saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

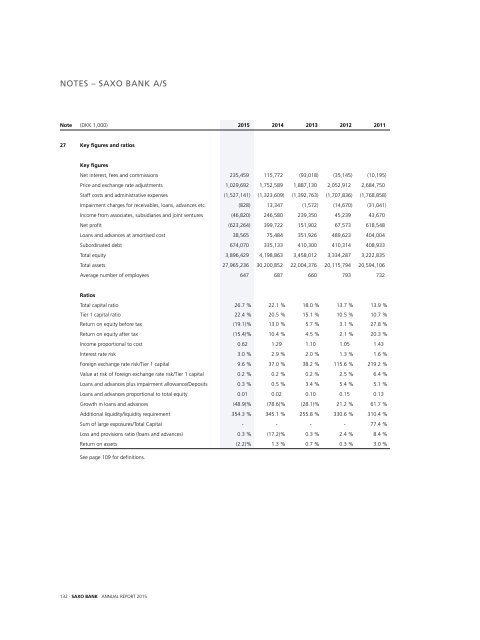

NOTES – SAXO BANK A/S<br />

Note (DKK 1,000) <strong>2015</strong> 2014 2013 2012 2011<br />

27 Key figures and ratios<br />

Key figures<br />

Net interest, fees and commissions 235,459 115,772 (93,018) (35,145) (10,195)<br />

Price and exchange rate adjustments 1,029,692 1,752,589 1,887,130 2,052,912 2,684,750<br />

Staff costs and administrative expenses (1,527,141) (1,323,609) (1,392,763) (1,707,836) (1,768,858)<br />

Impairment charges for receivables, loans, advances etc. (828) 13,347 (1,572) (14,670) (31,041)<br />

Income from associates, subsidiaries and joint ventures (46,820) 246,580 239,350 45,239 43,670<br />

Net profit (623,264) 399,722 151,902 67,573 618,548<br />

Loans and advances at amortised cost 38,565 75,484 351,926 489,623 404,004<br />

Subordinated debt 674,070 335,133 410,300 410,314 408,933<br />

Total equity 3,896,429 4,198,863 3,458,012 3,334,287 3,222,835<br />

Total assets 27,965,236 30,200,852 22,004,376 20,115,794 20,594,106<br />

Average number of employees 647 687 660 793 732<br />

Ratios<br />

Total capital ratio 26.7 % 22.1 % 18.0 % 13.7 % 13.9 %<br />

Tier 1 capital ratio 22.4 % 20.5 % 15.1 % 10.5 % 10.7 %<br />

Return on equity before tax (19.1)% 13.0 % 5.7 % 3.1 % 27.8 %<br />

Return on equity after tax (15.4)% 10.4 % 4.5 % 2.1 % 20.3 %<br />

Income proportional to cost 0.62 1.29 1.10 1.05 1.43<br />

Interest rate risk 3.0 % 2.9 % 2.0 % 1.3 % 1.6 %<br />

Foreign exchange rate risk/Tier 1 capital 9.6 % 37.0 % 38.2 % 115.6 % 219.2 %<br />

Value at risk of foreign exchange rate risk/Tier 1 capital 0.2 % 0.2 % 0.2 % 2.5 % 6.4 %<br />

Loans and advances plus impairment allowance/Deposits 0.3 % 0.5 % 3.4 % 5.4 % 5.1 %<br />

Loans and advances proportional to total equity 0.01 0.02 0.10 0.15 0.13<br />

Growth in loans and advances (48.9)% (78.6)% (28.1)% 21.2 % 61.7 %<br />

Additional liquidity/liquidity requirement 354.3 % 345.1 % 255.8 % 330.6 % 310.4 %<br />

Sum of large exposures/Total Capital - - - - 77.4 %<br />

Loss and provisions ratio (loans and advances) 0.3 % (17.2)% 0.3 % 2.4 % 8.4 %<br />

Return on assets (2.2)% 1.3 % 0.7 % 0.3 % 3.0 %<br />

See page 109 for definitions.<br />

132 · SAXO BANK · ANNUAL REPORT <strong>2015</strong>