Financial Report

Financial Report

Financial Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AFG<br />

Annual <strong>Report</strong><br />

2011<br />

in 1000 CHF<br />

Consolidated <strong>Financial</strong> Statements AFG Arbonia-Forster-Group<br />

Notes to the Consolidated <strong>Financial</strong> Statements<br />

141<br />

Impairments 2011 on other intangible assets<br />

As a result of a review towards the end of 2011 of the business plan at a foreign<br />

subsidiary an impairment of CHF 5.4 million had to be recorded on other intangible<br />

assets. Another impairment of CHF 17.3 million relates to the Surface Technology<br />

Division (see note 37).<br />

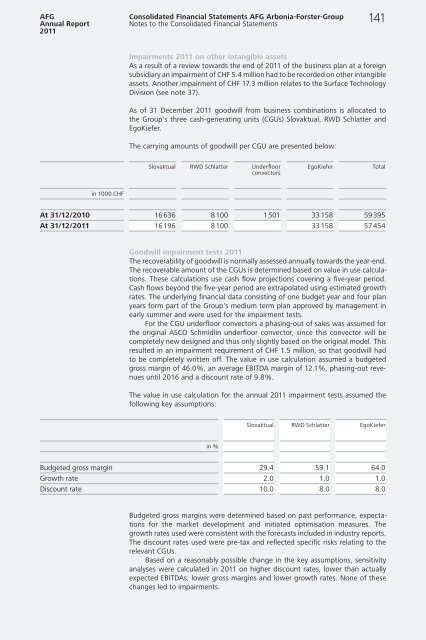

As of 31 December 2011 goodwill from business combinations is allocated to<br />

the Group's three cash-generating units (CGUs) Slovaktual, RWD Schlatter and<br />

EgoKiefer.<br />

The carrying amounts of goodwill per CGU are presented below:<br />

Slovaktual RWD Schlatter Underfloor<br />

convectors<br />

EgoKiefer Total<br />

At 31/12/2010 16 636 8 100 1 501 33 158 59 395<br />

At 31/12/2011 16 196 8 100 33 158 57 454<br />

Goodwill impairment tests 2011<br />

The recoverability of goodwill is normally assessed annually towards the year-end.<br />

The recoverable amount of the CGUs is determined based on value in use calculations.<br />

These calculations use cash flow projections covering a five-year period.<br />

Cash flows beyond the five-year period are extrapolated using estimated growth<br />

rates. The underlying financial data consisting of one budget year and four plan<br />

years form part of the Group's medium term plan approved by management in<br />

early summer and were used for the impairment tests.<br />

For the CGU underfloor convectors a phasing-out of sales was assumed for<br />

the original ASCO Schmidlin underfloor convector, since this convector will be<br />

completely new designed and thus only slightly based on the original model. This<br />

resulted in an impairment requirement of CHF 1.5 million, so that goodwill had<br />

to be completely written off. The value in use calculation assumed a budgeted<br />

gross margin of 46.0 %, an average EBITDA margin of 12.1 %, phasing-out revenues<br />

until 2016 and a discount rate of 9.8 %.<br />

The value in use calculation for the annual 2011 impairment tests assumed the<br />

following key assumptions:<br />

in %<br />

Slovaktual RWD Schlatter EgoKiefer<br />

Budgeted gross margin 29.4 59.1 64.0<br />

Growth rate 2.0 1.0 1.0<br />

Discount rate 10.0 8.0 8.0<br />

Budgeted gross margins were determined based on past performance, expectations<br />

for the market development and initiated optimisation measures. The<br />

growth rates used were consistent with the forecasts included in industry reports.<br />

The discount rates used were pre-tax and reflected specific risks relating to the<br />

relevant CGUs.<br />

Based on a reasonably possible change in the key assumptions, sensitivity<br />

analyses were calculated in 2011 on higher discount rates, lower than actually<br />

expected EBITDAs, lower gross margins and lower growth rates. None of these<br />

changes led to impairments.