Poland

RE_Guide_2016_final

RE_Guide_2016_final

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Accounting aspects of<br />

investing in the Real Estate<br />

market<br />

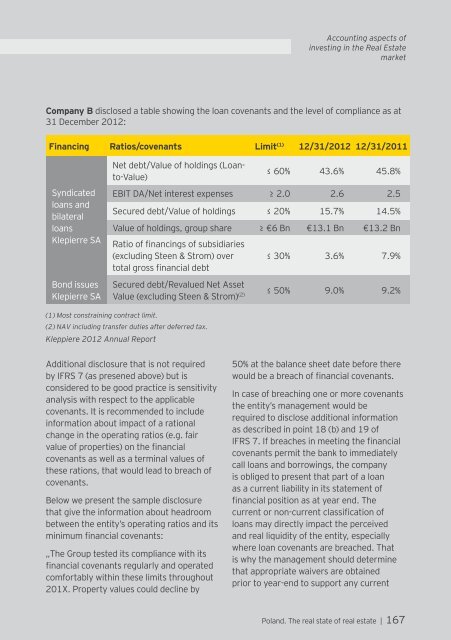

Company B disclosed a table showing the loan covenants and the level of compliance as at<br />

31 December 2012:<br />

Financing Ratios/covenants Limit (1) 12/31/2012 12/31/2011<br />

Syndicated<br />

loans and<br />

bilateral<br />

loans<br />

Klepierre SA<br />

Bond issues<br />

Klepierre SA<br />

Net debt/Value of holdings (Loanto-Value)<br />

≤ 60% 43.6% 45.8%<br />

EBIT DA/Net interest expenses ≥ 2.0 2.6 2.5<br />

Secured debt/Value of holdings ≤ 20% 15.7% 14.5%<br />

Value of holdings, group share ≥ €6 Bn €13.1 Bn €13.2 Bn<br />

Ratio of financings of subsidiaries<br />

(excluding Steen & Strom) over<br />

total gross financial debt<br />

Secured debt/Revalued Net Asset<br />

Value (excluding Steen & Strom) (2)<br />

≤ 30% 3.6% 7.9%<br />

≤ 50% 9.0% 9.2%<br />

(1) Most constraining contract limit.<br />

(2) NAV including transfer duties after deferred tax.<br />

Kleppiere 2012 Annual Report<br />

Additional disclosure that is not required<br />

by IFRS 7 (as presened above) but is<br />

considered to be good practice is sensitivity<br />

analysis with respect to the applicable<br />

covenants. It is recommended to include<br />

information about impact of a rational<br />

change in the operating ratios (e.g. fair<br />

value of properties) on the financial<br />

covenants as well as a terminal values of<br />

these rations, that would lead to breach of<br />

covenants.<br />

Below we present the sample disclosure<br />

that give the information about headroom<br />

between the entity’s operating ratios and its<br />

minimum financial covenants:<br />

„The Group tested its compliance with its<br />

financial covenants regularly and operated<br />

comfortably within these limits throughout<br />

201X. Property values could decline by<br />

50% at the balance sheet date before there<br />

would be a breach of financial covenants.<br />

In case of breaching one or more covenants<br />

the entity’s management would be<br />

required to disclose additional information<br />

as described in point 18 (b) and 19 of<br />

IFRS 7. If breaches in meeting the financial<br />

covenants permit the bank to immediately<br />

call loans and borrowings, the company<br />

is obliged to present that part of a loan<br />

as a current liability in its statement of<br />

financial position as at year end. The<br />

current or non-current classification of<br />

loans may directly impact the perceived<br />

and real liquidity of the entity, especially<br />

where loan covenants are breached. That<br />

is why the management should determine<br />

that appropriate waivers are obtained<br />

prior to year-end to support any current<br />

<strong>Poland</strong>. The real state of real estate | 167