saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES – SAXO BANK GROUP<br />

Note (DKK 1,000)<br />

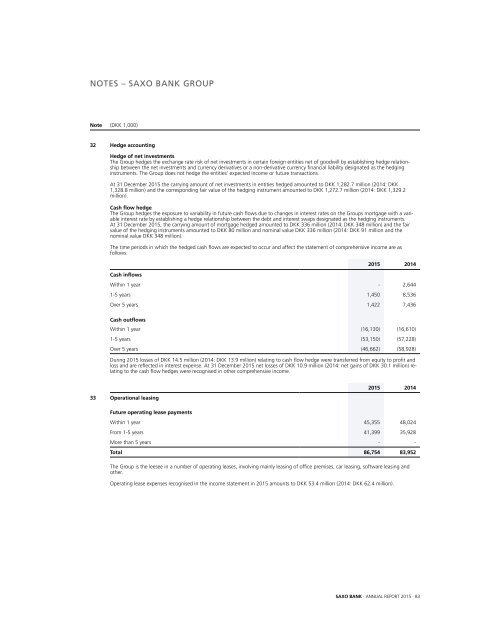

32 Hedge accounting<br />

Hedge of net investments<br />

The Group hedges the exchange rate risk of net investments in certain foreign entities net of goodwill by establishing hedge relationship<br />

between the net investments and currency derivatives or a non-derivative currency financial liability designated as the hedging<br />

instruments. The Group does not hedge the entities’ expected income or future transactions.<br />

At 31 December <strong>2015</strong> the carrying amount of net investments in entities hedged amounted to DKK 1,282.7 million (2014: DKK<br />

1,328.8 million) and the corresponding fair value of the hedging instrument amounted to DKK 1,272.7 million (2014: DKK 1,329.2<br />

million).<br />

Cash flow hedge<br />

The Group hedges the exposure to variability in future cash flows due to changes in interest rates on the Groups mortgage with a variable<br />

interest rate by establishing a hedge relationship between the debt and interest swaps designated as the hedging instruments.<br />

At 31 December <strong>2015</strong>, the carrying amount of mortgage hedged amounted to DKK 336 million (2014: DKK 348 million) and the fair<br />

value of the hedging instruments amounted to DKK 80 million and nominal value DKK 336 million (2014: DKK 91 million and the<br />

nominal value DKK 348 million).<br />

The time periods in which the hedged cash flows are expected to occur and affect the statement of comprehensive income are as<br />

follows:<br />

<strong>2015</strong> 2014<br />

Cash inflows<br />

Within 1 year - 2,644<br />

1-5 years 1,450 8,536<br />

Over 5 years 1,422 7,436<br />

Cash outflows<br />

Within 1 year (16,130) (16,610)<br />

1-5 years (53,150) (57,228)<br />

Over 5 years (46,662) (58,928)<br />

During <strong>2015</strong> losses of DKK 14.5 million (2014: DKK 13.9 million) relating to cash flow hedge were transferred from equity to profit and<br />

loss and are reflected in interest expense. At 31 December <strong>2015</strong> net losses of DKK 10.9 million (2014: net gains of DKK 30.1 million) relating<br />

to the cash flow hedges were recognised in other comprehensive income.<br />

33 Operational leasing<br />

<strong>2015</strong> 2014<br />

Future operating lease payments<br />

Within 1 year 45,355 48,024<br />

From 1-5 years 41,399 35,928<br />

More than 5 years - -<br />

Total 86,754 83,952<br />

The Group is the leesee in a number of operating leases, involving mainly leasing of office premises, car leasing, software leasing and<br />

other.<br />

Operating lease expenses recognised in the income statement in <strong>2015</strong> amounts to DKK 53.4 million (2014: DKK 62.4 million).<br />

SAXO BANK · ANNUAL REPORT <strong>2015</strong> · 83