You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

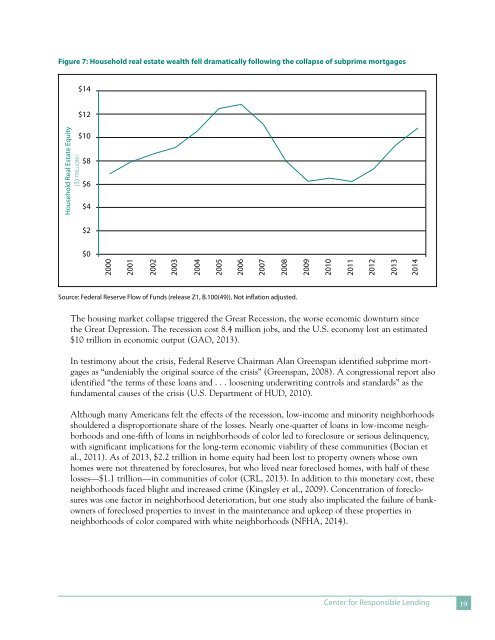

Figure 7: Household real estate wealth fell dramatically following the collapse <strong>of</strong> subprime mortgages<br />

$14<br />

Household Real Estate Equity<br />

($) trillions<br />

$12<br />

$10<br />

$8<br />

$6<br />

$4<br />

$2<br />

$0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

Source: Federal Reserve Flow <strong>of</strong> Funds (release Z1, B.100(49)), Not inflation adjusted.<br />

<strong>The</strong> housing market collapse triggered the Great Recession, the worse economic downturn since<br />

the Great Depression. <strong>The</strong> recession cost 8.4 million jobs, and the U.S. economy lost an estimated<br />

$10 trillion in economic output (GAO, 2013).<br />

In testimony about the crisis, Federal Reserve Chairman Alan Greenspan identified subprime mortgages<br />

as “undeniably the original source <strong>of</strong> the crisis” (Greenspan, 2008). A congressional report also<br />

identified “the terms <strong>of</strong> these loans and . . . loosening underwriting controls and standards” as the<br />

fundamental causes <strong>of</strong> the crisis (U.S. Department <strong>of</strong> HUD, 2010).<br />

Although many Americans felt the effects <strong>of</strong> the recession, low-income and minority neighborhoods<br />

shouldered a disproportionate share <strong>of</strong> the losses. Nearly one-quarter <strong>of</strong> loans in low-income neighborhoods<br />

and one-fifth <strong>of</strong> loans in neighborhoods <strong>of</strong> color led to foreclosure or serious delinquency,<br />

with significant implications for the long-term economic viability <strong>of</strong> these communities (Bocian et<br />

al., 2011). As <strong>of</strong> 2013, $2.2 trillion in home equity had been lost to property owners whose own<br />

homes were not threatened by foreclosures, but who lived near foreclosed homes, with half <strong>of</strong> these<br />

losses—$1.1 trillion—in communities <strong>of</strong> color (CRL, 2013). In addition to this monetary cost, these<br />

neighborhoods faced blight and increased crime (Kingsley et al., 2009). Concentration <strong>of</strong> foreclosures<br />

was one factor in neighborhood deterioration, but one study also implicated the failure <strong>of</strong> bankowners<br />

<strong>of</strong> foreclosed properties to invest in the maintenance and upkeep <strong>of</strong> these properties in<br />

neighborhoods <strong>of</strong> color compared with white neighborhoods (NFHA, 2014).<br />

Center for Responsible Lending 19