Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EVIDENCE FOR ACCOUNTING RATHER THAN REAL RESPONSES<br />

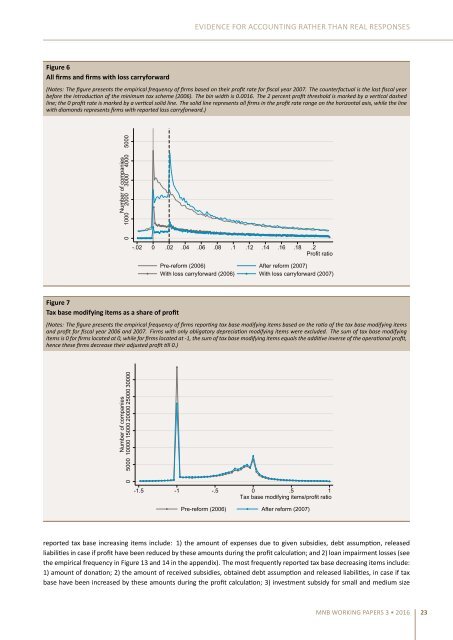

Figure 6<br />

All firms and firms with loss carryforward<br />

(Notes: The figure presents the empirical frequency of firms based on their profit rate for fiscal year 2007. The counterfactual is the last fiscal year<br />

before the introducon of the minimum tax scheme (2006). The bin width is 0.0016. The 2 percent profit threshold is marked by a vercal dashed<br />

line; the 0 profit rate is marked by a vercal solid line. The solid line represents all firms in the profit rate range on the horizontal axis, while the line<br />

with diamonds represents firms with reported loss carryforward.)<br />

Number of companies<br />

0 1000 2000 3000 4000 5000<br />

-.02 0 .02 .04 .06 .08 .1 .12 .14 .16 .18 .2<br />

Profit ratio<br />

Pre-reform (2006) After reform (2007)<br />

With loss carryforward (2006) With loss carryforward (2007)<br />

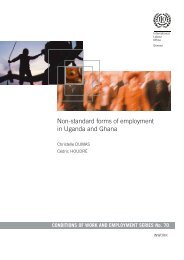

Figure 7<br />

Tax base modifying items as a share of profit<br />

(Notes: The figure presents the empirical frequency of firms reporng tax base modifying items based on the rao of the tax base modifying items<br />

and profit for fiscal year 2006 and 2007. Firms with only obligatory depreciaon modifying items were excluded. The sum of tax base modifying<br />

items is 0 for firms located at 0, while for firms located at -1, the sum of tax base modifying items equals the addive inverse of the operaonal profit,<br />

hence these firms decrease their adjusted profit ll 0.)<br />

Number of companies<br />

0 5000 10000 15000 20000 25000 30000<br />

-1.5 -1 -.5 0 .5 1<br />

Tax base modifying items/profit ratio<br />

Pre-reform (2006) After reform (2007)<br />

reported tax base increasing items include: 1) the amount of expenses due to given subsidies, debt assumpon, released<br />

liabilies in case if profit have been reduced by these amounts during the profit calculaon; and 2) loan impairment losses (see<br />

the empirical frequency in Figure 13 and 14 in the appendix). The most frequently reported tax base decreasing items include:<br />

1) amount of donaon; 2) the amount of received subsidies, obtained debt assumpon and released liabilies, in case if tax<br />

base have been increased by these amounts during the profit calculaon; 3) investment subsidy for small and medium size<br />

MNB WORKING PAPERS 3 • 2016 23