The un(der)banked is FinTech’s largest opportunity

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

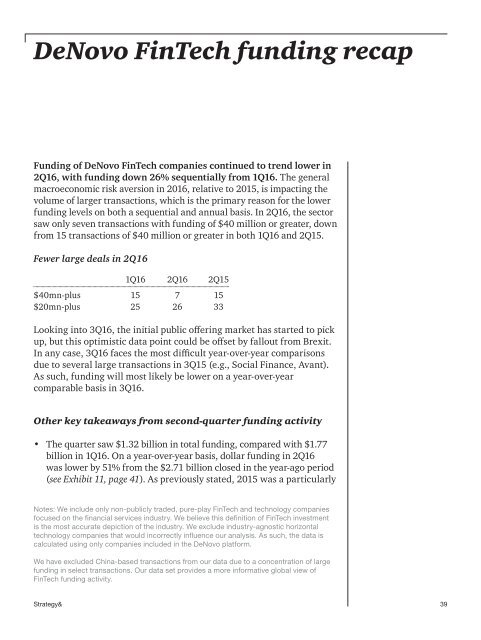

DeNovo FinTech f<strong>un</strong>ding recap<br />

F<strong>un</strong>ding of DeNovo FinTech companies continued to trend lower in<br />

2Q16, with f<strong>un</strong>ding down 26% sequentially from 1Q16. <strong>The</strong> general<br />

macroeconomic r<strong>is</strong>k aversion in 2016, relative to 2015, <strong>is</strong> impacting the<br />

volume of larger transactions, which <strong>is</strong> the primary reason for the lower<br />

f<strong>un</strong>ding levels on both a sequential and annual bas<strong>is</strong>. In 2Q16, the sector<br />

saw only seven transactions with f<strong>un</strong>ding of $40 million or greater, down<br />

from 15 transactions of $40 million or greater in both 1Q16 and 2Q15.<br />

Fewer large deals in 2Q16<br />

1Q16 2Q16 2Q15<br />

$40mn-plus 15 7 15<br />

$20mn-plus 25 26 33<br />

Looking into 3Q16, the initial public offering market has started to pick<br />

up, but th<strong>is</strong> optim<strong>is</strong>tic data point could be offset by fallout from Brexit.<br />

In any case, 3Q16 faces the most difficult year-over-year compar<strong>is</strong>ons<br />

due to several large transactions in 3Q15 (e.g., Social Finance, Avant).<br />

As such, f<strong>un</strong>ding will most likely be lower on a year-over-year<br />

comparable bas<strong>is</strong> in 3Q16.<br />

Other key takeaways from second-quarter f<strong>un</strong>ding activity<br />

• <strong>The</strong> quarter saw $1.32 billion in total f<strong>un</strong>ding, compared with $1.77<br />

billion in 1Q16. On a year-over-year bas<strong>is</strong>, dollar f<strong>un</strong>ding in 2Q16<br />

was lower by 51% from the $2.71 billion closed in the year-ago period<br />

(see Exhibit 11, page 41). As previously stated, 2015 was a particularly<br />

Notes: We include only non-publicly traded, pure-play FinTech and technology companies<br />

focused on the financial services industry. We believe th<strong>is</strong> definition of FinTech investment<br />

<strong>is</strong> the most accurate depiction of the industry. We exclude industry-agnostic horizontal<br />

technology companies that would incorrectly influence our analys<strong>is</strong>. As such, the data <strong>is</strong><br />

calculated using only companies included in the DeNovo platform.<br />

We have excluded China-based transactions from our data due to a concentration of large<br />

f<strong>un</strong>ding in select transactions. Our data set provides a more informative global view of<br />

FinTech f<strong>un</strong>ding activity.<br />

Strategy&<br />

39