shares.Electricity production in 2012 was 1347.9 million kW/h.ABOUT THE COMPANYIntegrated Report 2012 29

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Shardarinskaya HPP”JSC “Shardarinskaya HPP”is located in the middle reach ofthe Syrdarya River and is the last HPP of Naryn-Syrdaryasystem.Site of Shardarinskaya HPP is located at Zhaushikumhighland where the riverian degradation narrows to 5 km.Shardar hydrosystem with seasonal regulation reservoirwas designed and builtas a complex, one of the maindirections of its use is the irrigation of agricultural landsalong the banks of the middle and lower reaches of theriver.46x107.8 m power house of run-of-river-type is combinedinto a single structure with two hole (5x6m) drafts on theleft and right sides of the units. Grade-control structuresinclude apron and retaining walls of the upper and tailwater. Pipe drainage is located along the upper and leftbanksides of power house footing.The sole shareholder of JSC “Shardarinskaya HPP” is JSC“Samruk-Energy” – 100% of shares.Electricity production in 2012 was 569.3 million kW/h.Construction of Shardar hydro system allowed releasingthe HPP of overlying cascade from irrigation functions,ensuring that they work in a power mode.ABOUT THE COMPANYIntegrated Report 2012 30

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesJSC “Samruk-Green Energy”LLP “Samruk-Green Energy” was established on January25, 2012 to handle projects in the field of renewable energysources and is a fast growing company operating in thisarea.The only partner of LLP “Samruk-Green Energy” is JSC“Samruk-Energy” – 100% ownership.The main activity of LLP “Samruk-Green Energy” is toimplement the following strategic objectives:• Design and construction of facilities for the use ofrenewable energy sources, separate technical unitsand related facilities for production of electricity and/orheat using renewable energy sources;• production and sale of electricity and heat withrenewable energy sources;• ensuring efficiency (operation) of systems for transmission of electricity produced using renewable energysources, from production location to the distributionsy stems;• organization and provision of consulting services,participation in research and development works in thefield of renewable energy.Location: Republic of Kazakhstan, Astana.ABOUT THE COMPANYIntegrated Report 2012 31

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesLLP “Energy of the Semirechye”LLP “Energy of the Semirechye” is a joint venture establishedto carry out activities on construction of wind power plant(hereinafter – WPP) with 60 MW to 300 MW capacity inShelek corridor of Yenbekshikazakhskiy district of Almatyoblast. The partners of LLP “Energy of the Semirechye” are:• LLP “Samruk-Green Energy” – 51%;• JSC “National Company “Socio – EntrepreneurialCorporation “Zhetysu” – 49%.Location: Republic of Kazakhstan, Almaty.Electricity generation in 2012 was not carried out.ABOUT THE COMPANYIntegrated Report 2012 32

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsHydropower plants and renewable energy sourcesLLP “First Wind Power Plant”LLP “First Wind Power Plant”was established on June 27,2011 and is a wholly owned subsidiary of LLP“Samruk-Green Energy”. The company is a legal entity established inaccordance with the legislation of the Republic of Kazakhstanand operates under the applicable regulation and legal actsof the Republic of Kazakhstan and the charter of LLP “FirstWind Power Plant”.LLP “First Wind Power Plant”is a dynamically developingcompany operating in the field of energy production usingrenewable energy sources.Location: Republic of Kazakhstan, Astana.Electricity generationin 2012 was not carried out.JSC “KazKuat”The Company is under liquidation and is not carryingoperational activity.ABOUT THE COMPANYIntegrated Report 2012 33

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsProducing and service companies“Forum Muider B.V.” CompanyForum Muider B.V. is a joint venture with United CompanyRUSAL with equal 50% / 50% shares of ownership,registered in the Netherlands, and is a holding companythat owns 100% stakes in the authorized capital of LLP“Bogatyr Komir”.LLP “Bogatyr Komir”Bogatyr Komir LLP is the largest open-pit coal miningcompany in Kazakhstan: the share of the company’s coaloutput in the total volume of coal mining in the country is38%.The only member of LLP “Bogatyr Komir” is Forum MuiderB.V.At present, production capacity of mines of LLP “BogatyrKomir” is 42 million tons of coal per year (Bogatyr coalminingfield – 32 million tons, Severnyi coal-mining field– 8 million tons).Taking into account the implementation of productionmodernization program with the transition to an automaticconveyor coal mining at Bogatyr mine (until the end of2017), the production capacity of Bogatyr coal mining fieldwill be 40 million tons. Similar project shall be implementedat Severnyi coal mining field as well.Coal production volume in 2012 was 44 mln tons.ABOUT THE COMPANYIntegrated Report 2012 34

