saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – RISK MANAGEMENT – SAXO BANK GROUP<br />

(DKK 1,000)<br />

MARKET RISK · continued<br />

The Group operates its trading and investment business using the Group’s online investment trading platforms. The Group has a low appetite for<br />

trading and investment related market risk and continue to execute strategic initiatives to minimise the need for open market risk exposures in the<br />

market making/trading activities. The Group’s market risk appetite including the appetite for investment risks in Group Treasury is defined by limits<br />

set in the Risk Appetite Statements. The Group has low risk appetite for structural market risk exposures to the extent these can be mitigated in a<br />

structured and meaningful way.<br />

The market risk is quantified and monitored against a number of exposure, loss and Value-at-Risk limits.<br />

Exposure and loss limit utilisations are monitored on a continuous basis, while Value-at-Risk limit utilisation is evaluated on an end-of-day basis.<br />

Exposure limits are both set according to the underlying asset class and different risk profiles within a single asset class.<br />

Exposure limits on foreign exchange are segmented into more granular levels based on instrument characteristics such as market availability,<br />

liquidity and volatility. On foreign exchange options limits are also set on the gamma and vega to ensure that the key risk elements (underlying<br />

price sensitivity, and volatility) from options are considered and monitored.<br />

Exposure limits on equities and commodities are set on gross, net and single to capture market movements and concentration risk. The single level<br />

is furthermore broken into tenors to avoid concentration risk in specific time buckets. Loss limits are set on a single day basis, and relative to the<br />

underlying asset class and exposure mandate.<br />

The Value-at-Risk (VaR) is an estimated loss to a portfolio value that potentially could arise over a specific time horizon (holding period) from<br />

an adverse market movement with a specified probability (confidence level). The VaR limit framework used by the Group is based on a 95%<br />

confidence level for a 1 day holding period. The VaR model used is based on Monte Carlo simulations to make full repricing for non-linear<br />

instruments.<br />

VaR is deemed to be a good basis for comparing and monitoring risk across different asset classes. However, the model is based on certain<br />

assumptions that should be noted:<br />

• A 1-day holding period assumes that it is possible to hedge or eliminate market risk exposure within that period. This may not always be the<br />

case for highly illiquid markets<br />

• At a 95% confidence level there is a 5% (1 in 20 days) risk of losses exceeding the estimated loss with no certainty of how much the<br />

exceedance will be<br />

• VaR is calculated on an end-of-day basis and does not reflect exposures that may arise on positions during the trading day<br />

• The use of historical data as a basis for determining the possible range of future outcomes may not always cover all possible scenarios<br />

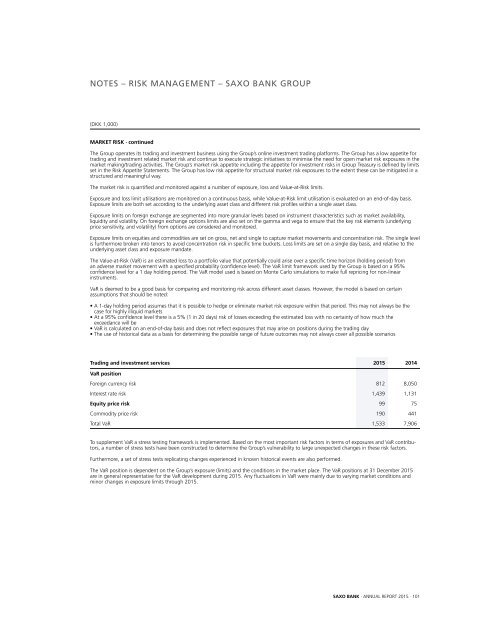

Trading and investment services <strong>2015</strong> 2014<br />

VaR position<br />

Foreign currency risk 812 8,050<br />

Interest rate risk 1,439 1,131<br />

Equity price risk 99 75<br />

Commodity price risk 190 441<br />

Total VaR 1,533 7,906<br />

To supplement VaR a stress testing framework is implemented. Based on the most important risk factors in terms of exposures and VaR contributors,<br />

a number of stress tests have been constructed to determine the Group’s vulnerability to large unexpected changes in these risk factors.<br />

Furthermore, a set of stress tests replicating changes experienced in known historical events are also performed.<br />

The VaR position is dependent on the Group’s exposure (limits) and the conditions in the market place. The VaR positions at 31 December <strong>2015</strong><br />

are in general representative for the VaR development during <strong>2015</strong>. Any fluctuations in VaR were mainly due to varying market conditions and<br />

minor changes in exposure limits through <strong>2015</strong>.<br />

SAXO BANK · ANNUAL REPORT <strong>2015</strong> · 101