You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• Companies that <strong>of</strong>fered credit cards with predatory features experienced higher losses compared<br />

with issuers whose cards were more consumer-friendly (Frank, 2012).8<br />

• Several studies find that payday loans have high borrower-level default rates. For example, a<br />

recent CRL study found that 46% <strong>of</strong> North Dakota payday borrowers defaulted within 2 years<br />

<strong>of</strong> taking out their first payday loan (Montezemolo & Wolff, 2015).9 Payday loans have other<br />

negative consequences in addition to default; for example, Skiba & Tobacman (2009) found that<br />

borrowers are more likely to file for Chapter 13 bankruptcy as a result <strong>of</strong> taking out a payday loan.<br />

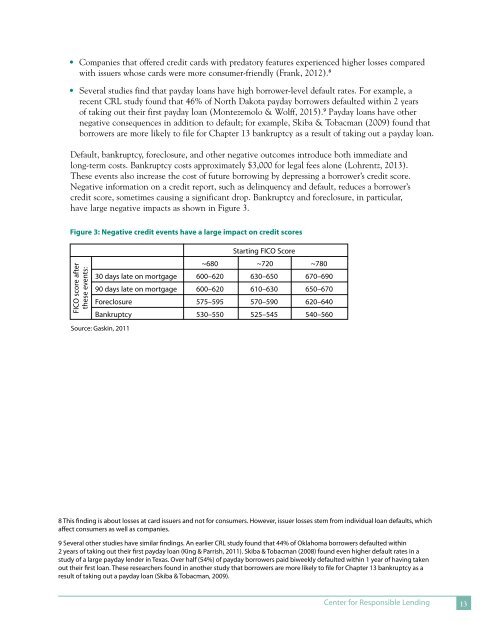

Default, bankruptcy, foreclosure, and other negative outcomes introduce both immediate and<br />

long-term costs. Bankruptcy costs approximately $3,000 for legal fees alone (Lohrentz, 2013).<br />

<strong>The</strong>se events also increase the cost <strong>of</strong> future borrowing by depressing a borrower’s credit score.<br />

Negative information on a credit report, such as delinquency and default, reduces a borrower’s<br />

credit score, sometimes causing a significant drop. Bankruptcy and foreclosure, in particular,<br />

have large negative impacts as shown in Figure 3.<br />

Figure 3: Negative credit events have a large impact on credit scores<br />

FICO score after<br />

these events:<br />

Source: Gaskin, 2011<br />

Starting FICO Score<br />

~680 ~720 ~780<br />

30 days late on mortgage 600–620 630–650 670–690<br />

90 days late on mortgage 600–620 610–630 650–670<br />

Foreclosure 575–595 570–590 620–640<br />

Bankruptcy 530–550 525–545 540–560<br />

8 This finding is about losses at card issuers and not for consumers. However, issuer losses stem from individual loan defaults, which<br />

affect consumers as well as companies.<br />

9 Several other studies have similar findings. An earlier CRL study found that 44% <strong>of</strong> Oklahoma borrowers defaulted within<br />

2 years <strong>of</strong> taking out their first payday loan (King & Parrish, 2011). Skiba & Tobacman (2008) found even higher default rates in a<br />

study <strong>of</strong> a large payday lender in Texas. Over half (54%) <strong>of</strong> payday borrowers paid biweekly defaulted within 1 year <strong>of</strong> having taken<br />

out their first loan. <strong>The</strong>se researchers found in another study that borrowers are more likely to file for Chapter 13 bankruptcy as a<br />

result <strong>of</strong> taking out a payday loan (Skiba & Tobacman, 2009).<br />

Center for Responsible Lending 13