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsProducing and service companiesLLP “Teguise Munai”The main activity of LLP “Teguise Munai” is organization ofgeological exploration.In accordance with the decision of the Board of Directorsof JSC “Samruk-Energy”dated December 22, 2011 andaccording to the Share Sales Agreement of 30.10.2012, theCompany acquired 100% interest in the share capital of LLP“Teguise Munai”, including 100% interest in the chartercapital of LLP “Mangishlak-Munai”.LLP “Mangishlak-Munai” owns all rights for development ofPridorozhnoye gas field.ABOUT THE COMPANYIntegrated Report 2012 35

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsDistribution and sales companiesJSC “Alatau Zharyk Kompaniyasy”JSC “Alatau Zharyk Companiyasy” (hereinafter – JSC“AZC”) represents a large power system of the south ofthe republic for transmission and distribution of electricpower to consumers, industrial and agricultural facilitiesin Almaty and Almaty oblast. The company’s area ofoperation stretches from the shores of Lake Balkhash tothe border with China.Balance sheet attribution of JSC “AZC” includes electricalnetwork voltage classes: 220-110-35-10-6-0.4 kV.The Company consists of:• overhead power lines of 220 kV length of 438.57 km;• 110 kV air lines length 2829.8 km;• 35 kV electrical network length 2590.53 km;• 6-10 kV air and cable lines total length 12433, 82 km;• 0.4 kV power lines length 10,650.13 km;• 35-220 kV substations and 6-10/0, 4 kV transformersubstations;• 210 electrical substations of 35 kV and above, with aninstalled capacity of 6588.48 MVA;• 6967 transformer substations of 6-10/0, 4 kV, with aninstalled capacity of 2332.67 MVA.Sole shareholder of JSC “Alatau Zharyk Companiyasy” isJSC “Samruk-Energy”.JSC “AZC” is included in the Kazakh energy system whichjointly with the energy companies of Uzbekistan andKyrgyzstan form a Unified Energy System of Central Asia(UESCA), which works in parallel with Russia.Over the last 5 years the company has implementeda number of large-scale projects. More than 20 newsubstations were built; a number of electrical networkswas reconstructed and modernized. As a result, thecapacity of the energy company has grown to 2,633 MVA.All new and reconstructed substations and transmissionlines are equipped with the most advanced technology tomeet all the criteria of international standards of quality.The company for the first time in Kazakhstan has adopteda composite wire on the lines of 110 kV (manufacturercompany Merkur, USA).The volume of electricity transmission for 2012 was 5917million kW/h.ABOUT THE COMPANYIntegrated Report 2012 36

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsDistribution and sales companiesJSC “Mangistau Electric DistributionCompany”JSC “Mangistau Electric Distribution Company” (hereinafter– JSC “MEDC”) is mainly engaged in transmission anddistribution of electricity to legal entities and the populationand is the only company in Mangistau oblast operating inthis field.About 90% of electricity consumption through the networksof JSC “MEDC”constitute the largest oil companies ofMangistau region (JSC “Mangistaumunaigaz”, JSC “NC“KazMunaiGas”, JSC “Karazhanbasmunai”, etc.).The company includes:• overhead power lines of 220 kV length of 665.1 km;• 110 kV overhead lines length 1348.595 km;• 35 kV overhead power lines with total length of 777.5 km;• 0.4 kV power lines length 601.781 km;• 35-220 kV substations and 6-10/0, 4 kV transformersubstations;• 57 electrical substations of 35 kV and above, with aninstalled capacity of 1,956.4 MVA;• 428 transformer substations of 6-10 kV, with an installedcapacity of 66.845 MW.The largest shareholder of JSC “Mangistau ElectricityDistribution Company” is JSC “Samruk-Energy” – 75% +1share.The volume of electricity transmission for 2012 was 2478million kW/h.ABOUT THE COMPANYIntegrated Report 2012 37

