You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MAGYAR NEMZETI BANK<br />

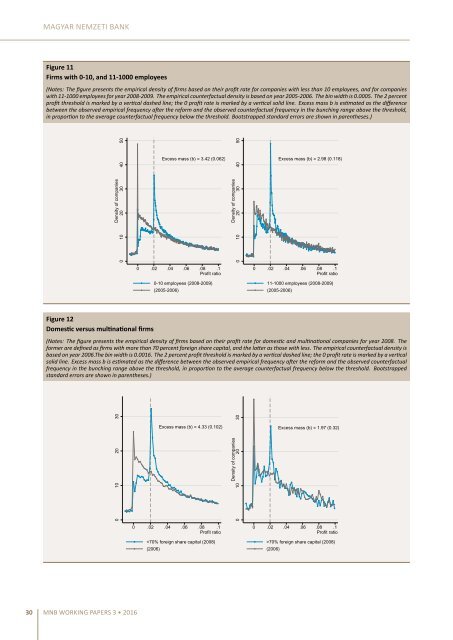

Figure 11<br />

Firms with 0-10, and 11-1000 employees<br />

(Notes: The figure presents the empirical density of firms based on their profit rate for companies with less than 10 employees, and for companies<br />

with 11-1000 employees for year 2008-2009. The empirical counterfactual density is based on year 2005-2006. The bin width is 0.0005. The 2 percent<br />

profit threshold is marked by a vercal dashed line; the 0 profit rate is marked by a vercal solid line. Excess mass b is esmated as the difference<br />

between the observed empirical frequency aer the reform and the observed counterfactual frequency in the <strong>bunching</strong> range above the threshold,<br />

in proporon to the average counterfactual frequency below the threshold. Bootstrapped standard errors are shown in parentheses.)<br />

Density of companies<br />

0 10 20 30 40 50<br />

Excess mass (b) = 3.42 (0.062)<br />

Density of companies<br />

0 10 20 30 40 50<br />

Excess mass (b) = 2.98 (0.118)<br />

0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

0-10 employees (2008-2009)<br />

(2005-2006)<br />

11-1000 employees (2008-2009)<br />

(2005-2006)<br />

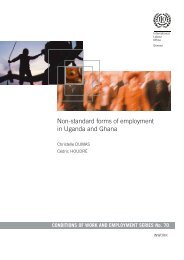

Figure 12<br />

Domesc versus mulnaonal firms<br />

(Notes: The figure presents the empirical density of firms based on their profit rate for domesc and mulnaonal companies for year 2008. The<br />

former are defined as firms with more than 70 percent foreign share capital, and the laer as those with less. The empirical counterfactual density is<br />

based on year 2006.The bin width is 0.0016. The 2 percent profit threshold is marked by a vercal dashed line; the 0 profit rate is marked by a vercal<br />

solid line. Excess mass b is esmated as the difference between the observed empirical frequency aer the reform and the observed counterfactual<br />

frequency in the <strong>bunching</strong> range above the threshold, in proporon to the average counterfactual frequency below the threshold. Bootstrapped<br />

standard errors are shown in parentheses.)<br />

0 10 20 30<br />

Excess mass (b) = 4.33 (0.102)<br />

Density of companies<br />

0 10 20 30<br />

Excess mass (b) = 1.97 (0.32)<br />

0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

0 .02 .04 .06 .08 .1<br />

Profit ratio<br />

70% foreign share capital (2008)<br />

(2006)<br />

30 MNB WORKING PAPERS 3 • 2016