Financial Report

Financial Report

Financial Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AFG<br />

Annual <strong>Report</strong><br />

2011<br />

Consolidated <strong>Financial</strong> Statements AFG Arbonia-Forster-Group<br />

Notes to the Consolidated <strong>Financial</strong> Statements<br />

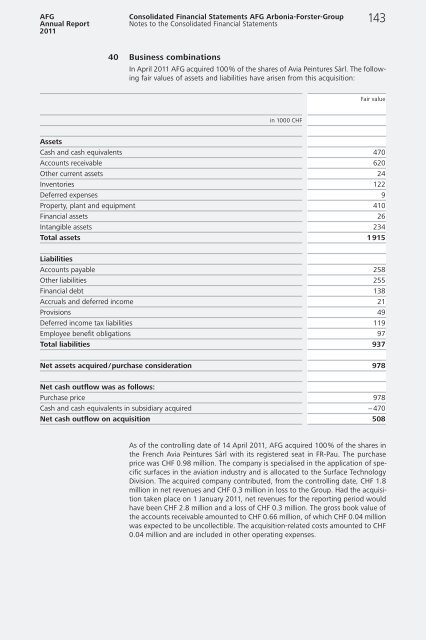

40 Business combinations<br />

143<br />

In April 2011 AFG acquired 100 % of the shares of Avia Peintures Sàrl. The following<br />

fair values of assets and liabilities have arisen from this acquisition:<br />

in 1000 CHF<br />

Fair value<br />

Assets<br />

Cash and cash equivalents 470<br />

Accounts receivable 620<br />

Other current assets 24<br />

Inventories 122<br />

Deferred expenses 9<br />

Property, plant and equipment 410<br />

<strong>Financial</strong> assets 26<br />

Intangible assets 234<br />

Total assets 1 915<br />

Liabilities<br />

Accounts payable 258<br />

Other liabilities 255<br />

<strong>Financial</strong> debt 138<br />

Accruals and deferred income 21<br />

Provisions 49<br />

Deferred income tax liabilities 119<br />

Employee benefit obligations 97<br />

Total liabilities 937<br />

Net assets acquired / purchase consideration 978<br />

Net cash outflow was as follows:<br />

Purchase price 978<br />

Cash and cash equivalents in subsidiary acquired − 470<br />

Net cash outflow on acquisition 508<br />

As of the controlling date of 14 April 2011, AFG acquired 100 % of the shares in<br />

the French Avia Peintures Sàrl with its registered seat in FR-Pau. The purchase<br />

price was CHF 0.98 million. The company is specialised in the application of specific<br />

surfaces in the aviation industry and is allocated to the Surface Technology<br />

Division. The acquired company contributed, from the controlling date, CHF 1.8<br />

million in net revenues and CHF 0.3 million in loss to the Group. Had the acquisition<br />

taken place on 1 January 2011, net revenues for the reporting period would<br />

have been CHF 2.8 million and a loss of CHF 0.3 million. The gross book value of<br />

the accounts receivable amounted to CHF 0.66 million, of which CHF 0.04 million<br />

was expected to be uncollectible. The acquisition-related costs amounted to CHF<br />

0.04 million and are included in other operating expenses.