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsDistribution and sales companiesLLP “AlmatyEnergoSbyt”LLP “AlmatyEnergoSbyt” was established in June 2006 tocarry out activities on power supply in accordance with theLaw on Power Energy.Starting from November 1, 2006 LLP “AlmatyEnergoSbyt”is the electricity supplier and delivers energy to consumersof Almaty and Almaty region.LLP “AlmatyEnergoSbyt” is included in the state registerof market entities with dominant position in the relevantproduct market for electricity supply of Almaty and Almatyregion. The company provides electricity to about 2.3million residents and 21 thousand enterprises.The only member of LLP “AlmatyEnergoSbyt” is JSC“Samruk-Energy” – 100% interest.At present, in addition to its own power plants, LLP“AlmatyEnergoSbyt” purchases over 50% of the requiredelectricity from other energy sources: from northernsources along the North-South line – 16.1%, from CentralAsia – 7.7%.One of the main activities of AlmatyEnergoSbyt is toimprove the quality of service to energy consumers.As part of implementation of the Consumer ServiceCenters program (hereinafter – the “CSC”) which aims toimprove the quality and enhance the culture of customerservice in every area, and starting from the establishmentof LLP “AlmatyEnergoSbyt”, the CSCs were opened in fourdistricts of Almaty: ROES #1, ROES #2, ROES #5, as well asregular CSCs opened in Kaskelen, Esik, Uzynagash village,Kegen village and Shelek village of Almaty oblast.Electricity sales for 2012 amounted to 5,626 million kW/h.ABOUT THE COMPANYIntegrated Report 2012 38

CONTENTInformation about the Company’s Subsidiary and Affiliated OrganizationsDistribution and sales companiesLLP “Samruk-EnergoStroyService”LLP “Samruk-EnergoStroyService” was established in 2009 to provideconstruction services and services for the design, manufacture, installationand repair of electrical power equipment.The only member of LLP “Samruk-EnergoStroyService” is JSC “Samruk-Energy” – 100% interest.The company provides high-quality construction, installation, repairand technical solutions for the power industry facilities, using advancedtechnology and international expertise of its specialists and partners.The company performs design and research activities in the electricitysector.ABOUT THE COMPANYIntegrated Report 2012 39

