saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT REPORT<br />

Saxo Bank Group <strong>report</strong>ed a net loss of DKK 645 million<br />

for <strong>2015</strong> compared to a net profit of DKK 381 million for<br />

2014. By the end of <strong>2015</strong> Client’s collateral deposits had<br />

increased by DKK 9.4 billion to DKK 77.6 billion, which is<br />

a new all-time high.<br />

The Board of Directors and the Board of Management<br />

find the result for the year unsatisfactory. However the<br />

Board of Directors and Board of Management notes that<br />

the result is heavily affected by the effects of the decision<br />

made by the Swiss National Bank on January 15, where<br />

the fixed floor between Euro and the Swiss franc was removed.<br />

Despite Saxo Banks warning about growing risk in CHF<br />

trades in September 2014, no one could have foreseen<br />

the historic movement. As a result a number of Saxo<br />

Bank’s clients ended up with insufficient margin collateral<br />

to cover their losses on positions in Swiss franc. Where clients<br />

have unsettled negative balances end of <strong>2015</strong> these<br />

balances have been fully provided for which has resulted<br />

in significant credit value adjustments for the year.<br />

The net loss for the Bank related to the Swiss event<br />

amounts to approximately DKK 0.7 billion and have been<br />

included in the result for the period. The collection process<br />

concerning the unsettled negative balances will continue<br />

and further coverage from clients will have a positive<br />

impact on the Bank’s future result.<br />

The inflow of clients’ collateral and new clients continued<br />

successfully in <strong>2015</strong>, but in the aftermath of the Swiss<br />

event with cautiousness and the uncertainty concerning<br />

China and thus the global economy continued as well<br />

throughout <strong>2015</strong>. Trading activities in <strong>2015</strong> have been<br />

lower than expected even though volatility has increased<br />

compared to 2014.<br />

Operating income decreased mostly due to the Swiss<br />

event from DKK 3.0 billion in 2014 to DKK 2.1 billion.<br />

Cost has been impacted by the increase of staff in the last<br />

two years as well as restructuring. Staff costs and administrative<br />

expenses of DKK 2.3 billion were therefore 14%<br />

above the 2014 expenses.<br />

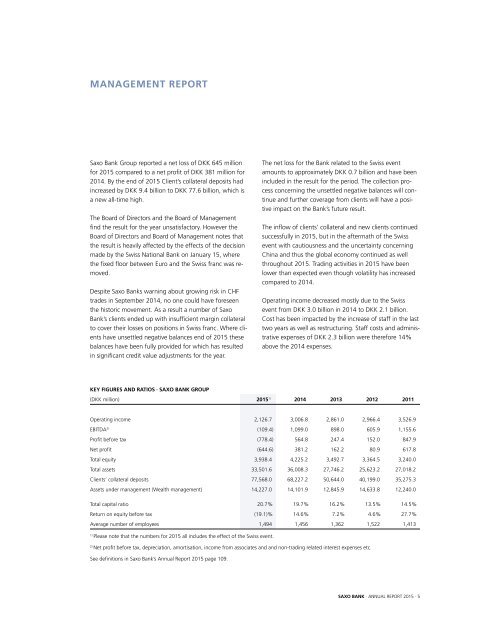

KEY FIGURES AND RATIOS · SAXO BANK GROUP<br />

(DKK million) <strong>2015</strong> 1) 2014 2013 2012 2011<br />

Operating income 2,126.7 3,006.8 2,861.0 2,966.4 3,526.9<br />

EBITDA 2) (109.4) 1,099.0 898.0 605.9 1,155.6<br />

Profit before tax (778.4) 564.8 247.4 152.0 847.9<br />

Net profit (644.6) 381.2 162.2 80.9 617.8<br />

Total equity 3,938.4 4,225.2 3,492.7 3,364.5 3,240.0<br />

Total assets 33,501.6 36,008.3 27,746.2 25,623.2 27,018.2<br />

Clients’ collateral deposits 77,568.0 68,227.2 50,644.0 40,199.0 35,275.3<br />

Assets under management (Wealth management) 14,227.0 14,101.9 12,845.9 14,633.8 12,240.0<br />

Total capital ratio 20.7% 19.7% 16.2% 13.5% 14.5%<br />

Return on equity before tax (19.1)% 14.6% 7.2% 4.6% 27.7%<br />

Average number of employees 1,494 1,456 1,362 1,522 1,413<br />

1)<br />

Please note that the numbers for <strong>2015</strong> all includes the effect of the Swiss event.<br />

2)<br />

Net profit before tax, depreciation, amortisation, income from associates and and non-trading related interest expenses etc.<br />

See definitions in Saxo Bank’s Annual Report <strong>2015</strong> page 109.<br />

SAXO BANK · ANNUAL REPORT <strong>2015</strong> · 5