You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>May</strong> <strong>2016</strong> Local Town Pages www.millismedwaynews.com Page 17<br />

What could the revenue difference be?<br />

To illustrate this, let us use the value originally proposed by Exelon’s consultant at $160 million dollars in year one. The value negotiated and agreed to in the<br />

PILOT is $210 million dollars, a figure very close to the Town’s consultant’s appraisal. If the lower figure were to be accepted by the ATB, AND all other formula<br />

assumptions in the PILOT remained in place (not likely), this specific revenue loss to <strong>Medway</strong> (versus the PILOT revenue) could reach $18 million dollars over the<br />

same 20 year period.<br />

Would a “No” vote on the PILOT Agreement warrant article have any impact on whether or not the Exelon Expansion Proposal is approved or not approved<br />

by the Energy Facilities Siting Board?<br />

No. The Energy Facilities Siting Board (EFSB) has sole authority to approve or deny the proposed Exelon Expansion Proposal. Town Meeting does not have any<br />

authority over approval of the Proposal nor can it legally impact that decision. In fact, the EFSB has concluded its hearing phase of the permitting process and<br />

would clearly be prohibited from even considering any action on the warrant in its decision making. This warrant article is not a legal referendum on the construction<br />

of the facility. It is strictly a taxing mechanism. Voting down this PILOT agreement does not stop or affect the licensing or construction of this power<br />

plant project, but instead will only penalize the Town if the facility is approved.<br />

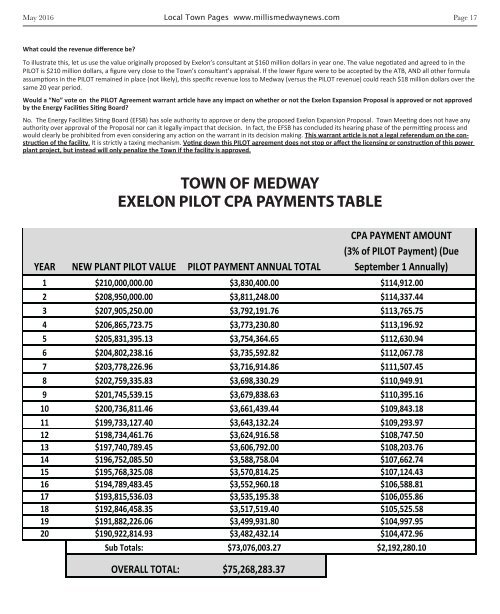

TOWN OF MEDWAY<br />

EXELON PILOT CPA PAYMENTS TABLE<br />

TOWN OF MEDWAY<br />

EXELON PILOT CPA PAYMENTS TABLE<br />

NEGOTIATED PILOT CPA PAYMENT AMOUNT<br />

YEAR NEW PLANT PILOT VALUE PILOT PAYMENT ANNUAL TOTAL<br />

(3% of PILOT Payment) (Due<br />

September 1 Annually)<br />

1 $210,000,000.00 $3,830,400.00 $114,912.00<br />

2 $208,950,000.00 $3,811,248.00 $114,337.44<br />

3 $207,905,250.00 $3,792,191.76 $113,765.75<br />

4 $206,865,723.75 $3,773,230.80 $113,196.92<br />

5 $205,831,395.13 $3,754,364.65 $112,630.94<br />

6 $204,802,238.16 $3,735,592.82 $112,067.78<br />

7 $203,778,226.96 $3,716,914.86 $111,507.45<br />

8 $202,759,335.83 $3,698,330.29 $110,949.91<br />

9 $201,745,539.15 $3,679,838.63 $110,395.16<br />

10 $200,736,811.46 $3,661,439.44 $109,843.18<br />

11 $199,733,127.40 $3,643,132.24 $109,293.97<br />

12 $198,734,461.76 $3,624,916.58 $108,747.50<br />

13 $197,740,789.45 $3,606,792.00 $108,203.76<br />

14 $196,752,085.50 $3,588,758.04 $107,662.74<br />

15 $195,768,325.08 $3,570,814.25 $107,124.43<br />

16 $194,789,483.45 $3,552,960.18 $106,588.81<br />

17 $193,815,536.03 $3,535,195.38 $106,055.86<br />

18 $192,846,458.35 $3,517,519.40 $105,525.58<br />

19 $191,882,226.06 $3,499,931.80 $104,997.95<br />

20 $190,922,814.93 $3,482,432.14 $104,472.96<br />

Sub Totals: $73,076,003.27 $2,192,280.10<br />

OVERALL TOTAL: $75,268,283.37