CONTENTInnovation activity of the CompanyInnovation activity in the sphere of renewable energysourcesIn general, for the effective implementation of renewable energy sources potential it isnecessary to:• Improve the legislation on the support of RES;• Create the Competent Authority responsible for determining the need in RES;• Create Kazakhstan Intelligent Energy System (hereinafter – KIES).Creating a highly efficient and technological smart grid will improve the quality of life of thepopulation, receive benefits from the available privileges and meet all the global challenges:• Energy security and redundancy;• Use of transit and export potential;• Use of renewable energy sources potential (wind power plants, solar power plants, smallhydro power plants, etc.);• Complete coverage of the Republic of Kazakhstan – solving the problem of remoteness ofenergy resources and generating sources from the industry and the public;• optimization of the energy structure in view of available reserves of energy resources;• energy sustainability, energy efficiency and energy saving;• innovation and scientific development;• increase of the value added of the economy of Kazakhstan;• increasing the role of the state in the energy sector.Creation of KIES will contribute to the integration into the SuperGrid global system ofEurope, Russia and China, initiated by the World Energy Council (WEC).In the world there is a tendency to reduce the cost of electricity from renewable energysources and the simultaneous increase in the cost of electricity from conventional sources,taking into account the ever-increasing fuel prices, and the need to implement measuresto reduce the burden on the environment.At present, the Company is implementing the following projects in the field of renewableenergy:• 2 MW Kapshagay Solar power plant expandable to 100 MW.In the medium term the Group of Companies of Samruk-Energy plans to implement thefollowing projects in the field of green energy:• Construction of a 60 MW wind power plant in Shelek corridor with the possibility ofexpanding to 300 MW, employment during operation – 12 people, producing more than180 million kW/h of electricity per year;• Production of electricity using straw. Capacity – 5 MW of electricity;• Construction of the second phase of wind power plant near the town of Yereimentauwith 50 MW capacity. Production of more than 150 million kW/h of electricity per year,employment in operation – 8 people;• Construction of counter regulating Kerbulakskaya HPP with 33 MW capacity. Electricityproduction in the amount of 221 million kW/h per year. Employment during construction– 550 people and employment during operation – 64 people.Innovation activity in the sector of coal and natural gasgenerationDevelopment of coal generation provides for the use of the following “clean coaltechnologies” that will improve the efficiency of energy facilities, reduce fuel consumptionand specific emissions of greenhouse gases (carbon dioxide) and hazardous substances(ash, nitrogen oxides and sulfur):1. Increased steam parameters in the steam cycle, circulating fluidized bed boilers, coalwaterfuel boilers, etc.2. The use of CHP – combined heat and power generation through construction of modernthermal power stations in places where there are appropriate heat loads.3. The introduction of modern methods of ash collection and reduce emissions of oxides ofnitrogen and sulfur.4. Disposal of ash waste – usage in construction and road building industry.Gas generation provides for the application of steam cycle which is characterized by highefficiency and low emissions of carbon dioxide and pollutants.In the sphere of coal generation the Company intends to implement the following projects:• Construction of the third power unit at Ekibastuzskaya GRES-2 with 600-660 MWcapacity with higher steam parameters – temperature of 566°C and a pressure of 24MPa. Implementation is scheduled for 2010–2015.In 2012, the adjustment was carried out for those parts of design and estimate documentationsubject for approval; priority works for the main building and the construction yard wereperformed.ABOUT THE COMPANYIntegrated Report 2012 40

CONTENT• Construction of Balkhashskaya TES of 1320 MW capacity with higher steam parametersand the modern system of ash removal and desulfurization. Implementation dates –2010–2018.Development of design and estimate documentation is being carried out for the EPCContract signed in 2012, and providers of boiler plant and steam turbine generator wereidentified on the basis of an open tender.• Installation of electrostatic precipitators at Ekibastuzskaya GRES-1 with 99,4-99,6%efficiency.Electro filters at energy blocks #4 and #8 of Ekibastuzskaya GRES-1 were put into operationin 2012.Promising projects include construction of modern CHPs in Semey, Kokshetau andTaldikorgan with combined production of heat and electricity.In the sector of gas generation the below project is being implemented:• Reconstruction and expansion of Almatinskaya CHP-1 of JSC “AlES” with the transferto gas and installation of gas turbines and heat recovery boiler. Project implementationperiod – 2011–2016 years. In 2012 the development of design estimates was started.Innovation activity in the sector of transmission,distribution and sale of electricityIn 2011-2012 as part of the project for power supply of the Asian Games and Almaty Metrofacilities JSC “AZC” commissioned Ermensay, Medeu, Shymbulak, Kazakh State University,Alatau and Otyrarsub-stations, equipped with the latest GIS (gas insulated switchgear)technology and microprocessor manufacturing protection devices of such internationalcompanies as ABB, Siemens, etc. Also, for the first time in Kazakhstan, JSC “AZC” startedto use composite cables at 110 kV lines.For an accurate accounting and operational control over the consumption and transmissionof electricity, as well as to provide access to the data obtained for calculation purposes,JSC “MEDC” has finalized the project on implementation of the automated system forcommercial accounting of electricity (ASCAE).Collectively, all these events contributed to the gradual introduction of highly integratedintelligent backbone and distribution networks of the new generation (Smart Grid), dynamiccontrol over power grids, improve safety and cost savings.ABOUT THE COMPANYIntegrated Report 2012 41

CONTENTFinancial and operating resultsAssets StructureIncome Forecast for 2013-2015Infrastructure Development and ModernizationAssets restructuring, reorganization, acquisition and creation of new businessesPromotion of Local ContentIndirect Economic ImpactIntegrated Report 2012 42

