Adopted Budget

XEhJr

XEhJr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32<br />

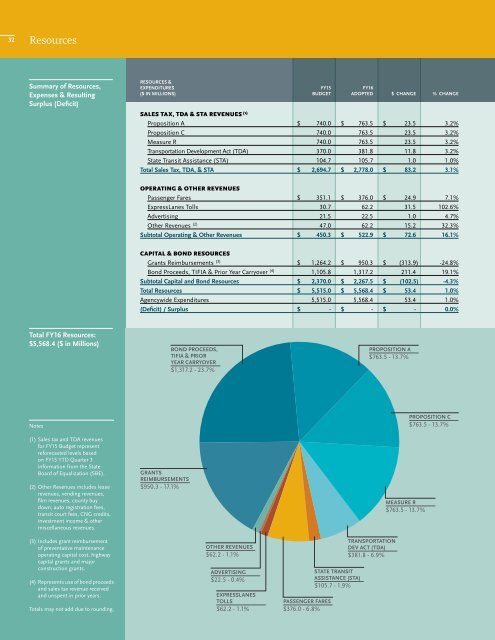

Resources<br />

summary of Resources,<br />

expenses & Resulting<br />

surplus (Deficit)<br />

ResOURces &<br />

exPenDiTURes Fy15 Fy16<br />

($ in MilliOns) BUDGeT ADOPTeD $ chAnGe % chAnGe<br />

sales tax, tda & sta revenues (1)<br />

Proposition A $ 740.0 $ 763.5 $ 23.5 3.2%<br />

Proposition C 740.0 763.5 23.5 3.2%<br />

Measure R 740.0 763.5 23.5 3.2%<br />

Transportation Development Act (TDA) 370.0 381.8 11.8 3.2%<br />

State Transit Assistance (STA) 104.7 105.7 1.0 1.0%<br />

Total sales Tax, TDA, & sTA $ 2,694.7 $ 2,778.0 $ 83.2 3.1%<br />

operating & other revenues<br />

Passenger Fares $ 351.1 $ 376.0 $ 24.9 7.1%<br />

ExpressLanes Tolls 30.7 62.2 31.5 102.6%<br />

Advertising 21.5 22.5 1.0 4.7%<br />

Other Revenues (2) 47.0 62.2 15.2 32.3%<br />

subtotal Operating & Other Revenues $ 450.3 $ 522.9 $ 72.6 16.1%<br />

capital & Bond resources<br />

Grants Reimbursements (3) $ 1,264.2 $ 950.3 $ (313.9) -24.8%<br />

Bond Proceeds, TIFIA & Prior Year Carryover (4) 1,105.8 1,317.2 211.4 19.1%<br />

subtotal capital and Bond Resources $ 2,370.0 $ 2,267.5 $ (102.5) -4.3%<br />

Total Resources $ 5,515.0 $ 5,568.4 $ 53.4 1.0%<br />

Agencywide Expenditures 5,515.0 5,568.4 53.4 1.0%<br />

(Deficit) / surplus $ - $ - $ - 0.0%<br />

Total Fy16 Resources:<br />

$5,568.4 ($ in Millions)<br />

BOND PROCEEDS,<br />

TIFIA & PRIOR<br />

YEAR CARRYOVER<br />

$1,317.2 - 23.7%<br />

PROPOSITION A<br />

$763.5 - 13.7%<br />

Notes<br />

(1) Sales tax and TDA revenues<br />

for FY15 <strong>Budget</strong> represent<br />

reforecasted levels based<br />

on FY15 YTD Quarter 3<br />

information from the State<br />

Board of Equalization (SBE).<br />

(2) Other Revenues includes lease<br />

revenues, vending revenues,<br />

film revenues, county buy<br />

down, auto registration fees,<br />

transit court fees, CNG credits,<br />

investment income & other<br />

miscellaneous revenues.<br />

(3) Includes grant reimbursement<br />

of preventative maintenance<br />

operating capital cost, highway<br />

capital grants and major<br />

construction grants.<br />

(4) Represents use of bond proceeds<br />

and sales tax revenue received<br />

and unspent in prior years.<br />

Totals may not add due to rounding.<br />

GRANTS<br />

REIMBuRSEMENTS<br />

$950.3 - 17.1%<br />

OTHER REVENuES<br />

$62.2 - 1.1%<br />

ADVERTISING<br />

$22.5 - 0.4%<br />

ExPRESSLANES<br />

TOLLS<br />

$62.2 - 1.1%<br />

PASSENGER FARES<br />

$376.0 - 6.8%<br />

STATE TRANSIT<br />

ASSISTANCE (STA)<br />

$105.7 - 1.9%<br />

TRANSPORTATION<br />

DEV ACT (TDA)<br />

$381.8 - 6.9%<br />

MEASuRE R<br />

$763.5 - 13.7%<br />

PROPOSITION C<br />

$763.5 - 13.7%