1owHYXa

1owHYXa

1owHYXa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Friday, February 19, 2016<br />

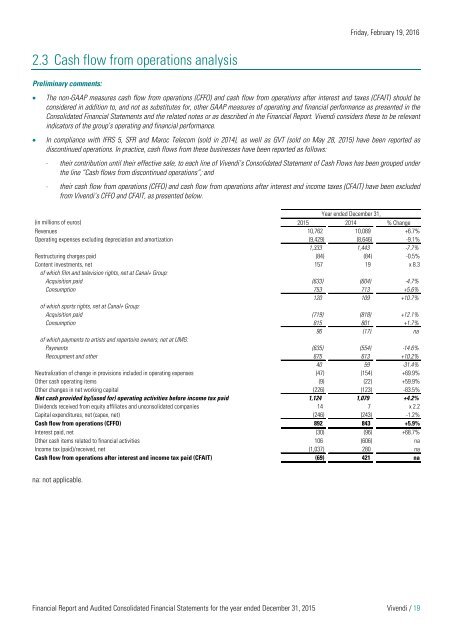

2.3 Cash flow from operations analysis<br />

Preliminary comments:<br />

<br />

<br />

The non-GAAP measures cash flow from operations (CFFO) and cash flow from operations after interest and taxes (CFAIT) should be<br />

considered in addition to, and not as substitutes for, other GAAP measures of operating and financial performance as presented in the<br />

Consolidated Financial Statements and the related notes or as described in the Financial Report. Vivendi considers these to be relevant<br />

indicators of the group’s operating and financial performance.<br />

In compliance with IFRS 5, SFR and Maroc Telecom (sold in 2014), as well as GVT (sold on May 28, 2015) have been reported as<br />

discontinued operations. In practice, cash flows from these businesses have been reported as follows:<br />

- their contribution until their effective sale, to each line of Vivendi’s Consolidated Statement of Cash Flows has been grouped under<br />

the line “Cash flows from discontinued operations”; and<br />

- their cash flow from operations (CFFO) and cash flow from operations after interest and income taxes (CFAIT) have been excluded<br />

from Vivendi’s CFFO and CFAIT, as presented below.<br />

Year ended December 31,<br />

(in millions of euros) 2015 2014 % Change<br />

Revenues 10,762 10,089 +6.7%<br />

Operating expenses excluding depreciation and amortization (9,429) (8,646) -9.1%<br />

1,333 1,443 -7.7%<br />

Restructuring charges paid (84) (84) -0.5%<br />

Content investments, net 157 19 x 8.3<br />

of which film and television rights, net at Canal+ Group:<br />

Acquisition paid (633) (604) -4.7%<br />

Consumption 753 713 +5.6%<br />

120 109 +10.7%<br />

of which sports rights, net at Canal+ Group:<br />

Acquisition paid (719) (818) +12.1%<br />

Consumption 815 801 +1.7%<br />

96 (17) na<br />

of which payments to artists and repertoire owners, net at UMG:<br />

Payments (635) (554) -14.6%<br />

Recoupment and other 675 613 +10.2%<br />

40 59 -31.4%<br />

Neutralization of change in provisions included in operating expenses (47) (154) +69.9%<br />

Other cash operating items (9) (22) +59.9%<br />

Other changes in net working capital (226) (123) -83.5%<br />

Net cash provided by/(used for) operating activities before income tax paid 1,124 1,079 +4.2%<br />

Dividends received from equity affiliates and unconsolidated companies 14 7 x 2.2<br />

Capital expenditures, net (capex, net) (246) (243) -1.2%<br />

Cash flow from operations (CFFO) 892 843 +5.9%<br />

Interest paid, net (30) (96) +68.7%<br />

Other cash items related to financial activities 106 (606) na<br />

Income tax (paid)/received, net (1,037) 280 na<br />

Cash flow from operations after interest and income tax paid (CFAIT) (69) 421 na<br />

na: not applicable.<br />

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2015 Vivendi / 19