CONTENTOperating activitiesThe Management and the Board of Directors of JSC “Samruk-Energy” take considerablemeasures to increase economic efficiency of Samruk-Energy Group of companies. Oneof the steps to achieve the set goals was the decision on restructuring of Samruk-EnergyGroup of companies – in 2011 the voluntary liquidation of JSC “KazKuat” and JSC “KMG-Energo” was initiated with the transfer of their assets to the ownership of JSC “Samruk-Energy”.Operational and financial performance indicators№ Indicator, thousand tenge2010Actual2011Actual2012Planned2012Actual% ofachievement1. Income 76 939 880 85 549 944 96 218 297 94 557 811 98%2. Cost of sales 60 932 911 68 823 661 78 941 345 77 064 207 98%3. Gross income 16 006 969 16 726 283 17 276 952 17 493 604 101%3.1. • Distribution costs 124 375 112 733 190 847 153 180 80%3.2. • Administrative expenses 4 881 940 6 405 338 6 944 042 6 770 266 97%3.3. • Financial income 2 654 737 834 330 949 076 1 701 666 179%3.4. • Financial expenses 5 553 261 5 365 512 6 734 430 5 300 112 79%4.Expense /income from exchange ratedifferencesShare in profit of investment objects- - - - -5. accounted by the equity method in- - - - -6.associated organizationsShare in profit of investment objectsaccounted by the equity method in3 449 023 10 024 877 11 079 058 13 176 583 119%jointly-controlled entities7. Other income 745 124 1 444 122 2 356 372 1 945 330 17%8. Other expenses - - 198 488 - -9. Income tax expenses 1 214 688 2 219 436 2 301 888 3 522 120 153%10.Profit for the year from discontinuedoperation- - - 60 100 -11. Profit for the year 10 862 599 14 794 170 15 177 027 18 631 605 123%12. Minority share 218 990 132 422 114 736 126 175Consolidated financial indicators for the year 2012 considerably exceeded the results of theyear 2011. Positive growth by 31% of the Company’s performance in 2012 was due to theincreased volumes of production, transmission, distribution and sale of electricity, as wellas the increase inincome from companies accounted by the equity method at 31% (stronglyinfluenced by the acquisition of a 50% stake in LLP “Ekibastuzskaya GRES-1 named afterBulat Nurzhanov”).Financial and operating resultsIntegrated Report 2012 43

CONTENT№Cost of salesIndicator, thousand tenge 2010 2011 20121. Raw materials 28 693 404 32 767 261 37 941 3082. Processing and other services 13 510 434 13 729 569 13 035 3453. Wages and salaries 11 213 359 13 076 988 13 705 9885. Depreciation and amortization of equivalents 4 988 441 6 607 741 8 145 9736. Taxes excluding income tax 966 337 876 681 1 741 6577. Other 1 560 936 1 765 421 2 493 936TOTAL: 60 932 911 68 823 661 77 064 207Significant growth of actual expenses in 2012 compared to 2011 occurred mainly due tohigher prices for purchased fuel (gas, oil, coal) in the amount of 5,174,047 thousand tenge,amortization growth (through the acquisition of fixed assets and intangible assets) in theamount of 1,538,232 thousand tenge, as well as tax increases by 864,976 thousand tenge(property tax, social tax and social payments, fees for emissions into the environment).Financial and operating resultsIntegrated Report 2012 44

CONTENTDistribution costs№ Indicator, thousand tenge 2010 2011 20121.Remuneration costs and social benefits ofpersonnel associated with the process of32 788 32 675 47 228distribution2.Taxes and other obligatory payments to thebudget3 043 3 161 4 6823.Other services and activities related todistribution84 824 71 860 95 8844. Travel and business trip expenses 314 597 5775. Other distribution expenses 3 407 4 441 4 809TOTAL: 124 375 112 733 153 180Increase in expenses occurred due to the increase of electricity production. The increaseinlabor costsand social benefits of personnel associated with sale process was due to annualindexation.Financial and operating resultsIntegrated Report 2012 45

