Annual Financial Statement P&I Personal & Informatik AG April 1 ...

Annual Financial Statement P&I Personal & Informatik AG April 1 ...

Annual Financial Statement P&I Personal & Informatik AG April 1 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As a result of the initial application of BilMoG, the Comapny’s provision for the purchase of<br />

own shares on March 31, 2011 amounted to 0 euros (previous year: 2,019,000 euros). Other<br />

revenue reserves were also liquidated in full as the result of the initial application of the new<br />

BilMoG regulations (March 31, 2010: 46,000 euros).<br />

As a result of the amended HGB accounting regulations covering deferred taxes and longterm<br />

reserves introduced by the new BilMoG version, the recognition of deferred tax liabilities<br />

amounting to 870,000 euros and the discounting of long-term reserves amounting to 65,000<br />

euros up to <strong>April</strong> 1, 2010 have been posted as income-neutral items against the die freely<br />

available revenue reserves (223,000 euros) and the net profit (582,000 euros) in accordance<br />

with Article 67, Para. 6, EGHGB.<br />

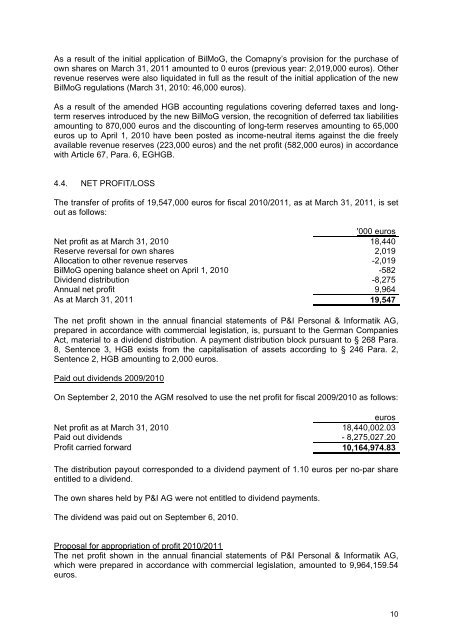

4.4. NET PROFIT/LOSS<br />

The transfer of profits of 19,547,000 euros for fiscal 2010/2011, as at March 31, 2011, is set<br />

out as follows:<br />

'000 euros<br />

Net profit as at March 31, 2010 18,440<br />

Reserve reversal for own shares 2,019<br />

Allocation to other revenue reserves -2,019<br />

BilMoG opening balance sheet on <strong>April</strong> 1, 2010 -582<br />

Dividend distribution -8,275<br />

<strong>Annual</strong> net profit 9,964<br />

As at March 31, 2011 19,547<br />

The net profit shown in the annual financial statements of P&I <strong>Personal</strong> & <strong>Informatik</strong> <strong>AG</strong>,<br />

prepared in accordance with commercial legislation, is, pursuant to the German Companies<br />

Act, material to a dividend distribution. A payment distribution block pursuant to § 268 Para.<br />

8, Sentence 3, HGB exists from the capitalisation of assets according to § 246 Para. 2,<br />

Sentence 2, HGB amounting to 2,000 euros.<br />

Paid out dividends 2009/2010<br />

On September 2, 2010 the <strong>AG</strong>M resolved to use the net profit for fiscal 2009/2010 as follows:<br />

euros<br />

Net profit as at March 31, 2010 18,440,002.03<br />

Paid out dividends - 8,275,027.20<br />

Profit carried forward 10,164,974.83<br />

The distribution payout corresponded to a dividend payment of 1.10 euros per no-par share<br />

entitled to a dividend.<br />

The own shares held by P&I <strong>AG</strong> were not entitled to dividend payments.<br />

The dividend was paid out on September 6, 2010.<br />

Proposal for appropriation of profit 2010/2011<br />

The net profit shown in the annual financial statements of P&I <strong>Personal</strong> & <strong>Informatik</strong> <strong>AG</strong>,<br />

which were prepared in accordance with commercial legislation, amounted to 9,964,159.54<br />

euros.<br />

10