You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

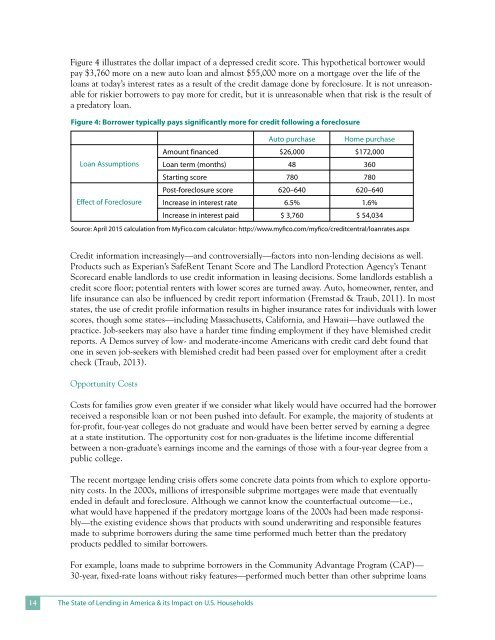

Figure 4 illustrates the dollar impact <strong>of</strong> a depressed credit score. This hypothetical borrower would<br />

pay $3,760 more on a new auto loan and almost $55,000 more on a mortgage over the life <strong>of</strong> the<br />

loans at today’s interest rates as a result <strong>of</strong> the credit damage done by foreclosure. It is not unreasonable<br />

for riskier borrowers to pay more for credit, but it is unreasonable when that risk is the result <strong>of</strong><br />

a predatory loan.<br />

Figure 4: Borrower typically pays significantly more for credit following a foreclosure<br />

Loan Assumptions<br />

Effect <strong>of</strong> Foreclosure<br />

Auto purchase<br />

Home purchase<br />

Amount financed $26,000 $172,000<br />

Loan term (months) 48 360<br />

Starting score 780 780<br />

Post-foreclosure score 620–640 620–640<br />

Increase in interest rate 6.5% 1.6%<br />

Increase in interest paid $ 3,760 $ 54,034<br />

Source: April 2015 calculation from MyFico.com calculator: http://www.myfico.com/myfico/creditcentral/loanrates.aspx<br />

Credit information increasingly—and controversially—factors into non-lending decisions as well.<br />

Products such as Experian’s SafeRent Tenant Score and <strong>The</strong> Landlord Protection Agency’s Tenant<br />

Scorecard enable landlords to use credit information in leasing decisions. Some landlords establish a<br />

credit score floor; potential renters with lower scores are turned away. Auto, homeowner, renter, and<br />

life insurance can also be influenced by credit report information (Fremstad & Traub, 2011). In most<br />

states, the use <strong>of</strong> credit pr<strong>of</strong>ile information results in higher insurance rates for individuals with lower<br />

scores, though some states—including Massachusetts, California, and Hawaii—have outlawed the<br />

practice. Job-seekers may also have a harder time finding employment if they have blemished credit<br />

reports. A Demos survey <strong>of</strong> low- and moderate-income Americans with credit card debt found that<br />

one in seven job-seekers with blemished credit had been passed over for employment after a credit<br />

check (Traub, 2013).<br />

Opportunity <strong>Costs</strong><br />

<strong>Costs</strong> for families grow even greater if we consider what likely would have occurred had the borrower<br />

received a responsible loan or not been pushed into default. For example, the majority <strong>of</strong> students at<br />

for-pr<strong>of</strong>it, four-year colleges do not graduate and would have been better served by earning a degree<br />

at a state institution. <strong>The</strong> opportunity cost for non-graduates is the lifetime income differential<br />

between a non-graduate’s earnings income and the earnings <strong>of</strong> those with a four-year degree from a<br />

public college.<br />

<strong>The</strong> recent mortgage lending crisis <strong>of</strong>fers some concrete data points from which to explore opportunity<br />

costs. In the 2000s, millions <strong>of</strong> irresponsible subprime mortgages were made that eventually<br />

ended in default and foreclosure. Although we cannot know the counterfactual outcome—i.e.,<br />

what would have happened if the predatory mortgage loans <strong>of</strong> the 2000s had been made responsibly—the<br />

existing evidence shows that products with sound underwriting and responsible features<br />

made to subprime borrowers during the same time performed much better than the predatory<br />

products peddled to similar borrowers.<br />

For example, loans made to subprime borrowers in the Community Advantage Program (CAP)—<br />

30-year, fixed-rate loans without risky features—performed much better than other subprime loans<br />

14<br />

<strong>The</strong> State <strong>of</strong> Lending in America & its Impact on U.S. Households