CONTENTAdministrative expenses№ Indicator, thousand tenge 2010 2011 20121. Wages and salaries 2 489 282 2 616 851 3 278 8872. Taxes excluding income tax 706 559 849 007 458 5373. Consulting, audit and informational services 422 645 681 312 677 3974. Depreciation and amortization 181 232 258 949 383 5995. Lease 353 857 291 311 284 1586. Raw materials 114 942 112 585 144 1677. Business trip expenses 130 088 156 848 153 40410. Technical maintenance and repair 94 377 89 687 61 28611. Bank charges 123 710 120 590 128 85212. Communication 66 381 85 545 84 79816. Other 198 867 1 142 653 1 115 18117. Total 4 881 940 6 405 338 6 770 266The increase in staff salaries was due to annual indexation.The main part of the tax is property tax.Tax cuts in 2012 occurred due to the inclusion of property tax in cost value structure for JSC“Alatau Zharyk Companiyasy”. In 2011, property tax was included in the tax on cost value,where as in 2012 it was divided between the cost value and administrative costs.Change in depreciation and amortization was due to purchase of fixed assets and intangibleassets.Financial and operating resultsIntegrated Report 2012 46

CONTENTFinancial income1 274 923834 012 1 698 368863 875500 69015 249 318 3 298Interest income on bankdepositsRevision of the repaymentschedule of the loan fromthe ShareholderForeign exchange gain, netOther2010201120122010 2011 2012(TOTAL 2 654 737 tenge)(TOTAL 834 330 tenge)(TOTAL 1 701 666 tenge)The increase in income from financing as a whole was due to income derived from theplacement of deposits by JSC “Alatau Zharyk Companiyasy”, as well as due to interest ondeposits placed by the Company in 2012 after receipt of funds from the issue of Eurobonds.Foreign exchange gainsin 2011 and 2012 were not obtained due to downward changes ofexchange rate.Financial and operating resultsIntegrated Report 2012 47

CONTENTFinancial expenses№ Indicator, thousand tenge 2010 2011 20121. Interest expenses on loans 3 397 146 2 501 074 1 780 9122. Foreign exchange loss, net profit 0 0 173 8393. Dividends on preferred shares of subsidiaries 135 379 134 724 155 4934. Unwinding of discount of present value of:4.1 Loans and financial support from shareholders 1 673 414 1 823 635 2 445 5084.2 Note payable 28 279 30 053 36 5904.3 Employee benefit obligations 21 969 37 626 47 1454.4 Provision for restoration of ash disposal 37 001 29 722 27 5084.5 Loans from customers 253 898 642 179 585 1394.6 Bonds issued 2 153 44 623 40 1635. Other 4 022 121 876 7 815TOTAL: 5 553 261 5 365 512 5 300 112Reduction of interest expenses in 2012 was due to decrease of interest rate from 12% to7.55% on the loan of JSC “Development Bank of Kazakhstan”and repayment of loans by JSC“AlES” during 2012.The increase in foreign exchange loss occurred because of downward exchange ratechanges in 2012.Assets structureTotal income for 2012 was 102,837.4 mln tenge (approved budget – 99,523.8 mln tenge),which is 103% of the planned figure. Comparing to similar period of last year, incomeincreased by 15,541.3 mln tenge or 17.7%.Income from sales of goods and rendering of services was 94,557.8 mln tenge (approvedbudget – 96,218.3 mln tenge) or 98.3% of the plan. Comparing to similar period of last year,income from the main activity increased by 9,007.9 mln tenge or 10.5%.Financial and operating resultsIntegrated Report 2012 48

