Annual Financial Statement P&I Personal & Informatik AG April 1 ...

Annual Financial Statement P&I Personal & Informatik AG April 1 ...

Annual Financial Statement P&I Personal & Informatik AG April 1 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P&I <strong>Personal</strong> & <strong>Informatik</strong> Combined Management Report (Group and Cooperation)<br />

The cash-flow from operating activities recorded during the year under review, fiscal<br />

2010/2011, dropped slightly from 21.5 million euros to 21.0 million euros despite the<br />

sound operating results. This decline mainly results from tax payments made for<br />

previous fiscal years and the increase in tax payments resulting from the new tax<br />

prepayment rulings for the year under review. Reserves have been allocated against<br />

tax payments for previous fiscal years.<br />

Cash-flow from the investments dropped from 8.4 million euros in the previous year to<br />

minus 19.3 million euros. There was an inflow of 10.6 million euros recorded in the<br />

balance from the sale of securities held as current assets during fiscal 2009/2010,<br />

conditional on the cash outflow resulting from the new investments in securities and<br />

term deposits with a maturity of longer than three years amounting to 18.5 million<br />

euros. In the previous year the investments cash balance also included the net<br />

payment for the purchase of Gronemeyer Gesellschaft für Datentechnik, EDV und<br />

Organisationsberatung mbH, in Höxter.<br />

Cashflow from the financing activities amounted to -8.3 million euros (previous year:<br />

- 8.1 million euros) and this was a direct result of the dividend payment. The previous<br />

year’s amount comprised the dividend payment and the share buyback scheme<br />

payments.<br />

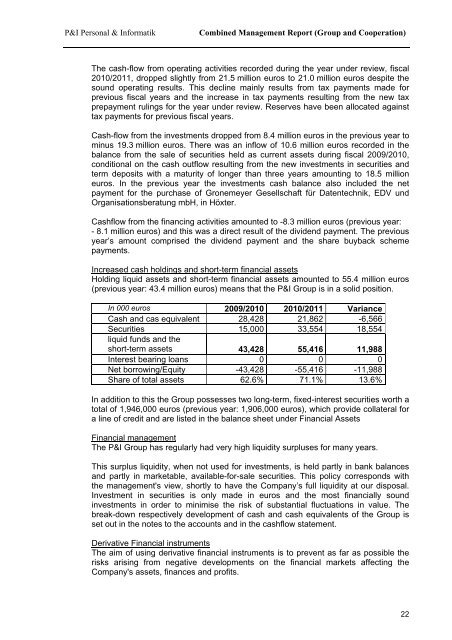

Increased cash holdings and short-term financial assets<br />

Holding liquid assets and short-term financial assets amounted to 55.4 million euros<br />

(previous year: 43.4 million euros) means that the P&I Group is in a solid position.<br />

In 000 euros 2009/2010 2010/2011 Variance<br />

Cash and cas equivalent 28,428 21,862 -6,566<br />

Securities<br />

liquid funds and the<br />

15,000 33,554 18,554<br />

short-term assets 43,428<br />

55,416 11,988<br />

Interest bearing loans 0 0 0<br />

Net borrowing/Equity -43,428 -55,416 -11,988<br />

Share of total assets 62.6% 71.1% 13.6%<br />

In addition to this the Group possesses two long-term, fixed-interest securities worth a<br />

total of 1,946,000 euros (previous year: 1,906,000 euros), which provide collateral for<br />

a line of credit and are listed in the balance sheet under <strong>Financial</strong> Assets<br />

<strong>Financial</strong> management<br />

The P&I Group has regularly had very high liquidity surpluses for many years.<br />

This surplus liquidity, when not used for investments, is held partly in bank balances<br />

and partly in marketable, available-for-sale securities. This policy corresponds with<br />

the management's view, shortly to have the Company’s full liquidity at our disposal.<br />

Investment in securities is only made in euros and the most financially sound<br />

investments in order to minimise the risk of substantial fluctuations in value. The<br />

break-down respectively development of cash and cash equivalents of the Group is<br />

set out in the notes to the accounts and in the cashflow statement.<br />

Derivative <strong>Financial</strong> instruments<br />

The aim of using derivative financial instruments is to prevent as far as possible the<br />

risks arising from negative developments on the financial markets affecting the<br />

Company's assets, finances and profits.<br />

22