1owHYXa

1owHYXa

1owHYXa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Friday, February 19, 2016<br />

three Vivendi SA bonds for an aggregate amount of €1,950 million, maturing in December 2016, March 2017 and December 2019,<br />

respectively, as well as the share repurchase program in place as of December 31, 2015 (€193 million).<br />

In addition, Vivendi SA has a €2 billion bank credit facility, undrawn as of December 31, 2015. On October 30, 2015, the maturity of this<br />

credit facility was extended for one year, to October 31, 2020.<br />

As of February 10, 2016, the date of the Management Board meeting that approved Vivendi’s Consolidated Financial Statements for the year<br />

ended December 31, 2015, after taking into account (i) the cash proceeds from the sale of Activision Blizzard shares and the unwinding of the<br />

related hedging instrument on January 13, 2016 (+€1.4 billion), (ii) the payment of the second interim dividend on February 3, 2016 with<br />

respect to fiscal year 2015 (-€1.3 billion), and (iii) the repurchase of treasury shares (-€0.5 billion), Vivendi’s Net Cash Position would be<br />

approximately €6 billion.<br />

2.1.2 Equity portfolio<br />

As of December 31, 2015, Vivendi held a portfolio of quoted and unquoted non-controlling equity interests, mainly in Telecom Italia,<br />

Activision Blizzard, Telefonica, Ubisoft and Gameloft. At this date, this equity portfolio represented an aggregate market value of<br />

approximately €6 billion (before taxes): please refer to Notes 11 and 12 to the Consolidated Financial Statements for the year ended<br />

December 31, 2015.<br />

As of February 10, 2016, the date of the Management Board meeting that approved Vivendi’s Consolidated Financial Statements for the year<br />

ended December 31, 2015, the market value of Vivendi’s portfolio of non-controlling equity interests amounted to approximately €3.8 billion.<br />

This change included the sale of the interest in Activision Blizzard and fluctuations in stock market prices.<br />

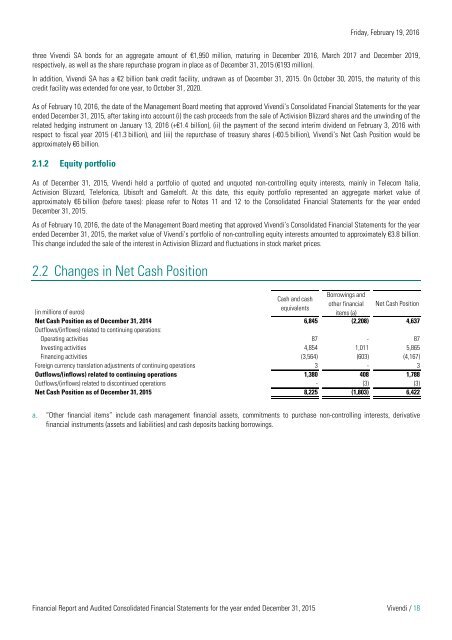

2.2 Changes in Net Cash Position<br />

Cash and cash<br />

equivalents<br />

Borrowings and<br />

other financial<br />

items (a)<br />

Net Cash Position<br />

(in millions of euros)<br />

Net Cash Position as of December 31, 2014 6,845 (2,208) 4,637<br />

Outflows/(inflows) related to continuing operations:<br />

Operating activities 87 - 87<br />

Investing activities 4,854 1,011 5,865<br />

Financing activities (3,564) (603) (4,167)<br />

Foreign currency translation adjustments of continuing operations 3 - 3<br />

Outflows/(inflows) related to continuing operations 1,380 408 1,788<br />

Outflows/(inflows) related to discontinued operations - (3) (3)<br />

Net Cash Position as of December 31, 2015 8,225 (1,803) 6,422<br />

a. “Other financial items” include cash management financial assets, commitments to purchase non-controlling interests, derivative<br />

financial instruments (assets and liabilities) and cash deposits backing borrowings.<br />

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2015 Vivendi / 18