CONTENT№ Indicator, mln tenge 2011Planned2012Actual 2012 Deviation, %1 Total income 87 795 99 524 102 837 103%2 Income from production and services 85 550 96 218 94 558 98%3 JSC “Bukhtarminskaya HPP” 1 476 1 485 1 495 101%4 JSC “KazKuat” 165 – – –5 JSC “Shardarinskaya HPP” 1 614 1 704 1 975 116%6 JSC “Moinakskaya HPP” – 2 446 413 81%7 LLP “AlmatyEnergoSbyt” 57 201 65 688 67 368 103%8 LLP “Samruk-EnergoStroyService” 11 391 13 587 11 000 81%9 JSC “MDEC” 4 546 5 617 5 853 104%10 JSC “AZC”, including: 61 905 66 669 65 161 98%11 JSC “AZC” 19 196 22 000 22 393 102%12 JSC “AlES” 47 284 48 858 47 014 96%13 JSC “Aktobe CHP” 4 308 4 646 4 520 97%14 Internal Group turnover (eliminated) for AZC - 8 883 - 8 835 - 8 766 99%15 Internal Group turnover (eliminated) - 52 583 - 60 978 - 58 706 96%Decrease in income from sale of products and provision of services by 1,660 million tengeoccurred mainly due to lower revenues in a number of subsidiaries. The reasons wereabsence of legal entity status of JSC “Moinakskaya HPP” until December 13, 2012, insufficientreceipt of revenue by LLP “SamrukEnergoStroyService”, decrease in production and salesin the Group of companies of JSC “AZC” and JSC “AlES”, decrease in electricity generationby Aktobe CHP due to the nature of combined production of electricity and heat.When eliminating the income of JSC “Samruk-Energy” as a whole the following internalturnover are excluded: purchase of electricity by LLP “AES”from JSC “AZC” (JSC “AlES”)and JSC “Moinakskaya HPP”, as well as services of JSC “AZC” for energy transit; purchaseof services of LLP “Samruk-EnergoStroyService” by JSC “AlES” and JSC “AZC”.However, along with a total decrease of income for the Group of companies of JSC “Samruk-Energy”, some companies showed an increase in income associated with an increase inpower generation, transmission and sale of electricity, as well as growth of tariffs.Financial and operating resultsIntegrated Report 2012 49

CONTENTIncome forecast for 2013-2015№ Indicator, million tenge planned 2013 planned 2014 planned 20151 Total income 147 376 154 263 172 1832 Income from production and services 139 151 153 249 171 1893 JSC “EK EDC” 8 046 9 116 10 3234 LLP “ShygysEnergoTrade” 23 870 26 767 29 7885 JSC “Bukhtarminskaya HPP” 1 484 1 486 1 4866 JSC “Shardarinskaya HPP” 1 756 1 685 1 8057 JSC “Moinakskaya HPP” 7 607 7 600 7 6008 LLP “AlmatyEnergoSbyt” 77 346 85 983 95 4959 LLP “Samruk-EnergoStroyService” 0 0 010 JSC “MDEC” 6 634 6 862 7 20211 LLP “Samruk-Green Energy” 196 247 4 26112 JSC “AZC”, including: 73 283 81 283 89 82813 JSC “AZC” 27 145 30 497 34 26314 JSC “AlES” 50 760 54 200 59 36715 JSC “Aktobe CHP” 5 134 7 031 7 38416 Internal Group turnover (eliminated) for AZC -9 756 -10 445 -11 18617 Internal Group turnover (eliminated) -61 071 -67 780 -76 598Growth in revenues is due to the inclusion in the consolidation of new assets (JSC “EK REC”,LLP “ShygysEnergoTrade”), the growth in electricity production (JSC “ShardarinskayaHPP”) and growth of tariffs (JSC “MEDC”).In addition, there has been an increase in the amount of intercompany sales by 6,576 milliontenge, associated with an increase in electricity purchase volumes of LLP “AES” from JSC“Moynakskaya HPP”, and with the inclusion of intercompany sales between the JSC “EKREC” and LLC “ShygysEnergoTrade” to the total amount.Growth of the above index compared to the previously approved figure is scheduled by 2015as follows: 2013 – 16%, 2014 – 14%, 2015 – 15%.Financial and operating resultsIntegrated Report 2012 50

