Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Lending Abuses and <strong>The</strong>ir <strong>Costs</strong><br />

Consumer loans help families make large purchases and manage the cost <strong>of</strong> regular expenditures.<br />

Consumers and lenders work together under a specified set <strong>of</strong> terms and conditions, which can be<br />

responsible or abusive. Responsible lending provides fair, affordable, and transparent loans. Abusive<br />

loans, on the other hand, carry a host <strong>of</strong> deceptive and abusive loan features. Consumer loans are<br />

not inherently helpful or harmful. Just as a hammer can be used to build a house or take it down,<br />

lending can help families build wealth or strip it away.<br />

<strong>The</strong> State <strong>of</strong> Lending in America series has explored many consumer credit products: mortgages, auto<br />

loans, credit cards, student loans, car-title loans, overdrafts, bank payday loans, payday loans, debt<br />

settlement, and debt collection. This chapter draws from each <strong>of</strong> these markets in explaining how<br />

lending affects households and how lending abuses harm families.1<br />

Responsible loans—such as properly-underwritten, fully amortizing loans—help borrowers gain<br />

access to opportunities. A car loan allows a worker to buy an essential asset for commuting to and<br />

from a job. A student loan pays for tuition and the job prospects that come with a college degree.<br />

A mortgage not only enables a family to purchase shelter, but also allows it to build equity over time.<br />

Saving enough cash to send a child to college or to purchase a house outright is impossible for most<br />

working families. Access to responsible lending products puts these goals—and the benefits they<br />

provide—within reach for families <strong>of</strong> modest means.<br />

Abusive loans, on the other hand, carry significant costs and lead to consumer harm. Payday and<br />

car-title loans, for example, lure borrowers in with the prospect <strong>of</strong> short-term cash but ultimately<br />

saddle borrowers in long-term, high-cost debt. Receiving a predatory loan can trap a borrower in a<br />

cycle <strong>of</strong> debt and prevent wealth-building opportunities for years to come.<br />

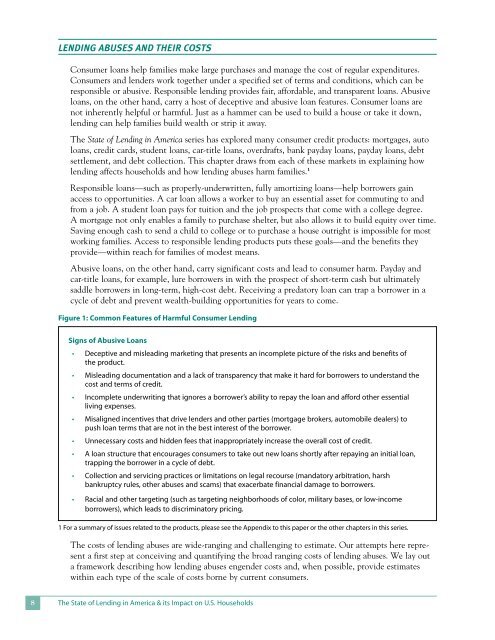

Figure 1: Common Features <strong>of</strong> Harmful Consumer Lending<br />

Signs <strong>of</strong> Abusive Loans<br />

• Deceptive and misleading marketing that presents an incomplete picture <strong>of</strong> the risks and benefits <strong>of</strong><br />

the product.<br />

• Misleading documentation and a lack <strong>of</strong> transparency that make it hard for borrowers to understand the<br />

cost and terms <strong>of</strong> credit.<br />

• Incomplete underwriting that ignores a borrower’s ability to repay the loan and afford other essential<br />

living expenses.<br />

• Misaligned incentives that drive lenders and other parties (mortgage brokers, automobile dealers) to<br />

push loan terms that are not in the best interest <strong>of</strong> the borrower.<br />

• Unnecessary costs and hidden fees that inappropriately increase the overall cost <strong>of</strong> credit.<br />

• A loan structure that encourages consumers to take out new loans shortly after repaying an initial loan,<br />

trapping the borrower in a cycle <strong>of</strong> debt.<br />

• Collection and servicing practices or limitations on legal recourse (mandatory arbitration, harsh<br />

bankruptcy rules, other abuses and scams) that exacerbate financial damage to borrowers.<br />

• Racial and other targeting (such as targeting neighborhoods <strong>of</strong> color, military bases, or low-income<br />

borrowers), which leads to discriminatory pricing.<br />

1 For a summary <strong>of</strong> issues related to the products, please see the Appendix to this paper or the other chapters in this series.<br />

<strong>The</strong> costs <strong>of</strong> lending abuses are wide-ranging and challenging to estimate. Our attempts here represent<br />

a first step at conceiving and quantifying the broad ranging costs <strong>of</strong> lending abuses. We lay out<br />

a framework describing how lending abuses engender costs and, when possible, provide estimates<br />

within each type <strong>of</strong> the scale <strong>of</strong> costs borne by current consumers.<br />

8<br />

<strong>The</strong> State <strong>of</strong> Lending in America & its Impact on U.S. Households