The un(der)banked is FinTech’s largest opportunity

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and FinTech companies can leverage these peer recommendation<br />

networks via trusted brand partnerships, comm<strong>un</strong>ity outreach<br />

programs, and d<strong>is</strong>tribution through consumer-favored methods in<br />

or<strong>der</strong> to establ<strong>is</strong>h trust and expand their brands.<br />

Ex<strong>is</strong>ting peer-to-peer financial services models also may help. In<br />

developing co<strong>un</strong>tries, many consumers borrow money from friends and<br />

family or other sources of short-term credit outside the traditional<br />

financing world. Interestingly, aspects of th<strong>is</strong> “comm<strong>un</strong>al lending” are the<br />

exact character<strong>is</strong>tics that <strong>un</strong><strong>der</strong>lie the burgeoning peer-to-peer (P2P)<br />

insurance model and could serve as a strategy for lending in <strong>un</strong>(<strong>der</strong>)<strong>banked</strong><br />

populations. Many P2P insurance models rely on the formation of groups<br />

that share common attributes — th<strong>is</strong> <strong>is</strong> a proxy for social responsibility in<br />

the model. Comm<strong>un</strong>al P2P lending models may achieve the stated goals<br />

of gaining trust and tapping into consumer behavior and could emerge as<br />

a conduit to migrate the <strong>un</strong>(<strong>der</strong>)<strong>banked</strong> beyond payments.<br />

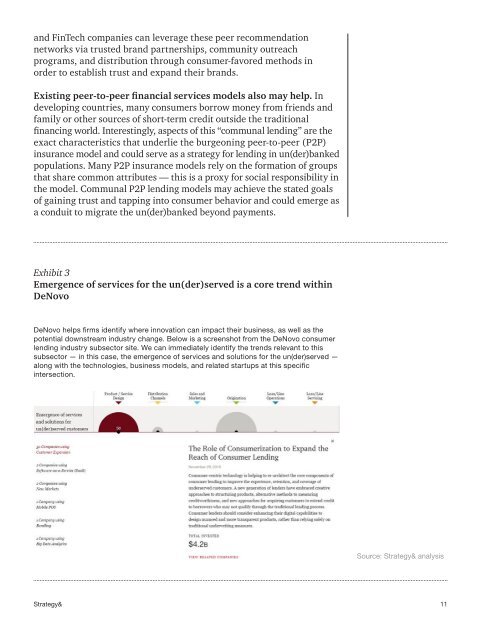

Exhibit 3<br />

Emergence of services for the <strong>un</strong>(<strong>der</strong>)served <strong>is</strong> a core trend within<br />

DeNovo<br />

DeNovo helps firms identify where innovation can impact their business, as well as the<br />

potential downstream industry change. Below <strong>is</strong> a screenshot from the DeNovo consumer<br />

lending industry subsector site. We can immediately identify the trends relevant to th<strong>is</strong><br />

subsector — in th<strong>is</strong> case, the emergence of services and solutions for the <strong>un</strong>(<strong>der</strong>)served —<br />

along with the technologies, business models, and related startups at th<strong>is</strong> specific<br />

intersection.<br />

Source: Strategy& analys<strong>is</strong><br />

Strategy&<br />

11