CONTENTEfficiency indicatorsEBITDA (thousand tenge)EBITDA margin (%)3500000025300000002025000000200000001500000010000000500000024 120 63728 687 16033 300 7001510521%20%20%02010 2011 201202010 2011 2012The dynamics of earnings before interest, taxes, depreciation and amortization (hereinafterEBITDA) for the last few years is positive. The figure for 2012 was 33,300,700 thous andtenge and increased compared to 2011 by 16%.Relatively high level of EBITDA in 2012 compared with 2011 was due to the increaseinoperating profit due to increased gross profit (revenue growth from core operations) as wellas higher depreciation charges in connection with the implementation of the investmentprogram.EBITDA marginis at the same level as in 2011.Financial and operating resultsIntegrated Report 2012 51

CONTENTLiquidity and financial stability:• Debt / EBITDA indicator (if calculated by proportional method) for 2012 amounted to4.43. Compared to the actual figure of the same period of last year (3.00) the worsening ofthe indicator was due to the rapid growth of debt compared to EBITDA;• Interest coverage indicator for 2012 was 3.6, improvement in comparison with the actualfigure for 2011 (3.26) was due to an increase in EBITDA and lower financing costs;• Financial leverage indicator in 2012 was 0.58, i.e., at the level of actual data for 2011 (0.58);• Current liquidity indicator amounted to 2.31, the improvement in comparison with theactual data of the same period of last year (1.68) was due to the growth of cash at the endof the reporting period.Cash flow retrospective№ Indicator, mln tenge 2010 2011 20121. Cash flows from operating activities 12 553 754 26 430 633 21 920 5742. Cash flows from / used in investing activities (54 764 699) (44 231 671) (44 234 153)3. Cash flows used in/ generated from financingactivities4. Net increase/ (decrease) in cash and cashequivalents45 215 431 55 448 609 67 135 3283 004 486 37 647 571 44 821 749Significant factors that affected cash flows from operating activities:In 2011, the Company treated the dividends received from subsidiaries and jointly controlledentities as cash flows from investing activities.In 2012, the Company conducted an evaluation and came to conclusion that treating ofdividends received from joint business as part of the operating activity in the consolidatedstatement of cash flows, more accurately discloses the nature of operations as theCompany and other members of joint ventures are actively involved in the daily activities ofthe joint ventures.In respect of financial activity, the main part of proceeds belongs to funds received in theform of dividends (4 bln tenge) and obtained by placing on the Irish Stock Exchange (ISE)and the Kazakhstan Stock Exchange (KASE) of five-year Eurobonds (75 bln tenge) andloans (17.2 bln tenge) attracted for the purpose of implementation of investment projects.Cash outflow consists of repayment of short-term and long-term loans (24.1 bln tenge)and dividend payments (4.5 billion tenge) to shareholders, including those in favor of JSC“Sovereign Wealth Fund “Samruk-Kazyna” (4.4 bln tenge).Financial and operating resultsIntegrated Report 2012 52

CONTENTStructure of own and borrowed capital1 981 484 2 142 287 1 998 3216 771 848110 320 700 169 683 385 289 930 60926 833 77476 715 0782010(TOTAL 112 302 184 tenge)120 294 884 222 868 95719 917 339 34 236 86729 471 162 32 824 7852010 20112012(TOTAL 171 825 672 tenge)2012(TOTAL 291 928 930 tenge)Shareholder capitalOther reserve capitalUndistributed profitEquity attributable to shareholders of the GroupofCompanies of Samruk-EnergyNon-controlling interestSignificant impact on the growth of the share capital occurred due to the acquisition of 50%share of LLP “Ekibastuzskaya GRES-1 named after Bulat Nurzhanov” in the amount of 101,620million tenge.The increase in other capital reserves was due to the fact that the Group of companies of JSC“Samruk-Energy” received from JSC “Sovereign Wealth Fund “Samruk-Kazyna” unattributednetworks cost 3,353 million tenge as a contribution to the capital of the Company.Long-term liabilities 31 December 2010 31 December 2011 31 December 2012Loans 77 411 510 83 506 212 155 187 362Short-term liabilitiesLoans 9 079 618 16 060 628 14 986 698In December 2012 the Company placed five-year Eurobonds (75 bln tenge) with a yield of3.75% per annum on the Irish Stock Exchange (ISE) and the Kazakhstan Stock Exchange(KASE).Financial and operating resultsIntegrated Report 2012 53