Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Who Pays<br />

Consumer debt is widespread. <strong>The</strong> 2013 Survey <strong>of</strong> Consumer Finances shows that three-quarters<br />

(74.5%) <strong>of</strong> families held some type <strong>of</strong> consumer debt. All types <strong>of</strong> American families held debt,<br />

including 52.4% <strong>of</strong> the lowest-income and 84.5% <strong>of</strong> the highest income households, along with<br />

72.9% <strong>of</strong> non-white and 75.3% <strong>of</strong> white households.<br />

Abusive lending practices, some <strong>of</strong> which are widespread, therefore have the potential to affect<br />

nearly every American. For example, approximately 36 million checking accounts are overdrawn<br />

at least once annually (Borné & Smith, 2013b). And 77 million credit files—about one in three—<br />

include a debt in collections (Ratcliffe et al., 2014).<br />

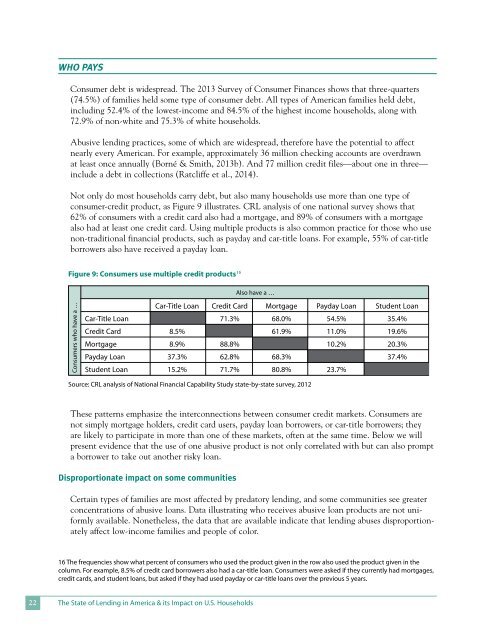

Not only do most households carry debt, but also many households use more than one type <strong>of</strong><br />

consumer-credit product, as Figure 9 illustrates. CRL analysis <strong>of</strong> one national survey shows that<br />

62% <strong>of</strong> consumers with a credit card also had a mortgage, and 89% <strong>of</strong> consumers with a mortgage<br />

also had at least one credit card. Using multiple products is also common practice for those who use<br />

non-traditional financial products, such as payday and car-title loans. For example, 55% <strong>of</strong> car-title<br />

borrowers also have received a payday loan.<br />

Figure 9: Consumers use multiple credit products16<br />

Also have a …<br />

Consumers who have a …<br />

Car-Title Loan Credit Card Mortgage Payday Loan Student Loan<br />

Car-Title Loan 71.3% 68.0% 54.5% 35.4%<br />

Credit Card 8.5% 61.9% 11.0% 19.6%<br />

Mortgage 8.9% 88.8% 10.2% 20.3%<br />

Payday Loan 37.3% 62.8% 68.3% 37.4%<br />

Student Loan 15.2% 71.7% 80.8% 23.7%<br />

Source: CRL analysis <strong>of</strong> National Financial Capability Study state-by-state survey, 2012<br />

<strong>The</strong>se patterns emphasize the interconnections between consumer credit markets. Consumers are<br />

not simply mortgage holders, credit card users, payday loan borrowers, or car-title borrowers; they<br />

are likely to participate in more than one <strong>of</strong> these markets, <strong>of</strong>ten at the same time. Below we will<br />

present evidence that the use <strong>of</strong> one abusive product is not only correlated with but can also prompt<br />

a borrower to take out another risky loan.<br />

Disproportionate impact on some communities<br />

Certain types <strong>of</strong> families are most affected by predatory lending, and some communities see greater<br />

concentrations <strong>of</strong> abusive loans. Data illustrating who receives abusive loan products are not uniformly<br />

available. Nonetheless, the data that are available indicate that lending abuses disproportionately<br />

affect low-income families and people <strong>of</strong> color.<br />

16 <strong>The</strong> frequencies show what percent <strong>of</strong> consumers who used the product given in the row also used the product given in the<br />

column. For example, 8.5% <strong>of</strong> credit card borrowers also had a car-title loan. Consumers were asked if they currently had mortgages,<br />

credit cards, and student loans, but asked if they had used payday or car-title loans over the previous 5 years.<br />

22<br />

<strong>The</strong> State <strong>of</strong> Lending in America & its Impact on U.S. Households