SOUTH AFRICA’S

1HAwfit

1HAwfit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

industries that sell their goods and services beyond<br />

the local economy—is an important indicator of overall<br />

competitiveness. 28 The share of regional output<br />

generated by tradable industries in the Gauteng<br />

City-Region is lower than all regional peers except<br />

for Warsaw. Within the city-region’s traded sector,<br />

financial and business services generated the largest<br />

shares of both employment and output, followed by<br />

manufacturing, transport and communications, and<br />

then agriculture and mining. Public services—including<br />

education and health—accounted for the largest<br />

portion of the city-region’s non-tradable employment<br />

and output, followed by wholesale, retail, and accommodation<br />

services.<br />

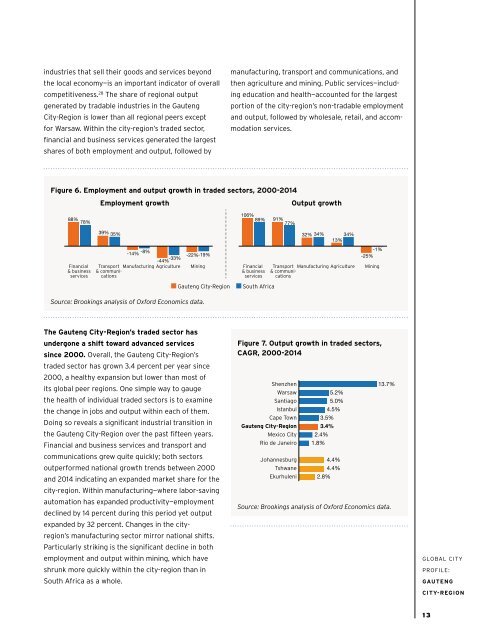

Figure 6. Employment and output growth in traded sectors, 2000-2014<br />

Employment growth<br />

Output growth<br />

88% 78%<br />

39% 35%<br />

-14% -8% -44% -33% -22%-19% 106%<br />

89% 91%<br />

77%<br />

32% 34%<br />

34%<br />

13%<br />

-1%<br />

-25%<br />

Financial<br />

& business<br />

services<br />

Transport Manufacturing Agriculture<br />

& communications<br />

Mining<br />

Financial<br />

& business<br />

services<br />

Transport Manufacturing Agriculture<br />

& communications<br />

Mining<br />

■ Gauteng City-Region<br />

■ South Africa<br />

Source: Brookings analysis of Oxford Economics data.<br />

The Gauteng City-Region’s traded sector has<br />

undergone a shift toward advanced services<br />

since 2000. Overall, the Gauteng City-Region’s<br />

traded sector has grown 3.4 percent per year since<br />

2000, a healthy expansion but lower than most of<br />

its global peer regions. One simple way to gauge<br />

the health of individual traded sectors is to examine<br />

the change in jobs and output within each of them.<br />

Doing so reveals a significant industrial transition in<br />

the Gauteng City-Region over the past fifteen years.<br />

Financial and business services and transport and<br />

communications grew quite quickly; both sectors<br />

outperformed national growth trends between 2000<br />

and 2014 indicating an expanded market share for the<br />

city-region. Within manufacturing—where labor-saving<br />

automation has expanded productivity—employment<br />

declined by 14 percent during this period yet output<br />

expanded by 32 percent. Changes in the cityregion’s<br />

manufacturing sector mirror national shifts.<br />

Particularly striking is the significant decline in both<br />

employment and output within mining, which have<br />

shrunk more quickly within the city-region than in<br />

South Africa as a whole.<br />

Figure 7. Output growth in traded sectors,<br />

CAGR, 2000-2014<br />

Shenzhen<br />

Warsaw<br />

Santiago<br />

Istanbul<br />

Cape Town<br />

Gauteng City-Region<br />

Mexico City<br />

Rio de Janeiro<br />

Johannesburg<br />

Tshwane<br />

Ekurhuleni<br />

2.4%<br />

1.8%<br />

3.5%<br />

3.4%<br />

2.8%<br />

5.2%<br />

5.0%<br />

4.5%<br />

4.4%<br />

4.4%<br />

13.7%<br />

Source: Brookings analysis of Oxford Economics data.<br />

GLOBAL CITY<br />

PROFILE:<br />

GAUTENG<br />

CITY-REGION<br />

13