saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – SAXO BANK GROUP<br />

Note (DKK 1,000)<br />

11 Share-based payments<br />

The Group has warrant programmes in Saxo Bank A/S and Saxo Payment A/S.<br />

Warrants Saxo Bank A/S<br />

In <strong>2015</strong> 2,156,175 warrants with a right to subscribe for shares in Saxo Bank A/S were sold. The fair value of the warrants in <strong>2015</strong><br />

was estimated to DKK 11 million. The fair value was measured using the Black-Scholes option pricing model based on the assumptions<br />

at the grant date considering time to maturity, risk-free interest rate (0.27%), volatility (25%), share price (115/140) and exercise<br />

restrictions etc. The warrants will vest over a period of 5 years. The warrants are conditional on the performance of the Group. In case<br />

of leave of a holder the warrants of said holder may be repurchased. The warrants may be exercised during 1 February 2020 until 28<br />

February 2022. The warrants or a portion thereof that are not exercised by 28 February 2022 will be deemed forfeited without any<br />

further compensation. The fair value at grant date of these warrants after deduction of cash payment received from participants is expensed<br />

in the income statement over the vesting period from <strong>2015</strong> to 2019.<br />

In 2014 390.000 warrants were sold to a consulting firm with an owner who has become a member of the Board of Directors at the<br />

fair value of DKK 2.6 million at the grant date. The warrants may be exercised during 15 March <strong>2015</strong> until 31 March 2017. The warrants<br />

or a portion thereof that are not exercised by 31 March 2017 will be deemed forfeited without any further compensation. The<br />

warrants are not conditional on performance or presence of the holder.<br />

Warrants were granted in 2007 (2,156,644 warrants) and 2008 (2,849,840 warrants). The exercise price of the granted warrants is<br />

equal to the fair value on the date of granting. At the time of grant the fair value of the warrants granted in 2007 was estimated to<br />

DKK 13 million and the fair value of the warrants granted in 2008 was estimated to DKK 55 million. The fair value was measured using<br />

the Black-Scholes option pricing model based on the assumptions at the grant date considering time to maturity, risk-free interest rate<br />

(3%), volatility (20% in 2007 and 25% in 2008), and exercise restrictions etc. The warrants were conditional on the performance of the<br />

individual and of the Group and/or presence of the holders concerned. The fair value at grant date of these warrants was expensed in<br />

the income statement over the vesting period from 2007 to 2014.<br />

The conditions for the outstanding number of warrants granted in 2007 and 2008 with expiry in 2014 have been modified. The lockup<br />

period has been extended to 30 June 2018. The fair value of DKK 13 million of the modified warrants is calculated based on the<br />

assumptions at the date of modification considering time to maturity and risk-free interest rate (4%). The fair value was expensed and<br />

recognised as Staff costs and administrative expenses in 2014. There are no additional terms or conditions associated with the extended<br />

lock-up period.<br />

The warrants are accounted for as equity-settled transactions.<br />

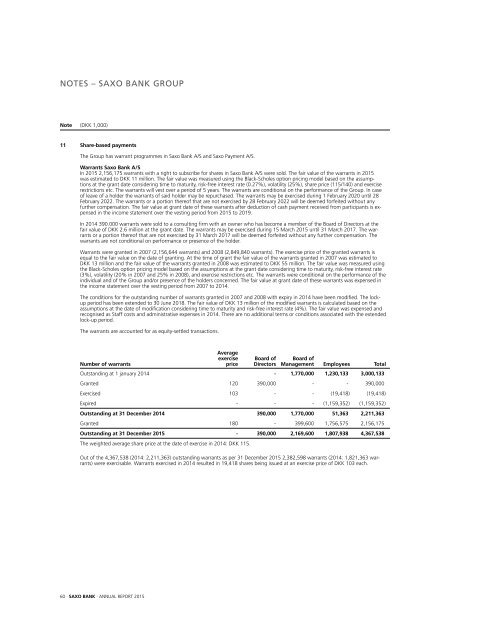

Number of warrants<br />

Average<br />

exercise<br />

price<br />

Board of<br />

Directors<br />

Board of<br />

Management Employees Total<br />

Outstanding at 1 january 2014 - 1,770,000 1,230,133 3,000,133<br />

Granted 120 390,000 - - 390,000<br />

Exercised 103 - - (19,418) (19,418)<br />

Expired - - - (1,159,352) (1,159,352)<br />

Outstanding at 31 December 2014 390,000 1,770,000 51,363 2,211,363<br />

Granted 180 - 399,600 1,756,575 2,156,175<br />

Outstanding at 31 December <strong>2015</strong> - 390,000 2,169,600 1,807,938 4,367,538<br />

The weighted average share price at the date of exercise in 2014: DKK 115.<br />

Out of the 4,367,538 (2014: 2,211,363) outstanding warrants as per 31 December <strong>2015</strong> 2,382,598 warrants (2014: 1,821,363 warrants)<br />

were exercisable. Warrants exercised in 2014 resulted in 19,418 shares being issued at an exercise price of DKK 103 each.<br />

60 · SAXO BANK · ANNUAL REPORT <strong>2015</strong>