You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

John Simpson Top 100|23<br />

been sharply reduced.<br />

In the overall assessment<br />

of the contribution of the<br />

construction sector, the official<br />

Stormont index shows that<br />

construction output fell by 49%<br />

from mid-2007 to late 2013.<br />

From late 2013, construction<br />

activity has recovered, from the<br />

very low point, by 19%. It is still<br />

38% below the peak in 2007.<br />

The construction sector is,<br />

therefore, in survival and<br />

revival mode. There have<br />

been conspicuous casualties<br />

and now there are new<br />

leaders emerging in a search<br />

for expanding and profitable<br />

market opportunities. Several<br />

large firms acknowledge<br />

that, whilst headquartered in<br />

Northern Ireland, contracts<br />

have been secured in Great<br />

Britain or in the Irish Republic.<br />

There are welcome signs of<br />

a strengthening and viable<br />

construction sector evidenced<br />

in the latest publication by the<br />

Belfast Telegraph of the Top<br />

100, identifying the leading<br />

local businesses, assessing them<br />

initially on the recent record of<br />

profitable trading.<br />

In the Top 100, there are eight<br />

construction companies that<br />

qualify for inclusion since their<br />

latest registered pre-tax profits<br />

are over £2.2m. They are listed<br />

in Table 1.<br />

Since this group of eight were<br />

identified in the Top 100, later<br />

registered results for McAleer<br />

and Rushe have been lodged<br />

and, retrospectively, it should<br />

be added with pre-tax profits<br />

of £5,060,000. Also, the results<br />

for Carnbane House should be<br />

updated for the 2014 results<br />

which show lower pre-tax<br />

profits of £4,463,000.<br />

There is another group whose<br />

recent profits have exceeded<br />

£1m including Heron Brothers,<br />

Management and<br />

Construction,<br />

John<br />

McQuillan,<br />

Termon<br />

Holdings,<br />

Henry<br />

Group, and<br />

Acheson<br />

Holdings (the<br />

successor to<br />

Acheson and<br />

Glover).<br />

The changing<br />

fortunes<br />

in the<br />

construction sector mean that<br />

the sector has lost Carvill, H&J<br />

Martin (now taken-over by<br />

Lagan) and Pattons, three big<br />

casualties of the recession<br />

In addition to the group which<br />

are essentially main contractors,<br />

there is another group of<br />

leading businesses which are,<br />

in different ways, in the supply<br />

chain. Table 2 lists 11 profit<br />

making companies which<br />

depend on construction and<br />

civil engineering.<br />

Closely following the supply<br />

companies in Table 2 can be<br />

added businesses such as<br />

Keystone Holdings, McAvoy<br />

Group, Stothers (M&E), and<br />

Walker Watson whose latest<br />

results show pre-tax profits of<br />

over £1m.<br />

Because of<br />

the differing<br />

organisational<br />

arrangements<br />

for many<br />

businesses<br />

in the<br />

construction<br />

sector ranging<br />

from some<br />

who rely<br />

heavily on subcontracting<br />

arrangements<br />

to others<br />

where nearly<br />

all work is<br />

conducted<br />

in-house, the<br />

businesses<br />

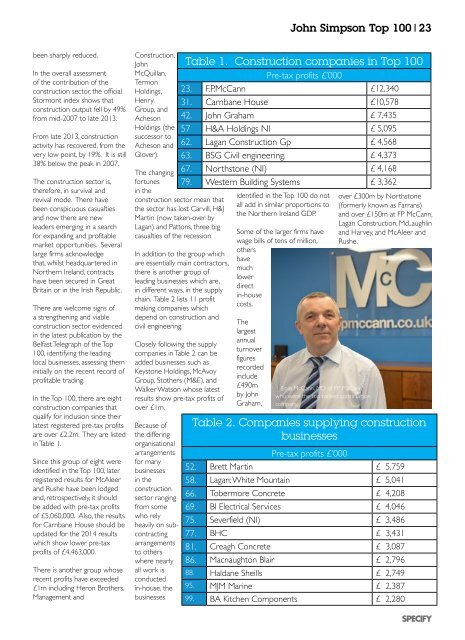

Table 1. Construction companies in Top 100<br />

Pre-tax profits £’000<br />

23. F.P.McCann £12,340<br />

31. Carnbane House £10,578<br />

42. John Graham £ 7,435<br />

57 H&A Holdings NI £ 5,095<br />

62. Lagan Construction Gp £ 4,568<br />

63. BSG Civil engineering. £ 4,373<br />

67. Northstone (NI) £ 4,168<br />

79. Western Building Systems £ 3,362<br />

identified in the Top 100 do not<br />

all add in similar proportions to<br />

the Northern Ireland GDP.<br />

Some of the larger firms have<br />

wage bills of tens of million,<br />

others<br />

have<br />

much<br />

lower<br />

direct<br />

in-house<br />

costs.<br />

The<br />

largest<br />

annual<br />

turnover<br />

figures<br />

recorded<br />

include<br />

£490m<br />

by John<br />

Graham,<br />

Eoin McCann, MD of FP McCann<br />

who were the top ranked construction<br />

company.<br />

over £300m by Northstone<br />

(formerly known as Farrans)<br />

and over £150m at FP McCann,<br />

Lagan Construction, McLaughlin<br />

and Harvey, and McAleer and<br />

Rushe.<br />

Table 2. Companies supplying construction<br />

businesses<br />

Pre-tax profits £’000<br />

52. Brett Martin £ 5,759<br />

58. Lagan: White Mountain £ 5,041<br />

66. Tobermore Concrete £ 4,208<br />

69. BI Electrical Services £ 4,046<br />

75. Severfield (NI) £ 3,486<br />

77. BHC £ 3,431<br />

81. Creagh Concrete £ 3,087<br />

86. Macnaughton Blair £ 2,796<br />

88. Haldane Sheills £ 2,749<br />

95. MJM Marine £ 2,387<br />

99. BA Kitchen Components £ 2,280