saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

saxo-bank-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – SAXO BANK GROUP<br />

Note (DKK 1,000)<br />

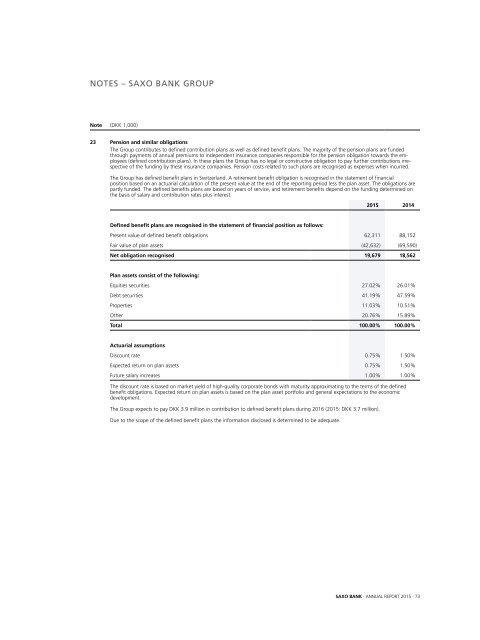

23 Pension and similar obligations<br />

The Group contributes to defined contribution plans as well as defined benefit plans. The majority of the pension plans are funded<br />

through payments of <strong>annual</strong> premiums to independent insurance companies responsible for the pension obligation towards the employees<br />

(defined contribution plans). In these plans the Group has no legal or constructive obligation to pay further contributions irrespective<br />

of the funding by these insurance companies. Pension costs related to such plans are recognised as expenses when incurred.<br />

The Group has defined benefit plans in Switzerland. A retirement benefit obligation is recognised in the statement of financial<br />

position based on an actuarial calculation of the present value at the end of the <strong>report</strong>ing period less the plan asset. The obligations are<br />

partly funded. The defined benefits plans are based on years of service, and retirement benefits depend on the funding determined on<br />

the basis of salary and contribution rates plus interest.<br />

<strong>2015</strong> 2014<br />

Defined benefit plans are recognised in the statement of financial position as follows:<br />

Present value of defined benefit obligations 62,311 88,152<br />

Fair value of plan assets (42,632) (69,590)<br />

Net obligation recognised 19,679 18,562<br />

Plan assets consist of the following:<br />

Equities securities 27.02% 26.01%<br />

Debt securities 41.19% 47.59%<br />

Properties 11.03% 10.51%<br />

Other 20.76% 15.89%<br />

Total 100.00% 100.00%<br />

Actuarial assumptions<br />

Discount rate 0.75% 1.50%<br />

Expected return on plan assets 0.75% 1.50%<br />

Future salary increases 1.00% 1.00%<br />

The discount rate is based on market yield of high-quality corporate bonds with maturity approximating to the terms of the defined<br />

benefit obligations. Expected return on plan assets is based on the plan asset portfolio and general expectations to the economic<br />

development.<br />

The Group expects to pay DKK 3.9 million in contribution to defined benefit plans during 2016 (<strong>2015</strong>: DKK 3.7 million).<br />

Due to the scope of the defined benefit plans the information disclosed is determined to be adequate.<br />

SAXO BANK · ANNUAL REPORT <strong>2015</strong> · 73