Global Automotive Executive Survey 2017

global-automotive-executive-survey-2017

global-automotive-executive-survey-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

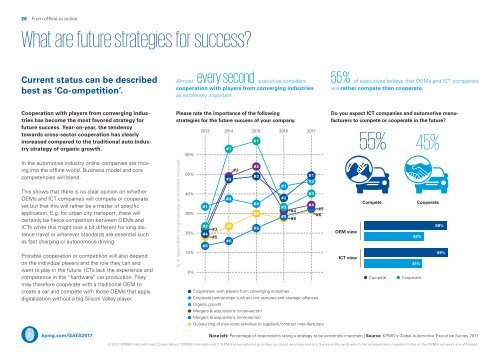

28 From offline to online<br />

What are future strategies for success?<br />

Current status can be described<br />

best as ‘Co-ompetition’.<br />

every second executive considers 55 %<br />

Almost<br />

cooperation with players from converging industries<br />

as extremely important.<br />

of executives believe that OEMs and ICT companies<br />

will rather compete than cooperate.<br />

Cooperation with players from converging industries<br />

has become the most favored strategy for<br />

future success. Year-on-year, the tendency<br />

towards cross- sector cooperation has clearly<br />

increased compared to the traditional auto industry<br />

strategy of organic growth.<br />

In the automotive industry online companies are moving<br />

into the offline world. Business model and core<br />

competencies will blend.<br />

This shows that there is no clear opinion on whether<br />

OEMs and ICT companies will compete or cooperate<br />

yet but that this will rather be a matter of specific<br />

application. E.g. for urban city transport, there will<br />

certainly be fierce competition between OEMs and<br />

ICTs while this might look a bit different for long distance<br />

travel or wherever standards are essential such<br />

as fast charging or autonomous driving.<br />

Possible cooperation or competition will also depend<br />

on the individual players and the role they can and<br />

want to play in the future. ICTs lack the experience and<br />

competence in the “hardware” car production. They<br />

may therefore cooperate with a traditional OEM to<br />

create a car and compete with those OEMs that apply<br />

digitalization without a big Silicon Valley player.<br />

Please rate the importance of the following<br />

strategies for the future success of your company.<br />

% of respondents rating a strategy as extremely important<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2013<br />

#1<br />

#2<br />

#4<br />

#6<br />

#3<br />

#5<br />

2014 2015 2016 <strong>2017</strong><br />

Cooperation with players from converging industries<br />

Corporate partnerships such as joint ventures and strategic alliances<br />

Organic growth<br />

#1<br />

#3<br />

#4<br />

#5<br />

#6<br />

#2<br />

#1<br />

#2<br />

#5<br />

#6<br />

Mergers & acquisitions (cross-sector)<br />

Mergers & acquisitions (inner-sector)<br />

#3 #1<br />

#2<br />

#1<br />

#4<br />

Outsourcing of (non-)core activities to suppliers / contract manufacturers<br />

#2<br />

#3<br />

#5<br />

#4<br />

#6<br />

#3<br />

#4<br />

#5<br />

#6<br />

Do you expect ICT companies and automotive manufacturers<br />

to compete or cooperate in the future?<br />

OEM view<br />

ICT view<br />

55%<br />

Compete<br />

Compete<br />

42%<br />

41%<br />

Cooperate<br />

45%<br />

Cooperate<br />

58%<br />

59%<br />

kpmg.com/GAES<strong>2017</strong><br />

Note left: Percentage of respondents rating a strategy to be extremely important | Source: KPMG’s <strong>Global</strong> <strong>Automotive</strong> <strong>Executive</strong> <strong>Survey</strong> <strong>2017</strong><br />

© <strong>2017</strong> KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.