Global Automotive Executive Survey 2017

global-automotive-executive-survey-2017

global-automotive-executive-survey-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 From offline to online<br />

Taking the temperature on the data literacy of auto companies<br />

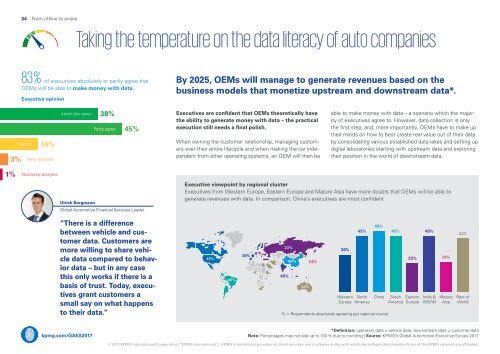

83 % of executives absolutely or partly agree that<br />

OEMs will be able to make money with data.<br />

<strong>Executive</strong> opinion<br />

By 2025, OEMs will manage to generate revenues based on the<br />

business models that monetize upstream and downstream data*.<br />

3%<br />

Neutral<br />

14%<br />

Partly disagree<br />

Absolutely agree<br />

38%<br />

Partly agree<br />

45%<br />

<strong>Executive</strong>s are confident that OEMs theoretically have<br />

the ability to generate money with data – the practical<br />

execution still needs a final polish.<br />

When owning the customer relationship, managing customers<br />

over their entire lifecycle and when making the car independent<br />

from other operating systems, an OEM will then be<br />

able to make money with data – a scenario which the majority<br />

of executives agree to. However, data collection is only<br />

the first step, and, more importantly, OEMs have to make up<br />

their minds on how to best create real value out of their data<br />

by consolidating various established data lakes and setting up<br />

digital laboratories starting with upstream data and exploring<br />

their position in the world of downstream data.<br />

1%<br />

Absolutely disagree<br />

Ulrich Bergmann<br />

<strong>Executive</strong> viewpoint by regional cluster<br />

<strong>Executive</strong>s from Western Europe, Eastern Europe and Mature Asia have more doubts that OEMs will be able to<br />

generate revenues with data. In comparison, China’s executives are most confident<br />

<strong>Global</strong> <strong>Automotive</strong> Financial Services Leader<br />

“There is a difference<br />

between vehicle and customer<br />

data. Customers are<br />

more willing to share vehicle<br />

data compared to behavior<br />

data – but in any case<br />

this only works if there is a<br />

basis of trust. Today, executives<br />

grant customers a<br />

small say on what happens<br />

to their data.”<br />

45%<br />

45%<br />

30%<br />

45%<br />

23%<br />

49%<br />

43%<br />

24%<br />

30%<br />

Western<br />

Europe<br />

45%<br />

North<br />

America<br />

49%<br />

China<br />

% = Respondents absolutely agreeing per regional cluster<br />

45%<br />

South<br />

America<br />

23%<br />

Eastern<br />

Europe<br />

45%<br />

India &<br />

ASEAN<br />

24%<br />

Mature<br />

Asia<br />

43%<br />

Rest of<br />

World<br />

kpmg.com/GAES<strong>2017</strong><br />

*Definition: upstream data = vehicle data; downstream data = customer data<br />

Note: Percentages may not add up to 100 % due to rounding | Source: KPMG’s <strong>Global</strong> <strong>Automotive</strong> <strong>Executive</strong> <strong>Survey</strong> <strong>2017</strong><br />

© <strong>2017</strong> KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.