in India

28R8uoc

28R8uoc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>tech <strong>in</strong> <strong>India</strong> - A global growth story<br />

58<br />

Israel<br />

Israel uses <strong>in</strong>digenous technology skills and a strong<br />

network of foreign <strong>in</strong>vestors, provid<strong>in</strong>g favourable<br />

environment to foster f<strong>in</strong>tech <strong>in</strong>novations.<br />

Israel has emerged as a strong f<strong>in</strong>tech ecosystem, with<br />

more than 500 active f<strong>in</strong>tech start-ups registered <strong>in</strong> 2015.<br />

This is primarily driven by their legacy of <strong>in</strong>novation and<br />

technology. This has been coupled with strong overseas<br />

<strong>in</strong>vestor <strong>in</strong>terest, presence of more than fourteen global<br />

<strong>in</strong>novation centres, three global f<strong>in</strong>tech hubs, an organized<br />

f<strong>in</strong>ancial sector and steady policy support. Tel Aviv has<br />

launched multiple <strong>in</strong>ternational events to provide a global<br />

platform to Israeli start-ups, which are presided by celebrity<br />

Israeli serial entrepreneurs to keep engag<strong>in</strong>g the right<br />

audience <strong>in</strong> the world forum.<br />

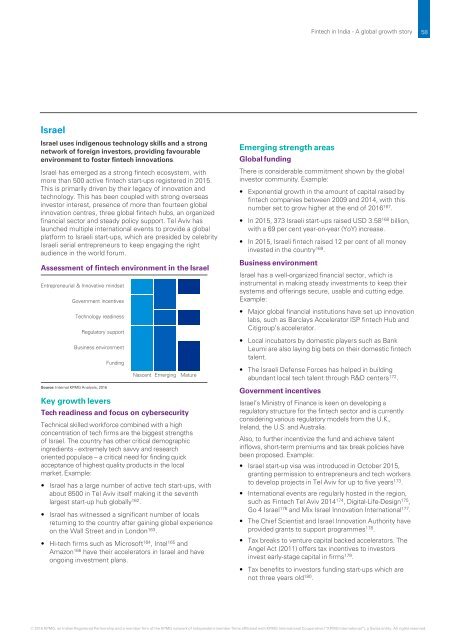

Assessment of f<strong>in</strong>tech environment <strong>in</strong> the Israel<br />

Entrepreneurial & Innovative m<strong>in</strong>dset<br />

Government <strong>in</strong>centives<br />

Technology read<strong>in</strong>ess<br />

Regulatory support<br />

Bus<strong>in</strong>ess environment<br />

Source: Internal KPMG Analysis, 2016<br />

Key growth levers<br />

Fund<strong>in</strong>g<br />

Nascent Emerg<strong>in</strong>g Mature<br />

Tech read<strong>in</strong>ess and focus on cybersecurity<br />

Technical skilled workforce comb<strong>in</strong>ed with a high<br />

concentration of tech firms are the biggest strengths<br />

of Israel. The country has other critical demographic<br />

<strong>in</strong>gredients - extremely tech savvy and research<br />

oriented populace – a critical need for f<strong>in</strong>d<strong>in</strong>g quick<br />

acceptance of highest quality products <strong>in</strong> the local<br />

market. Example:<br />

• Israel has a large number of active tech start-ups, with<br />

about 8500 <strong>in</strong> Tel Aviv itself mak<strong>in</strong>g it the seventh<br />

largest start-up hub globally 162 .<br />

• Israel has witnessed a significant number of locals<br />

return<strong>in</strong>g to the country after ga<strong>in</strong><strong>in</strong>g global experience<br />

on the Wall Street and <strong>in</strong> London 163 .<br />

• Hi-tech firms such as Microsoft 164 , Intel 165 and<br />

Amazon 166 have their accelerators <strong>in</strong> Israel and have<br />

ongo<strong>in</strong>g <strong>in</strong>vestment plans.<br />

Emerg<strong>in</strong>g strength areas<br />

Global fund<strong>in</strong>g<br />

There is considerable commitment shown by the global<br />

<strong>in</strong>vestor community. Example:<br />

• Exponential growth <strong>in</strong> the amount of capital raised by<br />

f<strong>in</strong>tech companies between 2009 and 2014, with this<br />

number set to grow higher at the end of 2016 167 .<br />

• In 2015, 373 Israeli start-ups raised USD 3.58 168 billion,<br />

with a 69 per cent year-on-year (YoY) <strong>in</strong>crease.<br />

• In 2015, Israeli f<strong>in</strong>tech raised 12 per cent of all money<br />

<strong>in</strong>vested <strong>in</strong> the country 169 .<br />

Bus<strong>in</strong>ess environment<br />

Israel has a well-organized f<strong>in</strong>ancial sector, which is<br />

<strong>in</strong>strumental <strong>in</strong> mak<strong>in</strong>g steady <strong>in</strong>vestments to keep their<br />

systems and offer<strong>in</strong>gs secure, usable and cutt<strong>in</strong>g edge.<br />

Example:<br />

• Major global f<strong>in</strong>ancial <strong>in</strong>stitutions have set up <strong>in</strong>novation<br />

labs, such as Barclays Accelerator ISP f<strong>in</strong>tech Hub and<br />

Citigroup’s accelerator.<br />

• Local <strong>in</strong>cubators by domestic players such as Bank<br />

Leumi are also lay<strong>in</strong>g big bets on their domestic f<strong>in</strong>tech<br />

talent.<br />

• The Israeli Defense Forces has helped <strong>in</strong> build<strong>in</strong>g<br />

abundant local tech talent through R&D centers 172 .<br />

Government <strong>in</strong>centives<br />

Israel’s M<strong>in</strong>istry of F<strong>in</strong>ance is keen on develop<strong>in</strong>g a<br />

regulatory structure for the f<strong>in</strong>tech sector and is currently<br />

consider<strong>in</strong>g various regulatory models from the U.K.,<br />

Ireland, the U.S. and Australia.<br />

Also, to further <strong>in</strong>centivize the fund and achieve talent<br />

<strong>in</strong>flows, short-term premiums and tax break policies have<br />

been proposed. Example:<br />

• Israel start-up visa was <strong>in</strong>troduced <strong>in</strong> October 2015,<br />

grant<strong>in</strong>g permission to entrepreneurs and tech workers<br />

to develop projects <strong>in</strong> Tel Aviv for up to five years 173 .<br />

• International events are regularly hosted <strong>in</strong> the region,<br />

such as F<strong>in</strong>tech Tel Aviv 2014 174 , Digital-Life-Design 175 ,<br />

Go 4 Israel 176 and Mix Israel Innovation International 177 .<br />

• The Chief Scientist and Israel Innovation Authority have<br />

provided grants to support programmes 178 .<br />

• Tax breaks to venture capital backed accelerators. The<br />

Angel Act (2011) offers tax <strong>in</strong>centives to <strong>in</strong>vestors<br />

<strong>in</strong>vest early-stage capital <strong>in</strong> firms 179 .<br />

• Tax benefits to <strong>in</strong>vestors fund<strong>in</strong>g start-ups which are<br />

not three years old 180 .<br />

© 2016 KPMG, an <strong>India</strong>n Registered Partnership and a member firm of the KPMG network of <strong>in</strong>dependent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.