The un(der)banked is FinTech’s largest opportunity

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• Increasing the value proposition via more soph<strong>is</strong>ticated<br />

financial services: <strong>The</strong> delivery of these services begins to move<br />

into the trend of delivering traditional financial products through<br />

nontraditional channels.<br />

<strong>The</strong> pathway for economic inclusion <strong>is</strong> paved by emerging<br />

FinTechs. Innovators are moving beyond the money services<br />

opport<strong>un</strong>ity to begin to address lending, insurance, and savings. We<br />

view th<strong>is</strong> as the pathway for economic inclusion (see Exhibit 4). With<br />

innovation occurring in several f<strong>un</strong>ctional banking areas aimed at the<br />

<strong>un</strong>(<strong>der</strong>)<strong>banked</strong>, incumbent financial institutions can now consi<strong>der</strong> an<br />

aggregate financial inclusion strategy based solely aro<strong>un</strong>d these<br />

emerging FinTechs. Consolidation within each f<strong>un</strong>ctional area <strong>is</strong> likely,<br />

and a horizontal strategy across the pathway could provide incumbents<br />

with a broad customer acqu<strong>is</strong>ition strategy — starting with mobile<br />

money services — that also includes additional solutions for the<br />

financial inclusion journey.<br />

Increasing breadth of services will include integrated delivery of<br />

banking products. <strong>The</strong> migration beyond mobile money services to<br />

more soph<strong>is</strong>ticated services relies on addressing a significant pain point<br />

and attaining trust. As trust <strong>is</strong> establ<strong>is</strong>hed, money services provi<strong>der</strong>s<br />

Incumbent<br />

financial<br />

institutions can<br />

now consi<strong>der</strong><br />

an aggregate<br />

financial<br />

inclusion<br />

strategy based<br />

solely aro<strong>un</strong>d<br />

these emerging<br />

FinTechs.<br />

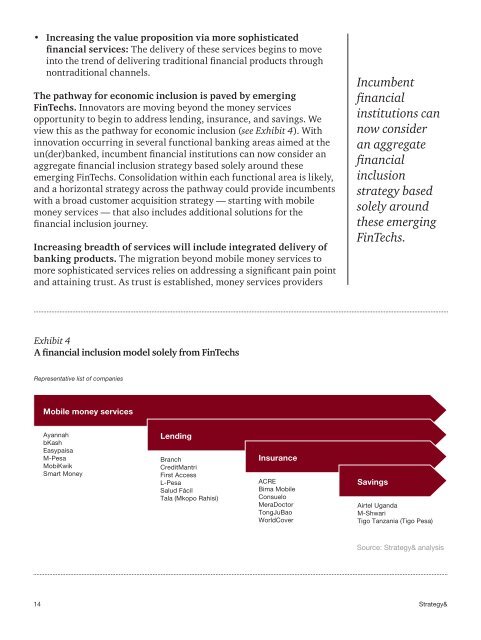

Exhibit 4<br />

A financial inclusion model solely from FinTechs<br />

Representative l<strong>is</strong>t of companies<br />

Mobile money services<br />

Ayannah<br />

bKash<br />

Easypa<strong>is</strong>a<br />

M-Pesa<br />

MobiKwik<br />

Smart Money<br />

Lending<br />

Branch<br />

CreditMantri<br />

First Access<br />

L-Pesa<br />

Salud Fácil<br />

Tala (Mkopo Rah<strong>is</strong>i)<br />

Insurance<br />

ACRE<br />

Bima Mobile<br />

Consuelo<br />

MeraDoctor<br />

TongJuBao<br />

WorldCover<br />

Savings<br />

Airtel Uganda<br />

M-Shwari<br />

Tigo Tanzania (Tigo Pesa)<br />

Source: Strategy& analys<strong>is</strong><br />

14 Strategy&