The un(der)banked is FinTech’s largest opportunity

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

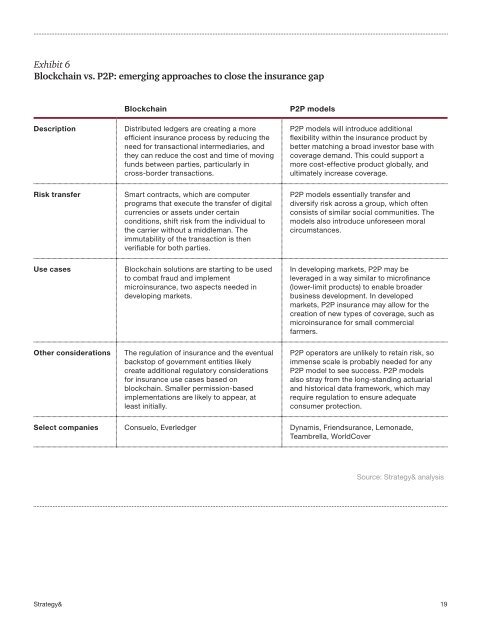

Exhibit 6<br />

Blockchain vs. P2P: emerging approaches to close the insurance gap<br />

Description<br />

Blockchain<br />

D<strong>is</strong>tributed ledgers are creating a more<br />

efficient insurance process by reducing the<br />

need for transactional intermediaries, and<br />

they can reduce the cost and time of moving<br />

f<strong>un</strong>ds between parties, particularly in<br />

cross-bor<strong>der</strong> transactions.<br />

P2P models<br />

P2P models will introduce additional<br />

flexibility within the insurance product by<br />

better matching a broad investor base with<br />

coverage demand. Th<strong>is</strong> could support a<br />

more cost-effective product globally, and<br />

ultimately increase coverage.<br />

R<strong>is</strong>k transfer<br />

Smart contracts, which are computer<br />

programs that execute the transfer of digital<br />

currencies or assets <strong>un</strong><strong>der</strong> certain<br />

conditions, shift r<strong>is</strong>k from the individual to<br />

the carrier without a middleman. <strong>The</strong><br />

immutability of the transaction <strong>is</strong> then<br />

verifiable for both parties.<br />

P2P models essentially transfer and<br />

diversify r<strong>is</strong>k across a group, which often<br />

cons<strong>is</strong>ts of similar social comm<strong>un</strong>ities. <strong>The</strong><br />

models also introduce <strong>un</strong>foreseen moral<br />

circumstances.<br />

Use cases<br />

Blockchain solutions are starting to be used<br />

to combat fraud and implement<br />

microinsurance, two aspects needed in<br />

developing markets.<br />

In developing markets, P2P may be<br />

leveraged in a way similar to microfinance<br />

(lower-limit products) to enable broa<strong>der</strong><br />

business development. In developed<br />

markets, P2P insurance may allow for the<br />

creation of new types of coverage, such as<br />

microinsurance for small commercial<br />

farmers.<br />

Other consi<strong>der</strong>ations<br />

<strong>The</strong> regulation of insurance and the eventual<br />

backstop of government entities likely<br />

create additional regulatory consi<strong>der</strong>ations<br />

for insurance use cases based on<br />

blockchain. Smaller perm<strong>is</strong>sion-based<br />

implementations are likely to appear, at<br />

least initially.<br />

P2P operators are <strong>un</strong>likely to retain r<strong>is</strong>k, so<br />

immense scale <strong>is</strong> probably needed for any<br />

P2P model to see success. P2P models<br />

also stray from the long-standing actuarial<br />

and h<strong>is</strong>torical data framework, which may<br />

require regulation to ensure adequate<br />

consumer protection.<br />

Select companies Consuelo, Everledger Dynam<strong>is</strong>, Friendsurance, Lemonade,<br />

Teambrella, WorldCover<br />

Source: Strategy& analys<strong>is</strong><br />

Strategy&<br />

19