Link to Admission Document - InternetQ

Link to Admission Document - InternetQ

Link to Admission Document - InternetQ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

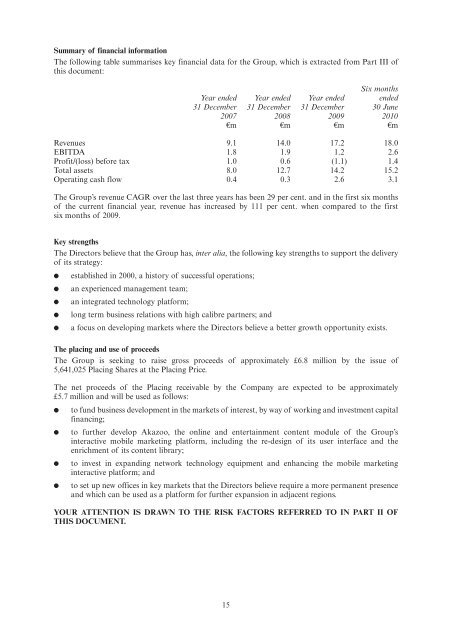

Summary of financial informationThe following table summarises key financial data for the Group, which is extracted from Part III ofthis document:Six monthsYear ended Year ended Year ended ended31 December 31 December 31 December 30 June2007 2008 2009 2010€m €m €m €mRevenues 9.1 14.0 17.2 18.0EBITDA 1.8 1.9 1.2 2.6Profit/(loss) before tax 1.0 0.6 (1.1) 1.4Total assets 8.0 12.7 14.2 15.2Operating cash flow 0.4 0.3 2.6 3.1The Group’s revenue CAGR over the last three years has been 29 per cent. and in the first six monthsof the current financial year, revenue has increased by 111 per cent. when compared <strong>to</strong> the firstsix months of 2009.Key strengthsThe Direc<strong>to</strong>rs believe that the Group has, inter alia, the following key strengths <strong>to</strong> support the deliveryof its strategy:●●●●●established in 2000, a his<strong>to</strong>ry of successful operations;an experienced management team;an integrated technology platform;long term business relations with high calibre partners; anda focus on developing markets where the Direc<strong>to</strong>rs believe a better growth opportunity exists.The placing and use of proceedsThe Group is seeking <strong>to</strong> raise gross proceeds of approximately £6.8 million by the issue of5,641,025 Placing Shares at the Placing Price.The net proceeds of the Placing receivable by the Company are expected <strong>to</strong> be approximately£5.7 million and will be used as follows:●●●●<strong>to</strong> fund business development in the markets of interest, by way of working and investment capitalfinancing;<strong>to</strong> further develop Akazoo, the online and entertainment content module of the Group’sinteractive mobile marketing platform, including the re-design of its user interface and theenrichment of its content library;<strong>to</strong> invest in expanding network technology equipment and enhancing the mobile marketinginteractive platform; and<strong>to</strong> set up new offices in key markets that the Direc<strong>to</strong>rs believe require a more permanent presenceand which can be used as a platform for further expansion in adjacent regions.YOUR ATTENTION IS DRAWN TO THE RISK FACTORS REFERRED TO IN PART II OFTHIS DOCUMENT.15