You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

APPENDIX<br />

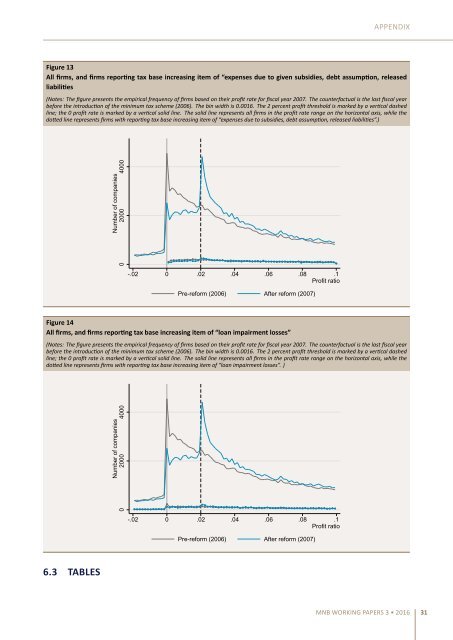

Figure 13<br />

All firms, and firms reporng tax base increasing item of “expenses due to given subsidies, debt assumpon, released<br />

liabilies<br />

(Notes: The figure presents the empirical frequency of firms based on their profit rate for fiscal year 2007. The counterfactual is the last fiscal year<br />

before the introducon of the minimum tax scheme (2006). The bin width is 0.0016. The 2 percent profit threshold is marked by a vercal dashed<br />

line; the 0 profit rate is marked by a vercal solid line. The solid line represents all firms in the profit rate range on the horizontal axis, while the<br />

doed line represents firms with reporng tax base increasing item of “expenses due to subsidies, debt assumpon, released liabilies”.)<br />

Number of companies<br />

0 2000 4000<br />

-.02 0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

Pre-reform (2006) After reform (2007)<br />

Figure 14<br />

All firms, and firms reporng tax base increasing item of “loan impairment losses”<br />

(Notes: The figure presents the empirical frequency of firms based on their profit rate for fiscal year 2007. The counterfactual is the last fiscal year<br />

before the introducon of the minimum tax scheme (2006). The bin width is 0.0016. The 2 percent profit threshold is marked by a vercal dashed<br />

line; the 0 profit rate is marked by a vercal solid line. The solid line represents all firms in the profit rate range on the horizontal axis, while the<br />

doed line represents firms with reporng tax base increasing item of “loan impairment losses”. )<br />

Number of companies<br />

0 2000 4000<br />

-.02 0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

Pre-reform (2006) After reform (2007)<br />

6.3 TABLES<br />

MNB WORKING PAPERS 3 • 2016 31