saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – SAXO BANK GROUP<br />

Note (DKK 1,000) <strong>2015</strong> 2014<br />

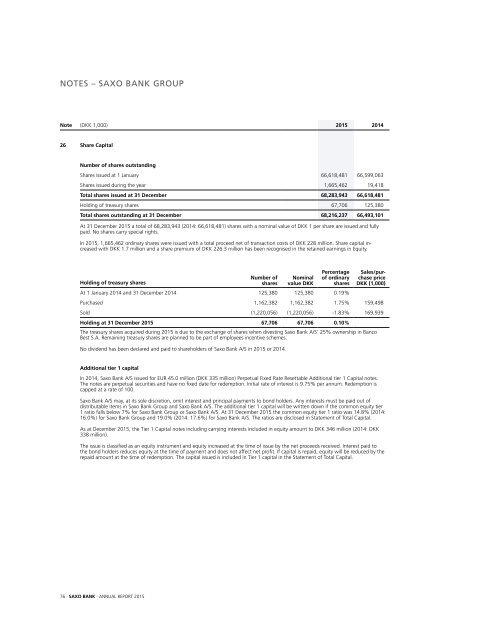

26 Share Capital<br />

Number of shares outstanding<br />

Shares issued at 1 January 66,618,481 66,599,063<br />

Shares issued during the year 1,665,462 19,418<br />

Total shares issued at 31 December 68,283,943 66,618,481<br />

Holding of treasury shares 67,706 125,380<br />

Total shares outstanding at 31 December 68,216,237 66,493,101<br />

At 31 December <strong>2015</strong> a total of 68,283,943 (2014: 66,618,481) shares with a nominal value of DKK 1 per share are issued and fully<br />

paid. No shares carry special rights.<br />

In <strong>2015</strong>, 1,665,462 ordinary shares were issued with a total proceed net of transaction costs of DKK 228 million. Share capital increased<br />

with DKK 1.7 million and a share premium of DKK 226.3 million has been recognised in the retained earnings in Equity.<br />

Number of<br />

shares<br />

Nominal<br />

value DKK<br />

Percentage<br />

of ordinary<br />

shares<br />

Sales/purchase<br />

price<br />

DKK (1,000)<br />

Holding of treasury shares<br />

At 1 January 2014 and 31 December 2014 125,380 125,380 0.19%<br />

Purchased 1,162,382 1,162,382 1.75% 159,498<br />

Sold (1,220,056) (1,220,056) -1.83% 169,939<br />

Holding at 31 December <strong>2015</strong> 67,706 67,706 0.10%<br />

The treasury shares acquired during <strong>2015</strong> is due to the exchange of shares when divesting Saxo Bank A/S’ 25% ownership in Banco<br />

Best S.A. Remaining treasury shares are planned to be part of employees incentive schemes.<br />

No dividend has been declared and paid to shareholders of Saxo Bank A/S in <strong>2015</strong> or 2014.<br />

Additional tier 1 capital<br />

In 2014, Saxo Bank A/S issued for EUR 45.0 million (DKK 335 million) Perpetual Fixed Rate Resettable Additional tier 1 Capital notes.<br />

The notes are perpetual securities and have no fixed date for redemption. Initial rate of interest is 9.75% per annum. Redemption is<br />

capped at a rate of 100.<br />

Saxo Bank A/S may, at its sole discretion, omit interest and principal payments to bond holders. Any interests must be paid out of<br />

distributable items in Saxo Bank Group and Saxo Bank A/S. The additional tier 1 capital will be written down if the common equity tier<br />

1 ratio falls below 7% for Saxo Bank Group or Saxo Bank A/S. At 31 December <strong>2015</strong> the common equity tier 1 ratio was 14.8% (2014:<br />

16.0%) for Saxo Bank Group and 19.0% (2014: 17.6%) for Saxo Bank A/S. The ratios are disclosed in Statement of Total Capital.<br />

As at December <strong>2015</strong>, the Tier 1 Capital notes including carrying interests included in equity amount to DKK 346 million (2014: DKK<br />

338 million).<br />

The issue is classified as an equity instrument and equity increased at the time of issue by the net proceeds received. Interest paid to<br />

the bond holders reduces equity at the time of payment and does not affect net profit. If capital is repaid, equity will be reduced by the<br />

repaid amount at the time of redemption. The capital issued is included in Tier 1 capital in the Statement of Total Capital.<br />

76 · SAXO BANK · ANNUAL REPORT <strong>2015</strong>