saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – SAXO BANK GROUP<br />

Note (DKK 1,000)<br />

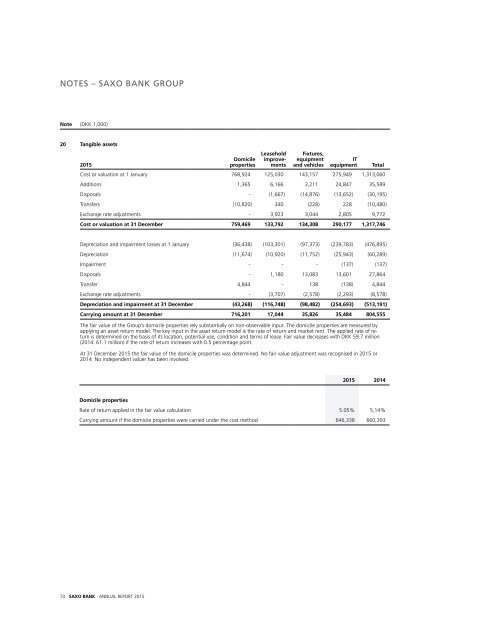

20 Tangible assets<br />

<strong>2015</strong><br />

Domicile<br />

properties<br />

Leasehold<br />

improvements<br />

Fixtures,<br />

equipment<br />

and vehicles<br />

IT<br />

equipment<br />

Cost or valuation at 1 January 768,924 125,030 143,157 275,949 1,313,060<br />

Additions 1,365 6,166 3,211 24,847 35,589<br />

Disposals - (1,667) (14,876) (13,652) (30,195)<br />

Transfers (10,820) 340 (228) 228 (10,480)<br />

Exchange rate adjustments - 3,923 3,044 2,805 9,772<br />

Cost or valuation at 31 December 759,469 133,792 134,308 290,177 1,317,746<br />

Total<br />

Depreciation and impairment losses at 1 January (36,438) (103,301) (97,373) (239,783) (476,895)<br />

Depreciation (11,674) (10,920) (11,752) (25,943) (60,289)<br />

Impairment - - - (137) (137)<br />

Disposals - 1,180 13,083 13,601 27,864<br />

Transfer 4,844 - 138 (138) 4,844<br />

Exchange rate adjustments - (3,707) (2,578) (2,293) (8,578)<br />

Depreciation and impairment at 31 December (43,268) (116,748) (98,482) (254,693) (513,191)<br />

Carrying amount at 31 December 716,201 17,044 35,826 35,484 804,555<br />

The fair value of the Group’s domicile properties rely substantially on non-observable input. The domicile properties are measured by<br />

applying an asset return model. The key input in the asset return model is the rate of return and market rent. The applied rate of return<br />

is determined on the basis of its location, potential use, condition and terms of lease. Fair value decreases with DKK 59.7 million<br />

(2014: 61.1 million) if the rate of return increases with 0.5 percentage point.<br />

At 31 December <strong>2015</strong> the fair value of the domicile properties was determined. No fair value adjustment was recognised in <strong>2015</strong> or<br />

2014. No independent valuer has been involved.<br />

<strong>2015</strong> 2014<br />

Domicile properties<br />

Rate of return applied in the fair value calculation 5.05% 5,14%<br />

Carrying amount if the domicile properties were carried under the cost method 646,338 660,393<br />

70 · SAXO BANK · ANNUAL REPORT <strong>2015</strong>