G7_JAPAN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Energy security<br />

$130BN<br />

20% Fall in investment in oil exploration<br />

and production between 2014 and 2015<br />

SAMUEL KUBANI/AFP/GETTY IMAGES<br />

level that will see all the necessary future<br />

investments take place? Clearly they are not.<br />

At current price levels, not all the necessary<br />

future investment is viable. Moreover, new<br />

barrels are needed not only to increase<br />

production, but also to accommodate for<br />

declining rates from existing fields.<br />

Restoring the balance<br />

If the necessary new capacity does not come<br />

online in the coming years, the market<br />

could move from one of too much supply<br />

to one of not enough. The previous high<br />

oil-price cycle was the outcome of a lack of<br />

investment in more supply. And today’s low<br />

oil-price environment is the result of too<br />

much investment in high-cost production<br />

during that period.<br />

It is essential to return balance to the<br />

market, and provide the stability and<br />

market conditions that allow for future<br />

investments. This is something that OPEC<br />

is continually striving for.<br />

The market is already showing signs<br />

that supply and demand fundamentals will<br />

start to correct themselves in 2016. But the<br />

issue of expanding inventories remains a<br />

significant concern. Since the end of 2015,<br />

the five-year average for commercial stocks<br />

among members of the Organisation for<br />

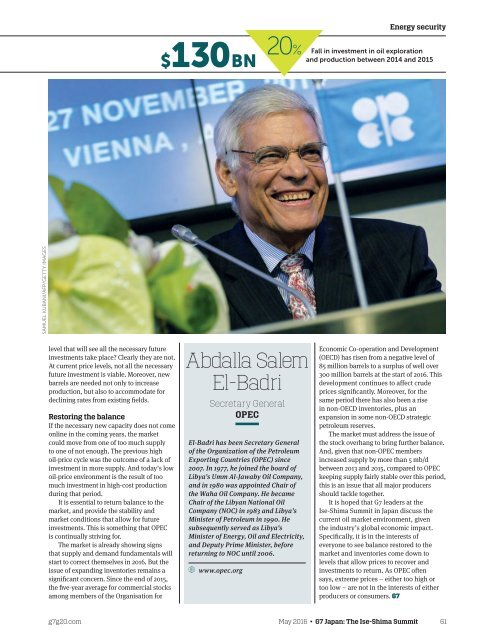

Abdalla Salem<br />

El-Badri<br />

Secretary General<br />

OPEC<br />

El-Badri has been Secretary General<br />

of the Organization of the Petroleum<br />

Exporting Countries (OPEC) since<br />

2007. In 1977, he joined the board of<br />

Libya’s Umm Al-Jawaby Oil Company,<br />

and in 1980 was appointed Chair of<br />

the Waha Oil Company. He became<br />

Chair of the Libyan National Oil<br />

Company (NOC) in 1983 and Libya’s<br />

Minister of Petroleum in 1990. He<br />

subsequently served as Libya’s<br />

Minister of Energy, Oil and Electricity,<br />

and Deputy Prime Minister, before<br />

returning to NOC until 2006.<br />

www.opec.org<br />

Economic Co-operation and Development<br />

(OECD) has risen from a negative level of<br />

85 million barrels to a surplus of well over<br />

300 million barrels at the start of 2016. This<br />

development continues to affect crude<br />

prices significantly. Moreover, for the<br />

same period there has also been a rise<br />

in non-OECD inventories, plus an<br />

expansion in some non-OECD strategic<br />

petroleum reserves.<br />

The market must address the issue of<br />

the stock overhang to bring further balance.<br />

And, given that non-OPEC members<br />

increased supply by more than 5 mb/d<br />

between 2013 and 2015, compared to OPEC<br />

keeping supply fairly stable over this period,<br />

this is an issue that all major producers<br />

should tackle together.<br />

It is hoped that <strong>G7</strong> leaders at the<br />

Ise-Shima Summit in Japan discuss the<br />

current oil market environment, given<br />

the industry’s global economic impact.<br />

Specifically, it is in the interests of<br />

everyone to see balance restored to the<br />

market and inventories come down to<br />

levels that allow prices to recover and<br />

investments to return. As OPEC often<br />

says, extreme prices – either too high or<br />

too low – are not in the interests of either<br />

producers or consumers. <strong>G7</strong><br />

g7g20.com May 2016 • <strong>G7</strong> Japan: The Ise-Shima Summit 61